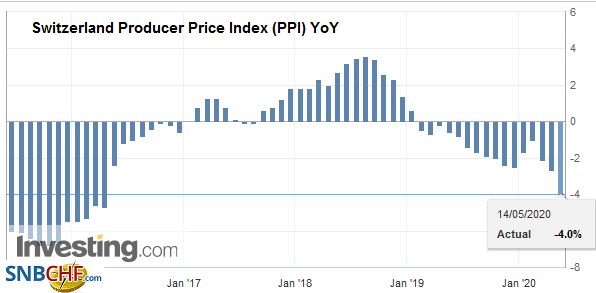

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued? 14.05.2020 – The Producer and Import Price Index fell in April 2020 by 1.3% compared with the previous month, reaching 98.1 points

Topics:

George Dorgan considers the following as important: 2) Swiss and European Macro, 2.) Swiss Statistics - Press Releases, Featured, newsletter, Switzerland Producer Price Index

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in the U.S., diminished the overvaluation. In 2017, however, producer prices are rising again – in both Europe and Switzerland. See more in Is the Swiss Franc overvalued?

| 14.05.2020 – The Producer and Import Price Index fell in April 2020 by 1.3% compared with the previous month, reaching 98.1 points (December 2015 = 100). The decline is due in particular to lower prices for petroleum products, petroleum and natural gas. Compared with April 2019, the price level of the whole range of domestic and imported products fell by 4.0%. These are the results of the Federal Statistical Office (FSO).

In particular, lower prices for petroleum products and scrap were responsible for the decrease in the Producer Price Index compared with the previous month. Irradiation, electromedical and electrotherapeutic equipment, non-ferrous metal products, general-purpose machinery and raw milk were also cheaper. The Import Price Index registered lower prices compared with March 2020, particularly for petroleum products, petroleum and natural gas as well as non-ferrous metals and products made therefrom. Price decreases were also seen for machinery, electrical equipment, metal products, pharmaceutical preparations, furniture as well as medical and dental instruments and supplies. |

Switzerland Producer Price Index (PPI) YoY, April 2020(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge |

Download press release: Producer and Import Price Index fell by 1.3% in April 2020

Tags: Featured,newsletter,Switzerland Producer Price Index