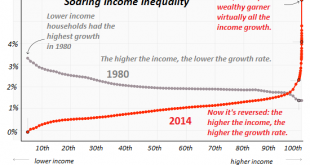

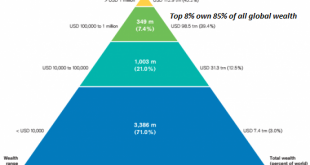

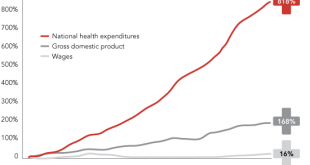

Our society has a legal structure of self-rule and ownership of capital, but in reality it is a Neofeudal Oligarchy. Now that the pandemic is over and the economy is roaring again–so the stock market says–we’re heading straight back up into the good old days of 2019. Nothing to worry about, we’ve recovered the trajectory of higher and higher, better every day in every way. Everything’s great except the fatal rot at the heart of the U.S. economy hasn’t even been...

Read More »Dollar Bid as Market Sentiment Yet to Recover

The US has started the formal process of withdrawing from the WHO; the dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges The White House is asking Congress to pass another $1 trln stimulus plan by early August; President Trump hosts Mexican President AMLO for a two-day visit Chancellor Sunak addresses UK Parliament today; Brexit talks continue; Nigeria devalued its official exchange rate yesterday RBNZ is considering an extension...

Read More »What Makes You Think the Stock Market Will Even Exist in 2024?

Given the extremes of the stock market’s frauds and even greater extremes of wealth/income inequality it has created, tell me again why the stock market will still exist in 2024? When I read a financial pundit predicting a bull market in stocks through 2024, blah-blah-blah, I wonder: what makes you think the stock market will even exist in 2024, at least in its current form? Given the current trajectory of the real economy into the Greatest Depression while the...

Read More »EM Preview for the Week Ahead

Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates. AMERICAS Brazil reports May retail sales Wednesday. Sales are expected to contract -13.5% y/y vs. -16.8% in April. June IPCA inflation will be reported Friday, which is...

Read More »Dancing Through the Geopolitical Minefield

The elites dancing through the minefield all have plans, but how many are prepared for the punch in the mouth? Open any newspaper from the past 100 years and you will soon find a newsworthy geopolitical hotspot or conflict. Geopolitical conflict is the default setting for humanity, it seems, but it does feel as if the minefield of geopolitical rivalries and flashpoints has been thickly sown and many of the players are dancing through the minefield with a worrisomely...

Read More »Dollar Soft Ahead of Jobs Report

Re-shutdowns continue to spread across the US; the dollar has come under pressure again Jobs data is the highlight ahead of the long holiday weekend in the US; weekly jobless claims will be reported FOMC minutes were revelatory; the Fed for now will rely on “outcome-based” forward guidance and asset purchases to achieve its goals; US House passed the latest China sanctions bill The UK offered a home to nearly 3 mln Hong Kong citizens; Russia President Putin will...

Read More »An Interesting Juncture in History

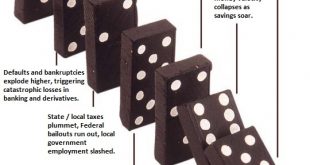

Just as the rewards of central-bank bubbles have not been evenly distributed, the pain created by the collapse of the bubbles won’t be evenly distributed, either. We’ve reached an interesting juncture in history, and I don’t mean the pandemic. I’m referring to the normalization of extremes in the economy, in social decay and in political dysfunction and polarization. Let’s ask a very simple question. The S&P 500 stock index went up five-fold from its 2009 low...

Read More »Dollar Begins the Week Under Pressure Again

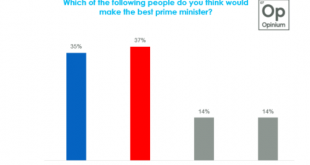

The virus news stream remains negative; pressure on the dollar has resumed The US economy is taking a step back just as Q3 is about to get under way; there are some minor US data reports today UK Labour leader Starmer overtook Prime Minister Johnson in the latest opinion poll; Macron’s party did poorly in French local elections French and German leaders meet to discuss the planned EU pandemic rescue package; UK and EU begin their “intensified timetable” for Brexit...

Read More »EM Preview for the Week Ahead

Risk assets came under pressure last week as the virus news stream worsened. It’s clear that large parts of the US will be forced to delay reopening until their virus numbers improve. Markets had gotten too bullish on the US recovery story and so this reality check soured sentiment. This is a very important week for US data, and we think risk sentiment will remain under pressure ahead of what we think will be a likely downside surprise in the US jobs number Thursday....

Read More »Forget the V, W or L Recovery: Focus on N-P-B

The only realistic Plan B is a fundamental, permanent re-ordering of the cost structure of the entire U.S. economy. The fantasy of a V-shaped recovery has evaporated, and expectations for a W or L-shaped recovery are increasingly untenable. So forget V, W and L; the letters that will shape the future are N, P, B: there is No Plan B. All the hopes for a recovery were based on a quick return to the economy that existed in late 2019. All the bailouts and stimulus...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org