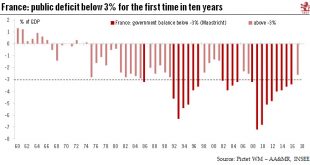

The deficit declined below 3% for the first time in a decade, which should boost France’s credibility with its neighbours.France’s public deficit fell to 2.6% of GDP in 2017 according to INSEE’s preliminary assessment, down from 3.4% in 2016 and below the 3% threshold for the first time since 2007. The outcome was better than the government’s estimate of a 2.9% deficit. If confirmed, France will exit the Excessive Deficit Procedure that the European Commission opened in 2009.France’s budget...

Read More »Larger-than-expected reduction in French public deficit

The deficit declined below 3% for the first time in a decade, which should boost France’s credibility with its neighbours.France’s public deficit fell to 2.6% of GDP in 2017 according to INSEE’s preliminary assessment, down from 3.4% in 2016 and below the 3% threshold for the first time since 2007. The outcome was better than the government’s estimate of a 2.9% deficit. If confirmed, France will exit the Excessive Deficit Procedure that the European Commission opened in 2009.France’s budget...

Read More »The US’s Chinese phone addiction

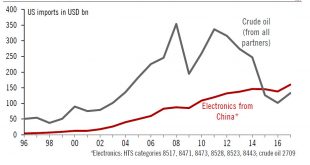

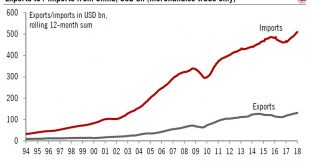

In 2017, for the third year in a row, Chinese phone and electronic good imports exceeded the value of oil imports to the US.For decades US trade policy’s biggest focus was on the country’s astronomical imports of oil. But the oil bill has moderated significantly in recent years, due to the domestic shale oil production boom and the (associated) drop in global oil prices.Lately, and more particularly since Donald Trump arrived in the White House, the focus has turned to trade with China....

Read More »The US’s Chinese phone addiction

In 2017, for the third year in a row, Chinese phone and electronic good imports exceeded the value of oil imports to the US.For decades US trade policy’s biggest focus was on the country’s astronomical imports of oil. But the oil bill has moderated significantly in recent years, due to the domestic shale oil production boom and the (associated) drop in global oil prices.Lately, and more particularly since Donald Trump arrived in the White House, the focus has turned to trade with China....

Read More »Impact of recent tariffs on US and China’s GDP should be limited for now

Trump’s trade tariffs should have a very small impact and may be a ploy to reach a trade agreement.The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD 506bn of total Chinese merchandise imports). The list of products targeted still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn.But...

Read More »Impact of recent tariffs on US and China’s GDP should be limited for now

Trump’s trade tariffs should have a very small impact and may be a ploy to reach a trade agreement.The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD 506bn of total Chinese merchandise imports). The list of products targeted still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn.But...

Read More »Disentangling the Swiss current account

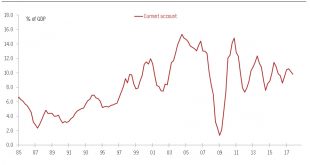

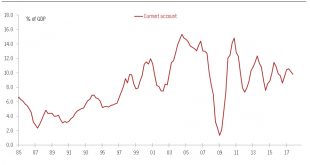

Switzerland’s high current account surplus is far from being a good proxy for assessing the fair value of the Swiss franc.Switzerland has run a current account surplus since the 1980s. In 2017, it stood at around 9.8% of GDP, CHF66bn. This was CHF4bn higher than in 2016.Economic theory suggests that a large current account surplus is a function of an undervalued currency. Based on this premise, there may be question marks over the SNB’s contention that the Swiss franc was “overvalued”.In a...

Read More »Disentangling the Swiss current account

Switzerland’s high current account surplus is far from being a good proxy for assessing the fair value of the Swiss franc.Switzerland has run a current account surplus since the 1980s. In 2017, it stood at around 9.8% of GDP, CHF66bn. This was CHF4bn higher than in 2016.Economic theory suggests that a large current account surplus is a function of an undervalued currency. Based on this premise, there may be question marks over the SNB’s contention that the Swiss franc as “overvalued”.In a...

Read More »A period of transition

Download issue:English /Français /Deutsch /Español /ItalianoThe early weeks of 2018 were full of twists for financial markets, with a rapid rise in bond yields leading to a short, sharp sell-off in equities. And while volatility subsequently fell back, it has still not returned to the low levels of 2017.What is going on? According to Christophe Donay, Head of Asset Allocation & Macro Research at Pictet Wealth Management (PWM), the correction we saw in early February was “the most visible...

Read More »A period of transition

Download issue:English /Français /Deutsch /Español /ItalianoThe early weeks of 2018 were full of twists for financial markets, with a rapid rise in bond yields leading to a short, sharp sell-off in equities. And while volatility subsequently fell back, it has still not returned to the low levels of 2017.What is going on? According to Christophe Donay, Head of Asset Allocation & Macro Research at Pictet Wealth Management (PWM), the correction we saw in early February was “the most visible...

Read More » Perspectives Pictet

Perspectives Pictet