Signs of a certain loss of momentum may well fuel additional ECB dovishness in the near term, but is unlikely to compromise upcoming policy normalisation.Euro area industrial production (excluding construction) was weak in February (-0.8% m-o-m) and follows the recent release of other disappointing pieces of hard data such as retail sales, German factory orders and trade. Based on available ‘hard’ data, real GDP growth rate in the euro area is projected to be 0.1-0.2% q-o-q in Q1 2018, a sharp slowdown from 0.6% q-o-q in Q4 2017. However, ‘soft’ data, such as PMI surveys, while also down in February and March, point to much stronger growth of 0.6-0.7% q-o-q. There is therefore a very wide gap between hard and soft data.Several factors could explain the weakness in hard and soft data for

Topics:

Nadia Gharbi considers the following as important: Euro area growth momentum, euro area Q1 GDP, euro area soft hard data, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Signs of a certain loss of momentum may well fuel additional ECB dovishness in the near term, but is unlikely to compromise upcoming policy normalisation.

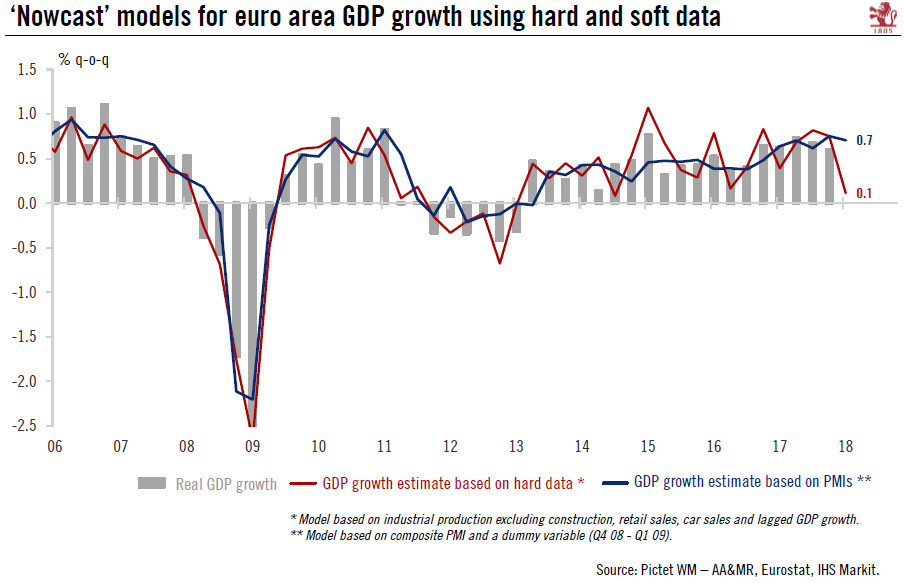

Euro area industrial production (excluding construction) was weak in February (-0.8% m-o-m) and follows the recent release of other disappointing pieces of hard data such as retail sales, German factory orders and trade. Based on available ‘hard’ data, real GDP growth rate in the euro area is projected to be 0.1-0.2% q-o-q in Q1 2018, a sharp slowdown from 0.6% q-o-q in Q4 2017. However, ‘soft’ data, such as PMI surveys, while also down in February and March, point to much stronger growth of 0.6-0.7% q-o-q. There is therefore a very wide gap between hard and soft data.

Several factors could explain the weakness in hard and soft data for the early months of 2018. Business surveys overstated the pace of growth in Q4 2017—hence the subsequent correction. Supply-side constraints (delivery times, backlogs, inventories) and labour bottlenecks have also restrained output growth. The rebasing of several ‘hard’ series data to year 2015 has likely added to the noise. Markit noted “an unusually high prevalence of staff sickness affecting activity” due to a severe flu wave in its latest press release. Harsh weather conditions and snow caused disruptions in a number of countries and sectors.

While the balance of risks could indeed shift to the downside if the correction in data were to be sustained, anecdotal evidence of supply chain delays and other temporary factors suggest that the underlying pace of activity expansion remains healthy. That said, the fall in forward-looking indices is consistent with our forecast of a gradual slowdown in the pace of growth in the euro area in the second half of 2018.