Pour l’année 2024, les acheteuses et les acheteurs avaient le choix, pour la première fois, entre la vignette autocollante conventionnelle et la vignette électronique. Un bon tiers des personnes ont opté pour la version numérique. [embedded content] Tags: Featured,newsletter

Read More »Octobre 2024 : la chimie-pharma détermine le record à l’export

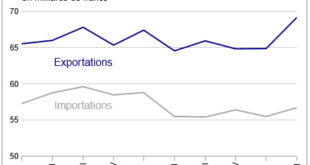

En octobre 2024, les exportations désaisonnalisées – dopées par la pharma – ont bondi de 10,2%, pour s’élever à un niveau record. Celles-ci accusaient toutefois encore une évolution légèrement négative au cours des trois mois précédents. Les importations ont pour leur part progressé de 1,8% par rapport à septembre. En raison de l’évolution disparate entre les deux directions du trafic, la balance commerciale boucle avec un excédent record de 6,0 milliards de francs....

Read More »Gross domestic product in the 2nd quarter of 2024: Swiss economic growth above average

In the second quarter of 2024, Switzerland's GDP adjusted for sporting events grew by 0.5%, following 0.3% in the previous quarter. This result was slightly above average, driven by the strong expansion of the chemical and pharmaceutical industry. Growth in the other sectors was mixed, reflecting weak domestic demand. Download press release...

Read More »Consumer prices remained stable in August

03.09.2024 - The consumer price index (CPI) remained unchanged in August 2024 compared with the previous month at 107.5 points (December 2020 = 100). Inflation was +1.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The stability of the index compared with the previous month was the result of...

Read More »Swiss retail trade turnover rose by 1.5% in July

02.09.2024 - Turnover adjusted for sales days and holidays rose in the retail sector by 1.5% in nominal terms in July 2024 compared with the previous year. Seasonally adjusted, nominal turnover rose by 2.0% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).Real turnover adjusted for sales days and holidays...

Read More »Turnover in the Swiss service sector fell by 0.8% in June

2.9.2024 - Services turnover adjusted for working days fell by 0.8% in June 2024 compared with the same month last year. This was mainly due to a decline in the economic section "Wholesale and retail trade". However, all other economic sections recorded an increase in turnover. These are provisional findings from the Federal Statistical Office (FSO).The economic...

Read More »Record exports in the 2nd quarter of 2024

After a tepid first quarter, Swiss foreign trade regained momentum in the second quarter of 2024. In seasonally adjusted terms, exports jumped by 6.6% and reached a record level. Imports increased by 2.2%. The trade balance closes with a historic quarterly surplus of 12.4 billion francs. In short Exports of raw materials and chemical bases doubled year-on-year Watch exports: stagnation at a high level Boom in the drug trade Flourishing trade with Slovenia, France...

Read More »Swiss timber harvest lower by 6% in 2023

17.07.2024 – In 2023, 4.9 million cubic metres of timber were harvested in Switzerland, a decrease of almost 6% compared to the previous year. There was a noticeable decline in sawlogs (–12%) and the harvests of industrial roundwood (–1%) and chopped wood (–5%). Meanwhile, the proportion of wood harvested for alternative fuel options (wood chips) continued to grow (+5%) and take up a larger share ‒ around 30% ‒ of the total harvest. The share of fuel wood in the...

Read More »Consumer prices increased by 0.3% in May

04.06.2024 - The consumer price index (CPI) increased by 0.3% in May 2024 compared with the previous month, reaching 107.7 points (December 2020 = 100). Inflation was +1.4% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The 0.3% increase compared with the previous month is due to several factors...

Read More »Increase of 1.7% in nominal wages in 2023 and 0.4% decline in real wages

25.04.2024 – The Swiss nominal wage index rose by an average of 1.7% in 2023 compared with 2022, to 102.4 points (base 2020 = 100). Given an average annual inflation rate of +2.1%, real wages fell by 0.4% (96.9 points, base 2020 = 100) according to calculations by the Federal Statistical Office (FSO). You will find further information such as tables and graphs in the press releases in German, French and Italian. The English version only includes the lead of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org