By Dara O’Sullivan, Derrick Leonard, and Ilan Solot With many markets still under lockdown and some going out on Easter holidays this week, we continue to see amended trading hours. The most notable change has been in India with a reduction in trading hours, while in Nigeria we saw a small amount of liquidity being released by the Central Bank of Nigeria (CBN). Below are our updates for the week. Please get in touch if you would like further information or to discuss...

Read More »Creating More Money Won’t Revive the Economy

In response to the coronavirus, central banks worldwide are currently pumping massive amounts of money. This pumping, it is held, is going to arrest the negative economic side effects that the virus-related panic inflicts on economies. As appealing as it sounds we suggest that this view is erroneous. The view that more money can revive an economy is based on the belief that money transmits its effect through aggregate expenditure. With more money in their pockets,...

Read More »In March, US Deaths From COVID-19 Totaled Less Than 2 Percent of All Deaths

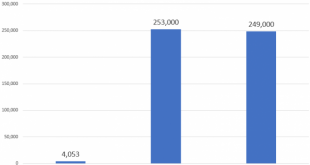

About 2.9 million people die in the United States each year from all causes. Monthly this total ranges from around 220,000 in the summertime to more than 280,000 in winter. In recent decades, flu season has often peaked sometime from January to March, and this is a major driver in total deaths. The average daily number of deaths from December through March is over eight thousand. So far, total death data is too preliminary to know if there has been any significant...

Read More »USD/CHF Price Analysis: Technical set-up remains tilted in favour of bullish traders

USD/CHF traded with a positive bias for the sixth consecutive session on Monday. Bulls are likely to wait for a sustained move beyond the very important 200-DMA. The USD/CHF pair built on last week’s goodish positive move of around 300 pips and continued gaining traction for the sixth straight session on Monday. The pair climbed to near two-week tops in the last hour, with bulls now looking to extend the momentum further beyond the 0.9800 round-figure mark. The...

Read More »Devisen: Eurokurs gibt leicht nach – Wenig verändert zum Franken

Gegenüber dem Schweizer Franken notiert der Euro mit 1,0556 ebenfalls wenig verändert. Und der Dollar kostet 0,9777 Franken. Derweil interveniert die Schweizerische Nationalbank (SNB) wohl weiterhin am Devisenmarkt. Denn die erneut kräftige Zunahme der Sichtguthaben – diese Woche um 6,7 Milliarden nach 11,7 Milliarden in der Vorwoche – deutet daraufhin, dass sich die SNB auch in der vergangenen Woche gegen die Aufwertung des Frankens gestemmt hat. An den...

Read More »Government urged to do more to help companies

On April 3, the Swiss government doubled its coronavirus emergency loan scheme to CHF40 billion after being flooded by requests for help by businesses. The Swiss government should scale up its efforts to help businesses overcome the coronavirus crisis, according to the director of the KOF Swiss Economic Instituteexternal link. Transport companies are also calling for more assistance. “If many companies are over-indebted after the crisis, they will not invest for...

Read More »Recession is unavoidable, reckon Swiss finance bosses

An empty restaurant in Lucerne on March 20 (Keystone) The coronavirus pandemic has fundamentally changed the economic outlook for Switzerland within a very short period of time, with Swiss CFOs more pessimistic than ever before. Neither during the euro crisis nor during the Swiss franc shock were chief financial officers as negative about economic prospects as they are today, according to the latest half-yearly surveyexternal link published on Monday by consultants...

Read More »It’s Hard To See Anything But Enormous Long-term Cost

The unemployment rate wins again. In a saner era, back when what was called economic growth was actually economic growth, this primary labor ratio did a commendable job accurately indicating the relative conditions in the labor market. You didn’t go looking for corroboration because it was all around; harmony in numbers for a far more peaceful and serene period. Ever since the Great “Recession”, however, the unemployment rate has really struggled. Nearly the...

Read More »Dollar Mixed, Equities Higher as Virus News Stream Improves

It was a relatively good weekend in virus-related news; measures of implied volatility continue to trend lower The dollar is trying to build on its recent gains; investors continue to try and gauge just how bad the US economy will get hit The outlook for oil prices remains highly uncertain and volatile Germany signaled that its stance regarding aid to the weaker eurozone countries remains unchanged; the news stream for the UK has turned negative Prime Minister Abe...

Read More »What “Lender of Last Resort” Is Supposed to Mean

Modern central banks have already moved far beyond what was once considered the proper role for a central bank as a “lender of last resort.” Now Keynesians and MMTers (modern monetary theorists) want to take things even further. As the COVID-19 pandemic and the consequent freezing of economic activity take place, many economists are hoping for central bankers and monetary policy to take the lead and steer the economy. However, this cannot possibly be the...

Read More » SNB & CHF

SNB & CHF

-637217795705356366-310x165.png)