While optimistic about this year, the CBO does not believe the pace of growth is sustainable and sees a substantial increase in the fiscal deficit. The Congressional Budget Office (CBO), a bipartisan budget body reporting to US lawmakers, released a fresh 10-year economic and budget outlook earlier this week, incorporating the effects of both the December tax cuts and the March Congressional spending deal.The news is not great. The CBO seems half convinced about the medium-term benefits of the Trump tax cuts. It assumes some relatively elevated ‘crowding-out’ (a higher federal deficit will ‘crowd out’ private investment in the future) and negative feedback effects due to the higher interest rates that are likely to result as debt rises.The fiscal year 2018 budget deficit forecast was

Topics:

Thomas Costerg considers the following as important: Macroview, US budget deficit, US CBO forecasts, US debt sustainability, US GDP growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

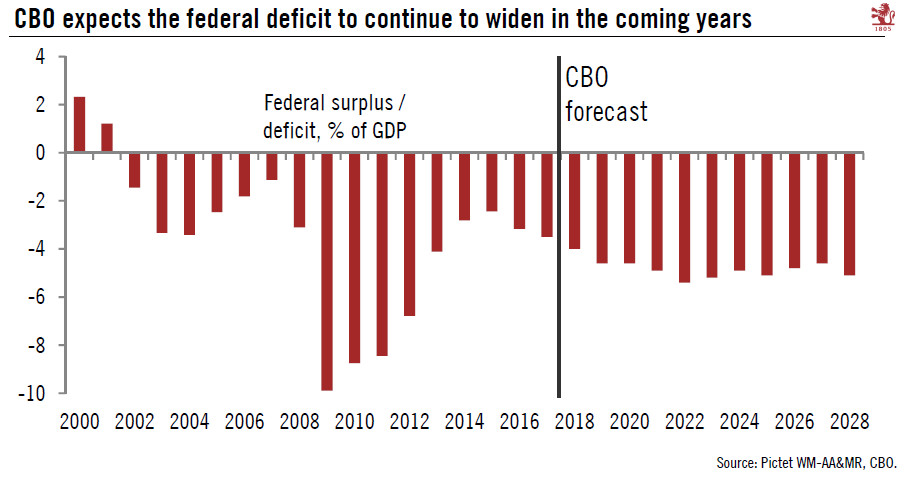

While optimistic about this year, the CBO does not believe the pace of growth is sustainable and sees a substantial increase in the fiscal deficit.

The Congressional Budget Office (CBO), a bipartisan budget body reporting to US lawmakers, released a fresh 10-year economic and budget outlook earlier this week, incorporating the effects of both the December tax cuts and the March Congressional spending deal.

The news is not great. The CBO seems half convinced about the medium-term benefits of the Trump tax cuts. It assumes some relatively elevated ‘crowding-out’ (a higher federal deficit will ‘crowd out’ private investment in the future) and negative feedback effects due to the higher interest rates that are likely to result as debt rises.

The fiscal year 2018 budget deficit forecast was raised substantially to USD804bn (up from USD563bn in previous estimate). It is now expected to cross the psychologically important USD1,000bn mark in 2020, two years earlier than had been expected last June. Over the next decade, the cumulative fiscal deficit is projected to rise to USD 11.7tn. The deficit is expected to creep up from 4.2% of GDP in fiscal year 2018 to more than 5% by 2022. The CBO expects GDP growth of 3.3% this year, but does not believe this pace can be sustained: it sees 2.4% growth next year and only 1.8% in 2020.

Echoing the CBO, we too expect solid GDP growth this year, led by corporate investment. Recent hard data confirm this view. Regarding US debt projections, the CBO’s projected increase in federal debt look scary, but we think the ‘crunch point’ is some time out. Interest rates remain very low by historical standards, and this permits some profligacy. The biggest risk would be a sudden increase in Federal Reserve interest rates.

However, our view remains that the Federal Reserve’s tightening will remain very gradual, and that the routine of one hike per quarter will be difficult to change. We do not foresee core inflation rising meaningfully above 2.5% year-on-year. But we see the recent aggressive trade rhetoric of the Trump Administration as a downside risk.