The Russian rouble is now undervalued – but risky - following a sharp drop in the wake of the Trump Administration’s announcement of new sanctions.On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government’s ongoing and increasingly brazen pattern of malign activity around the world”. These sanctions confirm a tougher stance of the US Congress against Russia.Following the announcement, the Russian rouble depreciated significantly against the dollar (as much as 12%), as the market assesses the impact of the sanctions on the Russian economy. The decline was likely magnified by the large long exposure to the rouble. Among short-term speculators, net long exposure to the rouble was around 65% of

Topics:

Luc Luyet considers the following as important: EM currencies, Macroview, Russian rouble, US Russia sanctions

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The Russian rouble is now undervalued – but risky - following a sharp drop in the wake of the Trump Administration’s announcement of new sanctions.

On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government’s ongoing and increasingly brazen pattern of malign activity around the world”. These sanctions confirm a tougher stance of the US Congress against Russia.

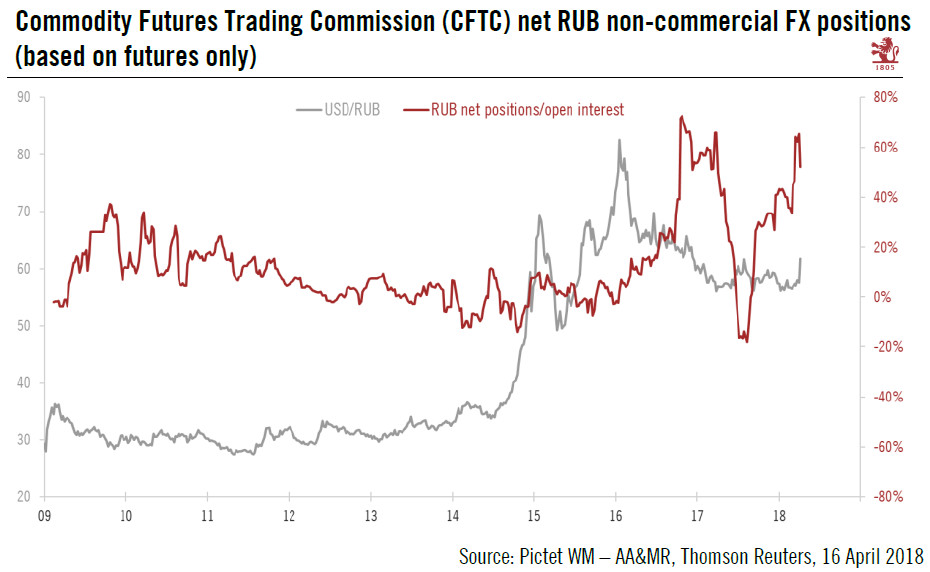

Following the announcement, the Russian rouble depreciated significantly against the dollar (as much as 12%), as the market assesses the impact of the sanctions on the Russian economy. The decline was likely magnified by the large long exposure to the rouble. Among short-term speculators, net long exposure to the rouble was around 65% of open interest, close to the highest levels of this indicator (see Chart below).

Looking at two metrics, valuation and deviation to oil price, the rouble is now significantly undervalued, and seems to discount additional sanctions on Russia.

Ultimately, the fate of the rouble will depend on whether its recent depreciation overstates or understates the threat of further sanctions and the negative impact on the Russian economy. The risk that sanctions could be extended to Russian sovereign debt at some point, however, suggests that the rouble has become definitively more risky.

Given the geopolitical tensions with Russia (e.g. Syria and Skripal poisoning case) and the very hawkish stance of the US Congress on Russia, an eventual extension of sanctions in respect of Russian sovereign debt following a series of new sanctions cannot be ruled out.