NAFTA renegotiation talks may be a positive signal for the US-China trade tensions.Having progressed slowly for several weeks, the NAFTA (North America Free Trade Agreement) renegotiation talks seem to have found some fresh impetus lately, with several officials suggesting that a deal could be reached as soon as early May. A trilateral meeting will take place in Washington DC this Thursday on the margins of the G20 finance ministers’ meeting.A key positive is that the US has reportedly dropped its most contentious demands in the renegotiation, such as the “sunset clause” that would have automatically ended NAFTA unless national parliaments expressly re-authorised it. The US has also reportedly dropped its requirements of high US content in NAFTA supply chains (50% US content formed the

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

NAFTA renegotiation talks may be a positive signal for the US-China trade tensions.

Having progressed slowly for several weeks, the NAFTA (North America Free Trade Agreement) renegotiation talks seem to have found some fresh impetus lately, with several officials suggesting that a deal could be reached as soon as early May. A trilateral meeting will take place in Washington DC this Thursday on the margins of the G20 finance ministers’ meeting.

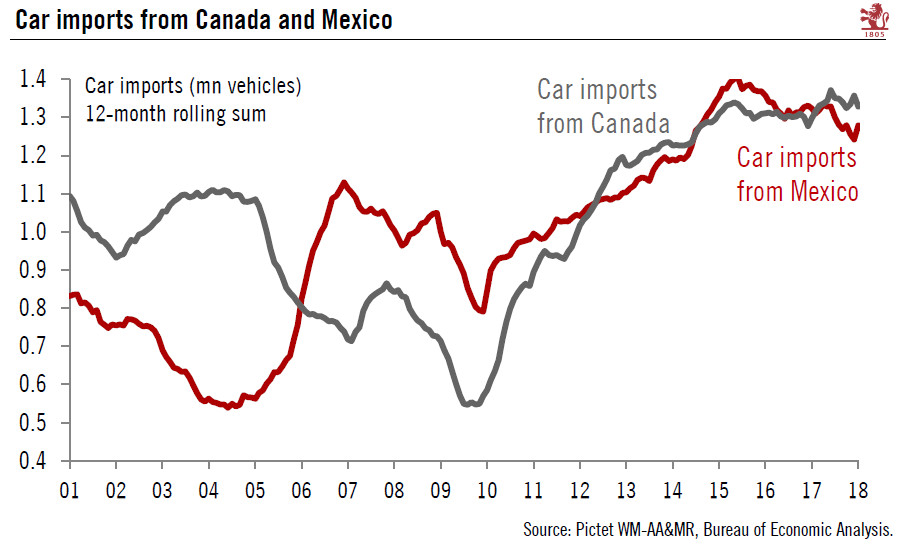

A key positive is that the US has reportedly dropped its most contentious demands in the renegotiation, such as the “sunset clause” that would have automatically ended NAFTA unless national parliaments expressly re-authorised it. The US has also reportedly dropped its requirements of high US content in NAFTA supply chains (50% US content formed the initial basis of the discussions), which could have disrupted the auto sector. At present, what’s on the table is an increase in the requirement for NAFTA-sourced parts to 75% – down from an initial proposal of 85% but up from the current 62.5%. This would result in the NAFTA renegotiations essentially being cosmetic in nature rather than making major differences to the treaty.

The question is whether it’s possible to draw inferences from the NAFTA talks for the ongoing discussions with China. Much as was the case with the negotiations with its NAFTA partners, the Trump Administration has started talks with China on the front foot with some rather inflamed rhetoric. This could be mostly bluster, and there could be a limited impact on bilateral trade in the end; but the recent escalation in the war of words has somewhat increased the downside risks (see US-China trade update, 10 April).