Over the last few months, gold’s performance has been remarkable. Many market observers and mainstream analysts have pointed to various geopolitical developments in their efforts to explain away the bullishness as a reaction to whatever happens to be in the headlines at the time. The Trump impeachment, the US-China trade war, more recently the tensions with Iran, are all among the reasons that have been put forward so far to justify the current gold rush. And yet, while all these...

Read More »What lies ahead for gold in 2020

Over the last few months, gold’s performance has been remarkable. Many market observers and mainstream analysts have pointed to various geopolitical developments in their efforts to explain away the bullishness as a reaction to whatever happens to be in the headlines at the time. The Trump impeachment, the US-China trade war, more recently the tensions with Iran, are all among the reasons that have been put forward so far to justify the current gold rush. And yet,...

Read More »2019 US-China trade outlook: major challenges remain

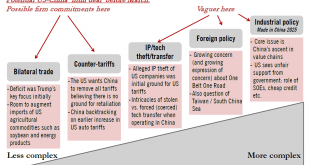

A tentative deal is possible by March, but tensions will likely flare up again.Following the Trump-Xi dinner on 1 December, there are signs of goodwill on both sides, leaving the impression that a ‘mini deal’ is possible before the 1 March 2019 deadline set by the US. This could push back the threat of additional tariffs in the very near term.But we think the devil will be in the details, and particularly in the implementation details. Some sort of hiccup is likely to take place once we...

Read More »US and China reach tariff truce

But signs already point to divergence in interpretation.A temporary trade truce was agreed between US President Donald Trump and China’s President Xi Jinping at a dinner during the G20 meeting this weekend. As part of this truce, the tariff rate on USD200 billion of Chinese imports will stay unchanged at 10% up to 1 March, instead of increasing to 25%, as planned, in January.Deferring the hike in tariffs is a way for the Trump administration to keep pressure on China to discuss wide-ranging...

Read More »Fresh tariffs should have limited impact on US economy for now

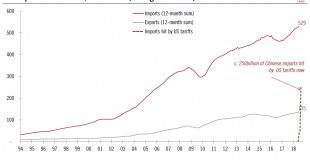

The latest US levies on USD200bn of Chinese imports could leave some room for negotiation before the tariff rate is increased.The Trump administration has announced new tariffs on USD200 billion of Chinese imports, initially at a rate of 10%, rising to 25% in January. This new wave of tariffs comes on top of the USD50 billion taxed over the summer at a rate of 25%. Trump has also threatened to impose levies on all remaining imports from China (worth an additional USD276 billion) if China...

Read More »US-China trade tensions could persist

China’s latest retaliatory measures seem fairly restrained, but the tension between the two nations could drag on for quite some time.On 3 August, the Chinese government announced a list of additional tariffs on USD 60 billion worth of US imports in retaliation to the US’s proposed tariffs on USD 200 billion of Chinese goods. When these tariffs are implemented will depend on when the US activates its tariffs. The announcement came shortly after President Trump stated that he was considering...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org