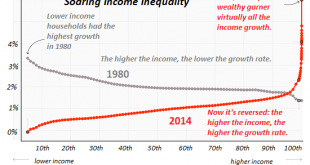

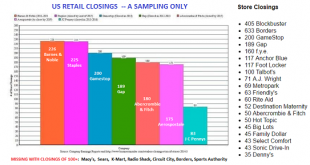

The bill for extreme wealth/income inequality is now overdue, and the penalties for ignoring the bill will be as extreme as the inequality. Our socio-economic-political system–let’s call it the status quo–has been hollowed out by extremes of wealth/power inequality driven by financialization and globalization, which have enriched the top 5% and left everyone else behind. As a result, the status quo has become increasingly fragile and brittle even as cheerleaders...

Read More »When Institutions Fail, Fragmentation and Decentralization Become Solutions

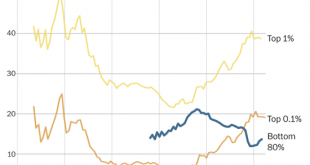

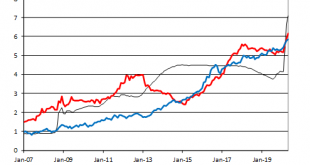

That which has failed is unsustainable, no matter how many trillions the Federal Reserve tosses against the tides of history. The Gulfs Between the Classes The Credibility Gap The Partnerships That Failed The Groups That Opted Out The Undermining of Effort Every one of these is a manifestation of institutional failure. The Gulfs Between the Classes (see chart of soaring inequality below) manifests a completely broken economic and social order, and the abject...

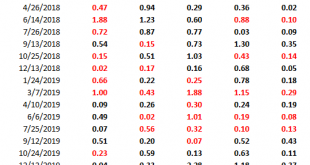

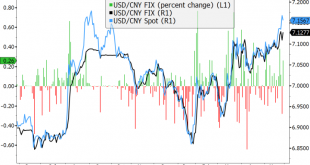

Read More »Dollar Firm as Risk-On Sentiment Ebbs Ahead of ECB Decision

Risk sentiment is taking a breather today after a strong run; the dollar is getting some modest traction Fed tweaked its municipal bond program; weekly jobless claims are expected to rise 1.843 mln; Brazil and Mexico are seeing record high daily death counts ECB is expected to ease today; Germany agreed on a new fiscal package that exceeded expectations BOE warned that UK banks should plan for a possible hard Brexit; Swiss deflation is deepening Australia reported...

Read More »The Post-Covid Economy Will Be Very Different From the Pre-Pandemic Bubble Economy

As the old models break down, opportunities for new models will arise. Unstable, unsustainable systems can lull observers into a comfy complacency as instability increases beneath a thin veneer of apparent stability. That’s the systemic story of the past 20 years: all the extremes that were needed to maintain the veneer of stability have increased the instability building beneath the complacent confidence. But sadly for the status quo, all bubbles pop, all...

Read More »Dollar Broadly Weaker After Reports of Possible Brexit Compromise

The dollar remains under pressure; there is a debate as to the root causes of recent dollar weakness May auto sales will be the only US data release today; protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation Press reports suggest a possible compromise in the UK-EU trade negotiations; oil futures...

Read More »We’re Living the Founding Fathers’ Nightmare: America Is Corrupt to the Core

Our ruling elites, devoid of leadership, are little more than the scum of self-interested, greedy grifters who rose to the top of America’s foul-smelling stew of corruption. The Founding Fathers were wary of institutional threats to liberty and the citizenry’s sovereignty, which included centralized concentrations of power (monarchy, central banks, federal agencies, etc.) and the tyranny of corruption unleashed by small-minded, self-interested, greedy grifters who...

Read More »This Is How Systems Collapse

Flooding the financial system with “free money” only restores the illusion of stability I updated my How Systems Collapse graphic from 2018 with a “we are here” line to indicate our current precarious position just before the waterfall: For those who would argue we’re nowhere near collapse, consider that over 20% of the Federal Reserve’s $2 trillion spew of free money went directly into the pockets of America’s billionaires: $434 billion by the latest estimates,...

Read More »Dollar Firm as US-China Tensions Continue to Rise

Tensions between the US and China continue to rise; the dollar is finding some traction Fed Beige Book contained no surprises; NY Fed President Williams said the Fed is “thinking very hard” about targeting yields; weekly jobless claims are expected at 2.1 mln vs. 2.438 mln last week Germany reports May CPI; ECB is likely to ease next week; BOE continues to show its dovish colors; Poland is expected to keep rates steady at 0.5% Japan’s Cabinet Office maintained its...

Read More »Asia Lockdowns vs. Re-Openings

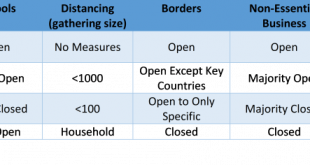

By Ilan Solot and Kieran Chard We apply the five-factor model used to analyse lockdowns and openings in developed markets and in Latin America to Asian Markets. It evaluates the restrictions imposed by different countries in the region, how they compare in terms of severity of lockdown, and where they are heading in the spectrum of reopening. The scale we use measures grade restrictions from 1 (open) to 4 (closed) across the following five factors: (a)...

Read More »Hong Kong Turbulence Likely to Rise as US-China Relations Worsen

Recent moves by China call into direct question the “one country, two systems” approach. Hong Kong assets have held up surprisingly well but we see turbulence ahead as US-China relations are set to deteriorate further. POLITICAL OUTLOOK Legislation was introduced last week that allows Beijing to directly impose a national security law on Hong Kong. Local legislative approval would be circumvented but Chief Executive Lam said Hong Kong authorities would fully...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org