But we expect further growth moderation before a slight rebound at the end of the year.Latest data releases from China broadly point to stabilisation in activity in August after a notable deceleration in the previous months. Industrial production, retail sales and fixed-asset investment all rebounded slightly last month. While the data releases seem to show some signs of stabilisation, we think growth momentum could remain soft in the near term given a continued decline fixed-asset investment and shadow banking. We should however expect a rebound towards the end of the year, thanks to supportive government policies.While regulators have eased the push for financial deleveraging, the broad direction of the deleveraging campaign has not changed. As a result, the size of China’s shadow

Topics:

Dong Chen considers the following as important: China economic activity, Chinese growth, Chinese industrial production, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

But we expect further growth moderation before a slight rebound at the end of the year.

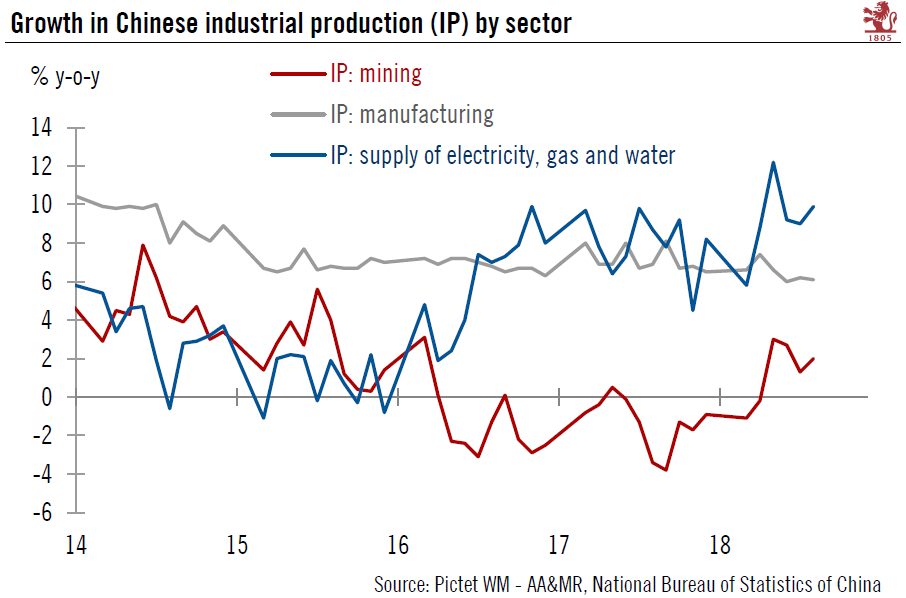

Latest data releases from China broadly point to stabilisation in activity in August after a notable deceleration in the previous months. Industrial production, retail sales and fixed-asset investment all rebounded slightly last month. While the data releases seem to show some signs of stabilisation, we think growth momentum could remain soft in the near term given a continued decline fixed-asset investment and shadow banking. We should however expect a rebound towards the end of the year, thanks to supportive government policies.

While regulators have eased the push for financial deleveraging, the broad direction of the deleveraging campaign has not changed. As a result, the size of China’s shadow banking sector continued to shrink in August. On the external front, there are few signs that trade tensions with the US will decline any time soon. President Trump has decided to put into action his threat of tariffs on a further USD200 billion of Chinese imports into action, starting in September. This will likely have a much more visible impact on the China’s manufacturing than previously introduced tariffs, and is likely to further weigh on sentiment.

Bank lending has rebounded from recent lows, but the strength of the rebound has been much milder than during previous stimulus drives. Apparently, the Chinese government has no intention to start another round of massive monetary easing. At the same time, monetary policy has been eased by cutting banks’ required reserve ratios and liquidity injected into the banking sector to encourage lending has been increased.

We expect the Chinese government to introduce further supportive policies, which may include additional cuts in required reserve ratios for banks as well as further incentives for infrastructure investment. However, before such measures are put in place and gradually feed into real economic activity, we expect China’s growth momentum to continue to moderate in the near term, likely until late Q4. At the moment, we are keeping out Chinese GDP forecast for 2018 unchanged at 6.6%.