Like so many other things that were once affordable, owning pets is increasingly pricey. One of the few joys still available to the average household is a pet. At least this is what I thought until I read 5 money-saving tips people hate, which included the lifetime costs of caring for a pet. It turns out Poochie and Kittie are as unaffordable as college, housing and healthcare (and pretty much everything else). Over the course of 15 years, small-dog Poochie will set...

Read More »Dollar Firm Despite Rising US Political Uncertainty

Focused On Strategy - Click to enlarge The dollar continues to benefit despite US political uncertainty President Trump claimed to be getting “closer and closer” to a trade deal with China; we are very skeptical There is a lot of US data to be reported and a heavy slate of Fed speakers today ECB board member Lautenschlaeger has resigned; sterling continues to soften as Brexit optimism fades Netanyahu has been tasked with forming the next Israeli government;...

Read More »Here’s How We Are Silenced by Big Tech

This is how they silence us: your content has been secretly flagged as being “unsafe,” i.e. “guilty of anti-Soviet thoughts;” poof, you’re gone. Big Tech claims it isn’t silencing skeptics, dissenters and critics of the status quo, but it is silencing us. Here’s how it’s done. Let’s start with Twitter. Twitter claims it doesn’t shadow ban (Setting the record straight on shadow banning), which it defines as deliberately making someone’s content undiscoverable to...

Read More »Dollar Firm as Risk-Off Impulses Return

Markets have moved into risk-off mode from a confluence of events emanating from the US Speaker of the House Pelosi formally launched a formal impeachment inquiry; DOJ inserted itself into Trump’s fight with New York state Trump’s speech to the UN General Assembly yesterday was noteworthy for its belligerence RBNZ and BOT kept rates steady, as expected; Czech is expected to follow suit The dollar is broadly firmer against the majors as risk-off impulses return to...

Read More »Financial Storm Clouds Gather

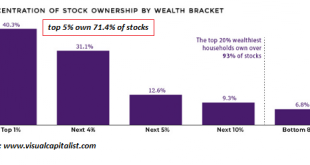

The price of this “solution”–the undermining of the financial system–will eventually be paid in full. The financial storm clouds are gathering, and no, I’m not talking about impeachment or the Fed and repo troubles–I’m talking about much more serious structural issues, issues that cannot possibly be fixed within the existing financial system. Yes, I’m talking about the cost structure of our society: earned income has stagnated while costs have soared, and households...

Read More »Waiting on the Calvary

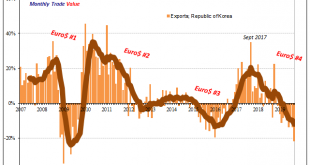

Engaged in one of those protectionist trade spats people have been talking about, the flow of goods between South Korea and Japan has been choked off. The specific national reasons for the dispute are immaterial. As trade falls off everywhere, countries are increasingly looking to protect their own. Nothing new, this is a feature of when prolonged stagnation turns to outright contraction. While the dispute with Japan hasn’t helped, it isn’t responsible for the level...

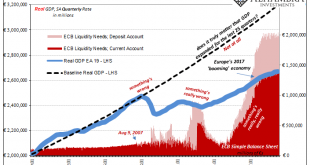

Read More »No Longer Hanging In, Europe May Have (Been) Broken Down

Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their “accommodations.” It’s only a little...

Read More »Automation and the Crisis of Work

Technology, like natural selection, has no goal. When it comes to the impact of automation (robots, AI, etc.) on jobs, there are two schools of thought: one holds that technology has always created more and better jobs than it destroys, and this will continue to be the case. The other holds that the current wave of automation will destroy far more jobs than it creates, but the solution is to tax the robots and use these revenues to distribute the wealth to everyone...

Read More »EM Preview for the Week Ahead

We think the Fed has signaled that the bar to another cut is high. Unless the US data weakens considerably, we see rates on hold for now and this means the liquidity story for EM has worsened. Elsewhere, US-China trade talks appear to be going nowhere. With no end in sight to the trade war, we remain negative on EM. Korea reports trade data for the first 20 days of September Monday. Between the US-China trade war and Korea-Japan tensions over exports of strategic...

Read More »Dollar Mixed on Central Bank Thursday

As expected, the Fed cut rates by 25 bp; the dollar firmed after the decision but has since given back some gains During the North American session, there will be a fair amount of US data BOE is expected to keep rates steady; UK reported August retail sales SNB and BOJ kept rates steady, as expected; Norges Bank unexpectedly hiked 25 bp Brazil cut rates 50 bp to 5.5%; Indonesia cut rates 25 bp to 5.25%; Taiwan kept rates steady at 1.375%; SARB is expected to remain...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org