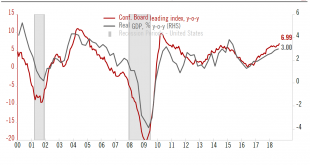

Investment and consumption remain the twin engines of US growth.The first estimate for Q3 GDP (3.5% quarter-on-quarter annualised) confirmed that the US business cycle remains solid. Whereas consumption was stronger than in previous quarters, investment was softer than in Q3—but the underlying story is that solid investment continues to support US growth.This data confirms our annual GDP forecast of 3.0%. This remains above the post-financial crisis average growth rate of 2.3%, and above the...

Read More »Fresh tariffs should have limited impact on US economy for now

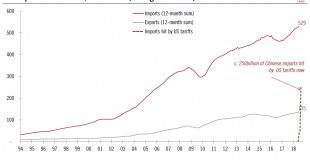

The latest US levies on USD200bn of Chinese imports could leave some room for negotiation before the tariff rate is increased.The Trump administration has announced new tariffs on USD200 billion of Chinese imports, initially at a rate of 10%, rising to 25% in January. This new wave of tariffs comes on top of the USD50 billion taxed over the summer at a rate of 25%. Trump has also threatened to impose levies on all remaining imports from China (worth an additional USD276 billion) if China...

Read More »Solid momentum in a US economy so far unaffected by trade tensions

Second-quarter growth points to a US economy in fine stead, driven by investment spending. Revisions show the savings rate is healthier than thought.US GDP grew 4.1% in the second quarter q-o-q (seasonally adjusted annualised reading, or SAAR), according to the first estimate, up from a revised 2.2% in Q1-2018 (2.0% previously). This is the strongest q-o-q reading since Q3 2014. But there was no particular ‘wow’ effect since the market had expected 4.2%. The y-o-y print, a more accurate and...

Read More »Underlying US inflation remains moderate

While trade tariffs could impact prices at some point, inflation looks unlikely to spiral out of control.Leaving aside energy prices (up 24% y-o-y), core CPI inflation in the US remained moderate in June rising 0.16% m-o-m, which pushed the y-o-y reading slightly up, to 2.3% from 2.2% in May. A print of 2.3% y-o-y, while above the one-year average of 1.9%, is a relatively tame reading in light of the very low US unemployment rate of 4.0%. By contrast, core CPI inflation peaked at 2.9% y-o-y...

Read More »Risk of trade war grows

The new US tariffs threatening Chinese imports and probable retaliation could bite into US and Chinese growth. As US midterm elections approach, the situation could worsen before it gets better.The Trump administration has stepped up its trade actions further by increasing the net of Chinese imports that will be subject to US tariffs: on top of the USD50 billion of Chinese imports subject to a 25% tariff already announced, the US Trade Representative has prepared a list of a further USD200...

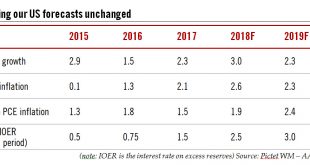

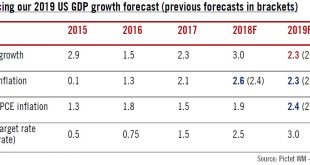

Read More »US growth looks firm in 2018; 2019 is more uncertain

While we are maintaining our 3% growth forecast for 2019, we have slightly reduced our baseline forecast for 2019.The Trump administration has been stepping up its trade rhetoric further, with concrete increases in trade tariffs already kicking in, and others in the near-term pipeline: tariffs on steel and aluminium came into effect in early June, and there will be 25% tariffs on USD 34 billion of Chinese imports (out of a total of USD505 billion in 2017) from 6 July. President Trump has...

Read More »Healthy U.S. jobs report points to early rate hike

The unemployment rate fell to a fresh cyclical low in November, and while wage growth disappointed, we expect it to pick up progressively next year.US non-farm payroll employment rose by a healthy 178,000 month-on-month (m-o-m) in November, in line with consensus expectations. Unexpectedly, the US unemployment rate fell further in November, to 4.6% from 4.9% in October, reaching its lowest level in more than nine years. At 4.6%, the US unemployment rate is now below the median rate of 4.8%...

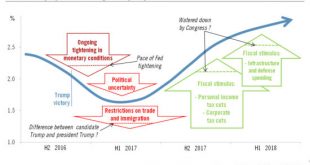

Read More »U.S. growth to slow in H1 2017 before rising again in H2

The tightening of monetary conditions is impeding near-term prospects for the US. But a probable fiscal stimulus will help revive growth again in the latter part of 2017.US GDP growth was revised up from 2.9% to 3.2% for the third quarter. The main reason was a higher estimate of growth in consumer spending. Turning to Q4, economic data published so far have been mixed. Data on consumption in October were a bit disappointing. And advance estimates for the trade deficit and inventories showed...

Read More »U.S. data remain mixed

Data released on 30 September continued to tally with our forecast of 1.5% GDP growth in the US for 2016 and a slow rise in core inflation to 1.9%. According to the Bureau of Economic Analysis (BEA), real consumer spending in the US fell 0.1% m-o-m in August, below consensus expectations. However, the figure for July was left unchanged, so that between Q2 and July-August, US personal consumption grew by 2.9% annualised.Other US data published in recent days has been mixed. Pending home...

Read More »Soft US GDP figures cause us to cut 2016 growth forecast

Disappointing GDP growth in the second quarter and downward revisions for the previous two quarters mean we are revising our GDP forecast for the US. US GDP grew by a surprisingly soft 1.2% (quarter on quarter, q-o-q, annualised) in Q2, well below consensus expectations of 2.5%. Moreover, growth in Q4 2015 and Q1 2016 was revised noticeably lower. Year-on-year growth in Q1 was revised down from 2.1% to 1.6%. In Q2, consumer spending grew by a strong 4.2% and final demand by a healthy 2.0%....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org