Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationIn spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration.Volatility is still higher than last year, and has increased noticeably in the bond market once again. We have been taking measures to calibrate our...

Read More »Fed not deviating from rate-hiking routine

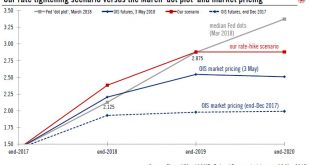

At its latest meeting, the Fed showed it remained cool-headed about inflation risks. It should not deviate from its gradualist approach of one rate hike per quarter.The Federal Reserve meeting of 1-2 May 2018 brought no surprises. As the Fed kept rates unchanged (i.e., the Fed’s interest rate on excess reserves still at 1.75%), as widely expected, the focus was on the post-meeting statement for possible signals on future rate hikes. There was no press conference.The question was how the Fed...

Read More »Policy normalisation may be delayed in Europe

Taking stock of recent dovish shifts in European central banks’ communication and reaffirming our broadly constructive macro outlook.The European Central Bank (ECB) does not seem overly concerned about the soft patch in the economy in Q1 and appears willing to collect more data before they start discussing the timing and modalities of the next policy steps. We expect the ECB to hint at an imminent end to asset purchases at its June meeting, but to wait until July to announce the modalities...

Read More »US chart of the week – Shaky ground

US residential construction is growing solidly, but the apartment sub-segment is showing signs of softening.US construction is doing broadly fine, echoing the solidity of the US business cycle. On a y-o-y basis, construction was up 3.9% in March and 5.5% y-o-y in Q1 2018. Construction outperformed nominal GDP, which was up 4.8% y-o-y in Q1.The main engine is the residential market, up 7.8% y-o-y in Q1. Nonresidential construction is growing less rapidly (+3.8% y-o-y in Q1), dampened...

Read More »Euro area growth: somewhere between hard and soft data

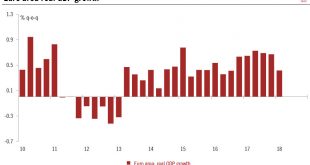

The euro area economy’s loss of momentum in Q1 derived largely from temporary factors. We remain construction on the cyclical outlook.Euro area real GDP expanded by 0.4% q-o-q in Q1, or 1.7% in annualised terms, according to Eurostat’s flash estimate. This comes after an upwardly revised figure of 0.7% q-o-q in Q4 2017. Although this first estimate could be subject to statistical revisions, it confirms that the euro area economy lost some momentum in Q1.This Q1 flash estimate confirms that...

Read More »On the lookout for further rise in 10-year yield

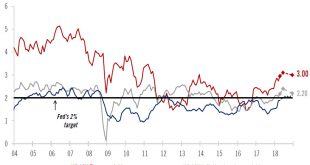

We still expect US 10-year yield to end 2018 at around 3.0%, but risks of a rise to 3.5% have increased.The 10-year Treasury yield broke through the key 3% threshold last week– as we had expected it would at some stage in our central scenario. We are sticking to this central scenario, which sees the 10-year Treasury yield ending the year at around 3%, but with some spikes above this level in Q2 and Q3 due to inflation fears.The central scenario (to which we assign a 55% probability) for US...

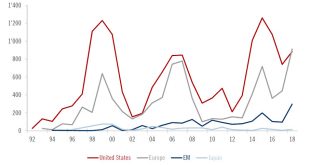

Read More »M&A buoyant so far this year

M&A activity has started the year strongly, especially in Europe, with cash-only deals to the fore as funding conditions continue to tighten.So far this year equity returns have been fairly disappointing and market volatility has significant increased compared with 2017. However, disappointment has been driven neither by poor economic conditions nor by a worsening of company fundamentals, and mergers and acquisitions (M&A) remain supportive. The acceleration of M&A in some...

Read More »Bank of Japan stays put, as expected

With moderate inflation momentum in Japan, we expect the BoJ to keep its monetary policy unchanged in 2018, although the possibility of a policy adjustment in 2019 might be rising.At its latest monetary policy meeting on April 27, the Bank of Japan (BoJ) decided to keep its current monetary easing programme intact.Under its yield curve control (YCC) policy, the BoJ applies a negative interest rate of -0.1% to the policy-rate balances in the current accounts held by financial institutions at...

Read More »Singapore grows sky-high greens

An engineer has devised a vertical farming system to grow green vegetables for the densely populated city-state, using very little water or energy and producing ten times the output per hectare of traditional cultivation methods.As the world’s population continues to grow and move into urban areas, feeding people in cities is recognised as a big challenge. Land is a precious commodity that is often threatened by over-farming, fertilisers pollute waterways, and chemicals to control pests and...

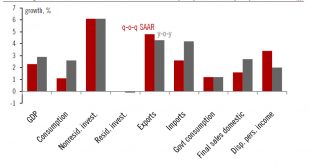

Read More »Deceleration in US GDP growth should prove transitory

Economic growth in the US slowed in Q1, but we expect a sharp rebound in Q2 as household consumption and corporate investment pick up.US Q1 GDP grew 2.3% q-o-q SAAR, slowing from 2.9% in Q4. Part of the deceleration was due to ‘residual seasonality’, we think, and was therefore technical.We expect US private consumption to rebound sharply in Q2, and, with investment growth likely to stay firm, we think Q2 GDP growth could head towards 3.5-4.0%.The Q1 employment cost index wage reading was...

Read More » Perspectives Pictet

Perspectives Pictet