China’s GDP growth figure in Q1 of 6.8% was fractionally ahead of forecasts but seasonal consumption masked changing patterns in underlying activity.Chinese GDP in Q1 2018 came in at Rmb19.9 trillion (about USD3.2 trillion), rising 6.8% year-over-year (y-o-y) in real terms. The growth rate is the same as in H2 2017 and beats the market consensus (6.7%) and our own forecast (6.6%).Details of the GDP report show strong signs of economic rebalancing. Traditional drivers of growth such as fixed...

Read More »Russian rouble: significantly undervalued but quite risky

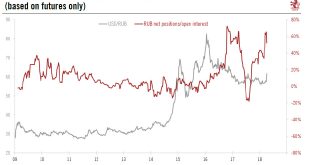

The Russian rouble is now undervalued – but risky - following a sharp drop in the wake of the Trump Administration’s announcement of new sanctions.On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government’s ongoing and increasingly brazen pattern of malign activity around the world”. These sanctions confirm a tougher stance of the US Congress against Russia.Following the announcement, the Russian...

Read More »US chart of the week – Two-tier job market

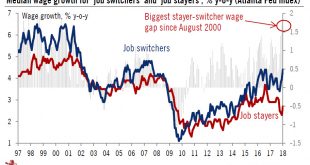

Atlanta Fed data reveals an increasingly polarised labour market, where job switchers do best as US wages remain flat.The latest release of the Atlanta Federal Reserve series on median wage growth provides interesting clues about the current US wage puzzle – i.e. the question why US wage growth remains tame despite the very tight labour market (the unemployment rate was only 4.1% in March).Of particular interest is the widening gap between wage growth for ‘job switchers’ (those who have...

Read More »NAFTA update – All’s well that ends well?

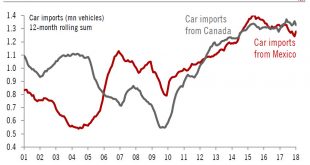

NAFTA renegotiation talks may be a positive signal for the US-China trade tensions.Having progressed slowly for several weeks, the NAFTA (North America Free Trade Agreement) renegotiation talks seem to have found some fresh impetus lately, with several officials suggesting that a deal could be reached as soon as early May. A trilateral meeting will take place in Washington DC this Thursday on the margins of the G20 finance ministers’ meeting.A key positive is that the US has reportedly...

Read More »Switzerland, still on the monitoring list

Switzerland meets two of the US Treasury’s three conditions for being deemed a ‘currency manipulator’.The US Department of Treasury has just published its semi-annual report on International Economic and Exchange Rate Policies. The main news was the inclusion of India on the department’s monitoring list, together with five other countries (China, Japan, Korea, Germany and Switzerland).The Treasury has established three criteria for a country to be deemed a currency manipulator: a bilateral...

Read More »The future of cities

The digital revolution has launched a wave of innovation in the world’s cities, says MIT’s Carlo Ratti, providing opportunities to improve urban mobility and create better workspaces for the changing nature of work.These are exciting times for cities, according to Carlo Ratti, Director of MIT’s Senseable City Lab and co-founder of Carlo Ratti Associati architecture studio. Although they occupy just 2 per cent of the Earth’s surface, they are home to more than half the world’s population,...

Read More »Japanese wage growth accelerates

Although wage growth in Japan is picking up and our inflation forecast may face some modest upside risk, we do not expect a change in the BoJ’s policies in 2018.Anaemic in the past couple of years, wage growth in Japan finally seems to be picking up. In January and February 2018, the average nominal cash earnings of Japanese workers grew by 1.2% and 1.3% year-over-year (y-o-y) respectively, compared to average growth of 0.4% y-o-y in the previous 12 months.In our view, the rise in wage...

Read More »Congressional Budget Office does not believe US tax cuts will ‘pay for themselves’

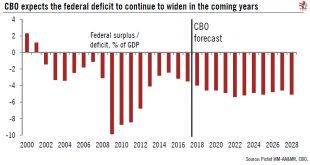

While optimistic about this year, the CBO does not believe the pace of growth is sustainable and sees a substantial increase in the fiscal deficit. The Congressional Budget Office (CBO), a bipartisan budget body reporting to US lawmakers, released a fresh 10-year economic and budget outlook earlier this week, incorporating the effects of both the December tax cuts and the March Congressional spending deal.The news is not great. The CBO seems half convinced about the medium-term benefits of...

Read More »Hard data proves soft in the euro area

Signs of a certain loss of momentum may well fuel additional ECB dovishness in the near term, but is unlikely to compromise upcoming policy normalisation.Euro area industrial production (excluding construction) was weak in February (-0.8% m-o-m) and follows the recent release of other disappointing pieces of hard data such as retail sales, German factory orders and trade. Based on available ‘hard’ data, real GDP growth rate in the euro area is projected to be 0.1-0.2% q-o-q in Q1 2018, a...

Read More »US chart of the week – Car deflation

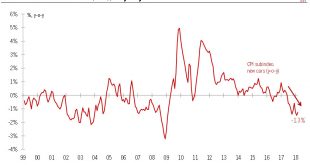

Pricing pressure on new cars suggests demand is weakening.March CPI inflation was relatively muted. Core inflation rose a relatively moderate 0.18% m-o-m, the same as in February, and below January’s 0.35% m-o-m rise. What this shows is that while core inflation is gradually improving – echoing the improvement in the US economy – fears of inflation getting out of hand are still proving unfounded.An interesting, and somewhat more alarming, aspect of the report is to be found in the sub-index...

Read More » Perspectives Pictet

Perspectives Pictet