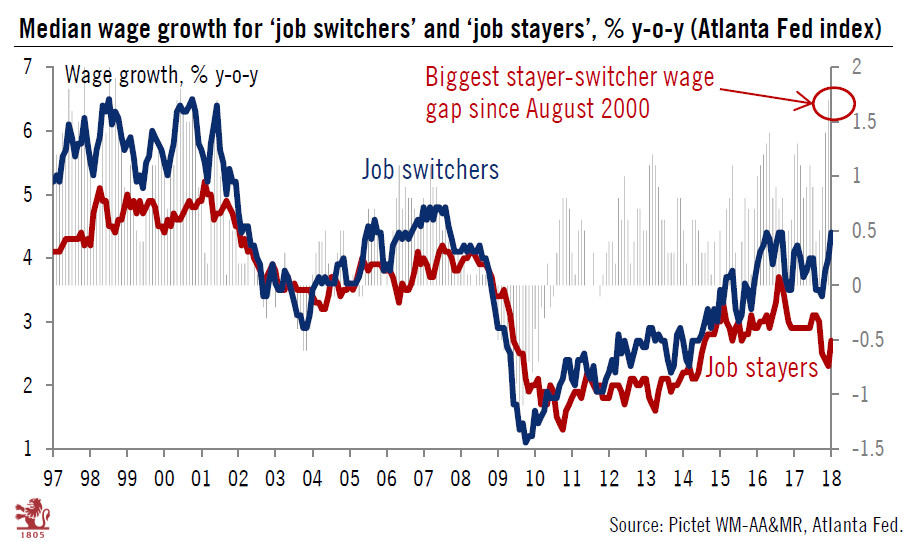

Atlanta Fed data reveals an increasingly polarised labour market, where job switchers do best as US wages remain flat.The latest release of the Atlanta Federal Reserve series on median wage growth provides interesting clues about the current US wage puzzle – i.e. the question why US wage growth remains tame despite the very tight labour market (the unemployment rate was only 4.1% in March).Of particular interest is the widening gap between wage growth for ‘job switchers’ (those who have changed employer in the past year) and for ‘job stayers’ (who kept the same job). In March, wage growth for the ‘switchers’ was 4.4% y-o-y, while wage growth for the ‘stayers’ was a mere 2.7%. In fact, the gap between the two series was 1.7 percentage point, the highest gap since August 2000. The recent

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Atlanta Fed data reveals an increasingly polarised labour market, where job switchers do best as US wages remain flat.

The latest release of the Atlanta Federal Reserve series on median wage growth provides interesting clues about the current US wage puzzle – i.e. the question why US wage growth remains tame despite the very tight labour market (the unemployment rate was only 4.1% in March).

Of particular interest is the widening gap between wage growth for ‘job switchers’ (those who have changed employer in the past year) and for ‘job stayers’ (who kept the same job). In March, wage growth for the ‘switchers’ was 4.4% y-o-y, while wage growth for the ‘stayers’ was a mere 2.7%. In fact, the gap between the two series was 1.7 percentage point, the highest gap since August 2000. The recent softness in the stayers’ wage growth is a sobering message for the US wage outlook. It echoes the view that the US labour market is increasingly ‘polarised’ with a small fringe of mobile, educated and young workers benefiting from accelerating wage gains, while the rest continues to see subdued paychecks.

While we think wage growth, and particularly the average hourly earnings series, could continue to march higher in coming months as the economy continues to improve and the labour market tightens further, we remain cognisant of the structural drags on wage growth (particularly reflected in the ongoing softness in the ‘job stayers’ series). These include the ageing of the population (and hence reduced labour force mobility), lack of empoyee bargaining power, a low inflation environment, technological progress (and robotisation), globalisation and low overall productivity, and the rising share of healthcare and pensions costs at the expense of ‘cash’ wages.