Geopolitics has moved from a slow-moving, relatively predictable chess match to rapidly evolving 3-D chess in which the rules keep changing in unpredictable ways. A declining standard of living in the developed world, declining growth for the developed world and geopolitical jockeying for control of resources make for a highly combustible mix awaiting a spark: welcome to the era of intensifying chaos and the rapid advance of new weapons of conflict as ruling elites...

Read More »EM Preview for the Week Ahead

EM FX was mostly firmer last week. ZAR, PEN, and CLP outperformed while TRY, HUF, and CNY underperformed. MSCI EM traded at new highs for the cycle but ran out of steam near the 1110 area, while MSCI EM FX lagged a bit and has yet to surpass its July high. Overall, the backdrop for EM remains constructive but investors must be prepared to differentiate amongst credits in 2020. AMERICAS Mexico reports mid-December CPI Monday, which is expected to rise 2.71% y/y vs....

Read More »Our Fragmentation Accelerates

As our fragmentation accelerates, shared economic interests are ignored in favor of divisive warring camps that share no common interests. That our society and economy are fragmenting is self-evident. This fragmentation is accelerating rapidly, as middle ground vanishes and competing camps harden their positions to solidify the loyalty of the “tribe.” All or nothing, either-or binaries are the order of the day: you’re either 100% with us or 100% against us, you’re...

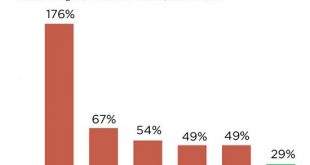

Read More »Skyrocketing Costs Will Pop All the Bubbles

The reckoning is coming, and everyone who counted on “eternal growth of borrowing” to stave off the reckoning is in for a big surprise. We’ve used a simple trick to keep the status quo from imploding for the past 11 years: borrow whatever it takes to keep paying the skyrocketing costs for housing, healthcare, college, childcare, government, permanent wars and so on. The trick has worked because central banks pushed interest rates to zero, lowering the costs of...

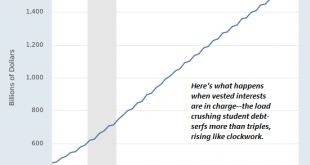

Read More »OK Boomer, OK Fed

Eventually the younger generations will connect all the economic injustices implicit in ‘OK Boomer’ with the Fed. Much of the cluelessness and economic inequality behind the OK Boomer meme is the result of Federal Reserve policies that have favored those who already own the assets (Boomers) that the Fed has relentlessly pumped higher, to the extreme disadvantage of younger generations who were not given the opportunity to buy assets cheap and ride the Fed wave...

Read More »Hard Brexit Redux?

The risks of a hard Brexit are perhaps higher than markets appreciated. Here, we set forth some possible scenarios as to what may unfold after the January 31 deadline. Uncertainty is likely to be protracted and markets hate uncertainty. As such, we see UK assets continuing to underperform. RECENT DEVELOPMENTS Fears of a hard Brexit are still alive and well. Prime Minister Johnson is pushing to guarantee a Brexit by end-2020 even if a new trade arrangement is not in...

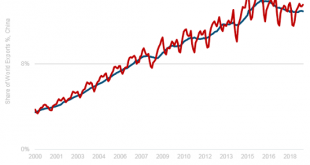

Read More »The “Trade Deal”: A Pathetic Parody, Credibility Squandered

Anyone who thinks this bogus “deal” has resolved any of the issues or uncertainties deserves to be fired immediately. Here’s a late-night TV parody of a trade deal: The agreement won’t be signed by both parties, though each might sign their own version of it, and the terms of the deal will never ever be revealed to the public, which includes everyone doing any business in the nations doing the “deal.” How is this “deal” not a pathetic parody of a real deal? A real...

Read More »EM Preview for the Week Ahead

Risk assets such as EM got a big boost last week, as tail risks from a hard Brexit and the US-China trade war have clearly ebbed. Still, the initial lack of details on the Phase One deal as well as uncertainty regarding the next phases have left the markets a bit jittery and nervous. Hopefully, this week may bring some further clarity and the good news is that the December 15 tariffs have been canceled. AMERICAS Brazil COPOM minutes will be released Tuesday. It cut...

Read More »A “Market” That Needs $1 Trillion in Panic-Money-Printing by the Fed to Stave Off Implosion Is Not a Market

It was all fun and games enriching the super-wealthy but now the karmic cost of the Fed’s manipulation and propaganda is about to come due. A “market” that needs $1 trillion in panic-money-printing by the Fed to stave off a karmic-overdue implosion is not a market: a legitimate market enables price discovery. What is price discovery? The decisions and actions of buyers and sellers set the price of everything: assets, goods, services, risk and the price of borrowing...

Read More »Risk Assets Rally as Major Tail Risks Ease

The biggest tail risks impacting markets this year have cleared up; risk assets are rallying, while safe haven assets are selling off During the North American session, US November retail sales will be reported Russia central bank cut rates 25 bp to 6.25%, as expected Bank of Japan released a mixed Q4 Tankan report The dollar is broadly lower against the majors as tail risk evaporates. Nokkie and sterling are outperforming, while Aussie and yen are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org