Switzerland meets two of the US Treasury’s three conditions for being deemed a ‘currency manipulator’.The US Department of Treasury has just published its semi-annual report on International Economic and Exchange Rate Policies. The main news was the inclusion of India on the department’s monitoring list, together with five other countries (China, Japan, Korea, Germany and Switzerland).The Treasury has established three criteria for a country to be deemed a currency manipulator: a bilateral trade surplus of over USD 20 billion with the US, a current account surplus larger than 3.0% of GDP, and persistent, one-sided intervention including net purchases of foreign currency, conducted repeatedly, totalling in excess of 2% of an economy’s GDP over a 12-month period.Switzerland fulfils two of

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Switzerland meets two of the US Treasury’s three conditions for being deemed a ‘currency manipulator’.

The US Department of Treasury has just published its semi-annual report on International Economic and Exchange Rate Policies. The main news was the inclusion of India on the department’s monitoring list, together with five other countries (China, Japan, Korea, Germany and Switzerland).

The Treasury has established three criteria for a country to be deemed a currency manipulator: a bilateral trade surplus of over USD 20 billion with the US, a current account surplus larger than 3.0% of GDP, and persistent, one-sided intervention including net purchases of foreign currency, conducted repeatedly, totalling in excess of 2% of an economy’s GDP over a 12-month period.

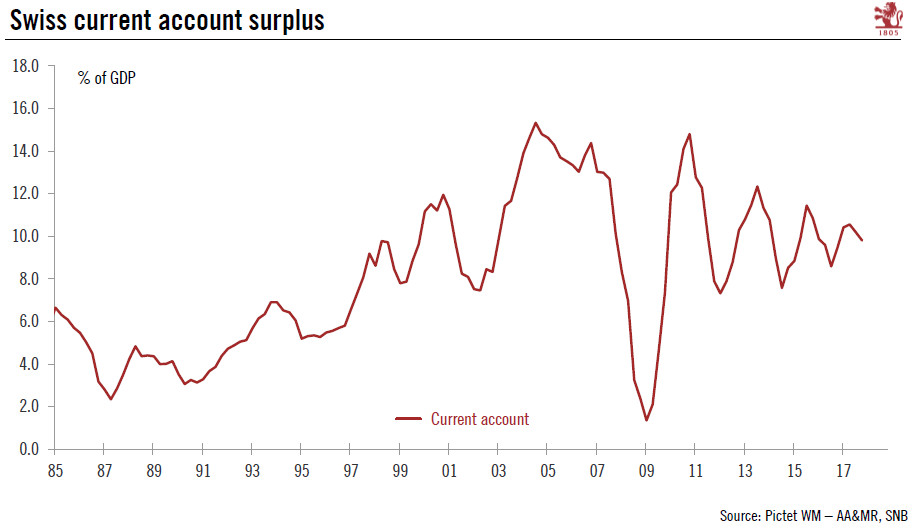

Switzerland fulfils two of the three criteria for being considered a currency manipulator. The country has a current account larger than 3.0% of GDP and central bank interventions in the foreign exchange market have exceeded 2% of GDP over a 12-month period.

However, the US Treasury seems again to have a relatively conciliatory view of Switzerland. It encouraged Switzerland to “adjust macroeconomic policies to more forcefully support domestic economy” and to “publish all intervention data on a higher frequency basis”. In this regard, the Swiss National Bank seems not to have intervened in the FX market so far this year based on the weekly variation of deposits.

For that reason, and given the small size of its economy, Switzerland is unlikely to be a major target of the US Administration.