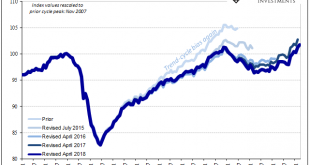

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

Read More »Our Strange Attraction to Self-Destructive Behaviors, Choices and Incentives

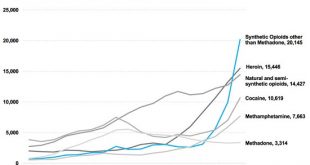

Self-destruction isn’t a bug, it’s a feature of our socio-economic system. The gravitational pull of self-destructive behaviors, choices and incentives is scale-invariant, meaning that we can discern the strange attraction to self-destruction in the entire scale of human experience, from individuals to families to groups to entire societies. The proliferation of self-destructive behaviors, choices and incentives in our...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous. Stock Markets Emerging Markets, April 18 - Click to enlarge...

Read More »What Do We Know About Syria? Next to Nothing

Anyone accepting “facts” or narratives from any interested party is being played. About the only “fact” the public knows with any verifiable certainty about Syria is that much of that nation is in ruins. Virtually everything else presented as “fact” is propaganda intended to serve one of the competing narratives or discredit one or more competing narratives. Consider a partial list of “interested parties” spinning their...

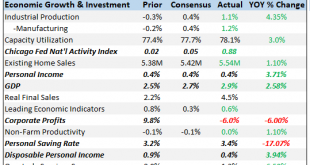

Read More »Bi-Weekly Economic Review

[embedded content] Related posts: Global Asset Allocation Update: The Certainty of Uncertainty Why Trade Wars Ignite and Why They’re Spreading The Genie’s Out of the Bottle: Eight Defining Trends Are Reversing Bi-Weekly Economic Review: Investing Is Not A Game of Perfect US-China Trade War Escalates As Further Measures Are Taken Less Retail Jobs,...

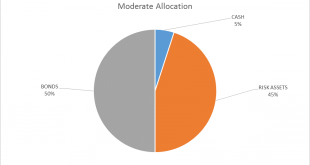

Read More »Global Asset Allocation Update: The Certainty of Uncertainty

There is no change to the risk budget this month. For the moderate risk investor, the allocation to bonds is 50%, risk assets 45% and cash 5%. Stocks continued their erratic ways since the last update with another test of the February lows that are holding – for now. While we believe growth expectations are moderating somewhat (see the Bi-Weekly Economic Review) the change isn’t sufficient to warrant an asset...

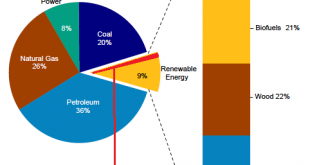

Read More »Why Trade Wars Ignite and Why They’re Spreading

The monetary distortions, imbalances and perverse incentives are finally bearing fruit: trade wars. What ignites trade wars? The oft-cited sources include unfair trade practices and big trade deficits. But since these have been in place for decades, they don’t explain why trade wars are igniting now. To truly understand why trade wars are igniting and spreading, we need to start with financial repression, a catch-all...

Read More »The Genie’s Out of the Bottle: Eight Defining Trends Are Reversing

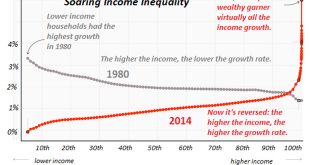

Though the Powers That Be will attempt to placate or suppress the Revolt of the Powerless, the genies of political disunity and social disorder cannot be put back in the bottle. The saying “the worm has turned” refers to the moment when the downtrodden have finally had enough, and turn on their powerful oppressors.The worms have finally turned against the privileged elites — who have benefited so greatly from...

Read More »Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a...

Read More »China Vows Retaliation With “Same Scale, Intensity” To Any New US Tariffs

Trump’s aggressive trade war overtures and China’s initial retaliatory moves have spooked Wall Street over the past week and again on Monday, which helped drive down the Dow Jones by 459 points, with the Nasdaq Composite quickly approaching correction territory. And as the mass exodus continues out of Wall Street’s highest-flying stocks, trade war concerns are sparking political, regulatory and market challenges that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org