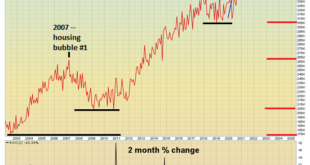

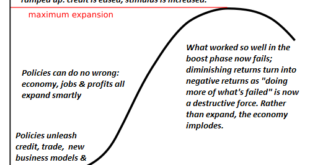

The decline phase of S-Curves can be gradual or a cliff-dive. Way back in 2007 I charted five long-wave cycles that I reckoned consequential: 1. Public debt (accumulating federal deficits) 2. Inflation 3. Oil (energy) 4. Interest rates 5. Speculative fever Fifteen years ago, my chart look-ahead was about three years, to 2010, with the basic idea being that these long-term cycles had already turned or were about to turn. Looking back, I should have added a few...

Read More »Curveballs in the Housing Bubble Bust

All these curveballs will further fragment the housing market. Oh for the good old days of a nice, clean housing bubble and bust as in 2004-2011: subprime lending expanded the pool of buyers, liar loans and loose credit created speculative leverage, the Federal Reserve provided excessive liquidity and the watchdogs of the industry were either induced (ahem) to look away or dozed off in a haze of gross incompetence. The bubble burst was also straightforward:...

Read More »Herd on the Street

The casino has become complex and there are no easy answers or predictable paths. The Wall Street herd had it easy from 2009 to 2021. Life was simple and life was good: markets were easy to predict. As long as the Federal Reserve kept interest rates near-zero and increased its balance sheet to buy Treasury bonds, the stock market rose. As long as the Fed increased its balance sheet to buy mortgage-backed securities, housing rose. If the Fed tried to reduce its...

Read More »What Happens When Complexity Unravels?

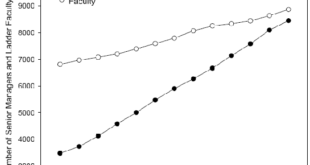

Those glancing at the appearances will be assured all is well and it will all sort itself out. Those who look behind the screen will move away as fast as they can. When finances tighten, there are two choices: cut expenses or increase revenues. Monopolies, cartels and governments can increase revenues by increasing taxes or the price of goods and services because users / customers / taxpayers have no alternative. The rest of us have to cut expenses. Making lasting...

Read More »Not the 1970s or the 1920s: We’re in Uncharted Territory

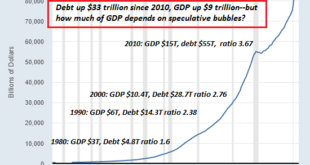

All of these similarities and differences are setting up a sea-change revaluation of capital, resources and labor that will be on the same scale as the extraordinary transitions of the 1920s and 1970s. The awakening of inflation after decades of slumber has triggered a flurry of comparisons to the 1970s accompanied by a chorus of projections for 1970s-type stagflation, defined as inflation plus economic stagnation– limited or negative growth and high unemployment....

Read More »The Contrarian Curse

What if all the new consensus memes are as wrong as the ones they replaced? I have the Contrarian Curse, and I have it bad. The Contrarian Curse is: as soon as the herd adopts your previously contrarian view, you start questioning the new consensus, just as you questioned the previous consensus. Example #1: fiat currencies are doomed. After all, if creating “money” out of thin air solves all our problems, why not just let everyone print as much as they want at home?...

Read More »Is Housing a Bubble That’s About to Crash?

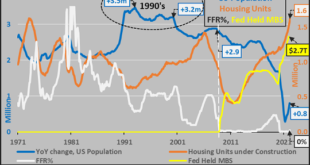

We are all prone to believing the recent past is a reliable guide to the future. But in times of dynamic reversals, the past is an anchor thwarting our progress, not a forecast. Are we heading into another real estate bubble / crash? Those who say “no” see the housing shortage as real, while those who say “yes” see the demand as a reflection of the Federal Reserve’s artificial goosing of the housing market via its unprecedented purchases of mortgage-backed securities...

Read More »Doom Porn and Empty Optimism

If we can’t discern the difference between doom-porn and investing in self-reliance, then solutions will continue to be out of reach. I’m often accused of calling 783 of the last two bubble pops (or was it 789? Forgive the imprecision). Like many others who have publicly explored the notion that the status quo isn’t actually sustainable despite its remarkable tenaciousness, I am pilloried as a doom-and-gloomer (among other things, ahem). Fair enough, and I’m fine...

Read More »Crash Is King

This may be one of many revaluations of capital vis a vis labor and resources and core vis a vis periphery. You’ve heard the expression “cash is king.” Very true. But it’s equally true that “crash is king:” when speculative excesses collapse under their own extremes, the crash crushes all other narratives and becomes the dominant dynamic. Everything that the mainstream uses to predict “value,” market action and “the future” is tossed out the window. Price-earnings,...

Read More »What’s Your Plan A, B and C?

Nothing unravels quite as dramatically as systems which are presumed to be rock-solid and forever. Here’s the default Bullish case for stocks and the economy: let’s call it Plan Zero. 1. The economy and equities can grow forever (a.k.a. infinite growth on a finite planet in a waste-is-growth Landfill Economy) 2. Higher energy costs have near-zero effect on the economy and stocks. 3. The Federal Reserve will deliver a soft landing which reduces inflation back to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org