The latest US levies on USD200bn of Chinese imports could leave some room for negotiation before the tariff rate is increased.The Trump administration has announced new tariffs on USD200 billion of Chinese imports, initially at a rate of 10%, rising to 25% in January. This new wave of tariffs comes on top of the USD50 billion taxed over the summer at a rate of 25%. Trump has also threatened to impose levies on all remaining imports from China (worth an additional USD276 billion) if China retaliates to the latest US salvo.The US economy is in strong shape, so the tariffs so far implemented and likely Chinese retaliation should have a limited impact for now (likely equivalent to around 0.2/0.3 percentage points). The US economy remains strong, with growth being powered by strong internal

Topics:

Thomas Costerg and Dong Chen considers the following as important: China growth, Chinese import tariffs, Macroview, US China trade war, US growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest US levies on USD200bn of Chinese imports could leave some room for negotiation before the tariff rate is increased.

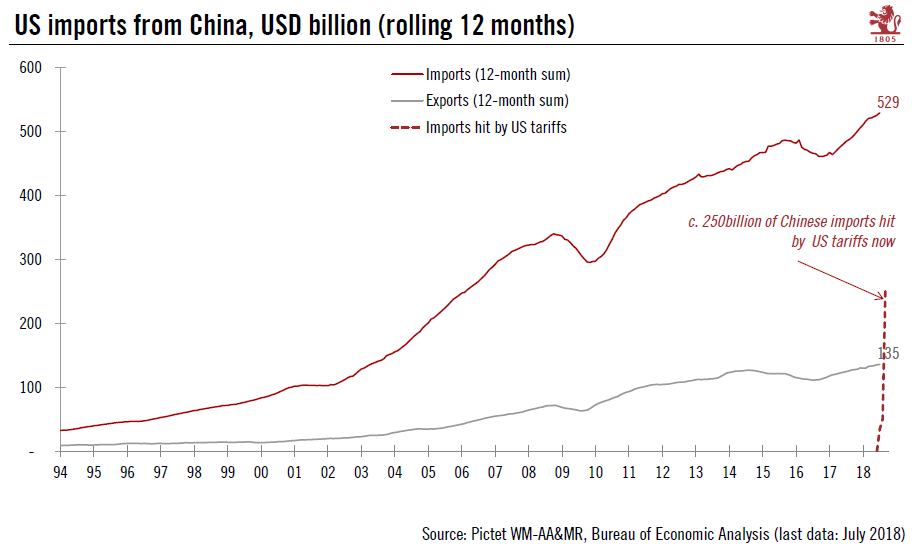

The Trump administration has announced new tariffs on USD200 billion of Chinese imports, initially at a rate of 10%, rising to 25% in January. This new wave of tariffs comes on top of the USD50 billion taxed over the summer at a rate of 25%. Trump has also threatened to impose levies on all remaining imports from China (worth an additional USD276 billion) if China retaliates to the latest US salvo.

The US economy is in strong shape, so the tariffs so far implemented and likely Chinese retaliation should have a limited impact for now (likely equivalent to around 0.2/0.3 percentage points). The US economy remains strong, with growth being powered by strong internal drivers, including robust expansion in corporate capex. This may explain the understated response of US firms to the latest tariff announcement. We predict that the impact on core inflation is also likely to remain moderate, probably boosting 2019 core PCE inflation in the US by 0.1 percentage point.

Our 2018 and 2019 US GDP growth forecast is 3.0% and 2.3%, respectively. Our 2018 and 2019 core PCE inflation forecast is 1.9% and 2.4%, respectively. We will await further details on China’s retaliation and potential supportive measures from the Trump Administration before fine-tuning our forecasts.

The latest US tariffs will fall mostly on imports from China of furniture, car parts and some electronics goods like circuit boards. But while popular smart phones and tablets made in China are off the tariff list for now, Trump did recently warn a leading consumer electronics company based in Silicon Valley that its manufacturing would have to be ‘onshored’ if it wanted to avoid being hit by tariffs. This is something worth monitoring. Phones and tablets will certainly be affected if Trump fulfils his threat to raise taxes on all Chinese imports.

Tariffs so far could cost China about 0.25% of annual GDP per year from 2019 on and below 0.1% for the rest of 2018. If Trump follows through with his threat of imposing tariffs on all Chinese imports at a rate of 25%, the damage to Chinese GDP could be around 1% However, further supportive measures from the Chinese government are likely to mitigate the downside risk.

President Trump concluded his statement on 17 September by saying that “Hopefully, this trade situation will be resolved, in the end, by myself and President Xi of China, for whom I have great respect and affection.”

The idea of increasing the tariff rate from 10% to 25% in January means that Trump still has negotiations in mind in the interim (in the spirit of his 1980s book, ‘The Art of the Deal’). While no formal meeting is scheduled, the two sides could talk on the margins of the G20 meeting in Buenos Aires in a few weeks’ time.