The eminent Oxford historian says that there is nothing new about globalisation, which began as much as 3,000 years ago. A key moment was when Alexander the Great’s conquests connected three continents and opened trading routes between the great cities of antiquity. What was the role of Alexander the Great in globalisation? His conquests between 334 and 323BC drew together North Africa, Europe and Asia and created what could fairly be called a global exchange system. Coins minted by his...

Read More »Europe chart of the week – wage growth

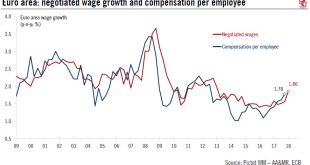

Euro area wage growth rose in the first quarter of the year, reinforcing our view that the ECB will end QE in December.For all the noise about Italian politics and the loss of economic momentum in the euro area, this week also brought some reassuring news that underlying inflationary pressure is gradually building. The ECB’s data series of euro area negotiated wages rose to a five-year high of 1.9% y-o-y in Q1 2018. The compensation per employee series, which the ECB staff is using as their...

Read More »The Entrepreneurs – Mountain retreat

[embedded content] The 4th edition of the Pictet Mountain Retreat was held in St Moritz in March 2018 at the heart of the Swiss Alps. It brought together an exclusive group of 50 entrepreneurs and investors in an intimate setting to network, unwind and have fun.This event combines sport, competition, Pictet expertise as well as relaxed moments spent in a cosy and exclusive environment.

Read More »Pictet – The Entrepreneurs – Mountain retreat (Abridged version)

The 4th edition of the Pictet Mountain Retreat was held in St Moritz in March 2018 at the heart of the Swiss Alps. It brought together an exclusive group of 50 entrepreneurs and investors in an intimate setting to network, unwind and have fun. This event combines sport, competition, Pictet expertise as well as relaxed moments spent in a cosy and exclusive environment.

Read More »Pictet – The Entrepreneurs – Mountain retreat (Full Version)

The 4th edition of the Pictet Mountain Retreat was held in St Moritz in March 2018 at the heart of the Swiss Alps. It brought together an exclusive group of 50 entrepreneurs and investors in an intimate setting to network, unwind and have fun. This event combines sport, competition, Pictet expertise as well as relaxed moments spent in a cosy and exclusive environment.

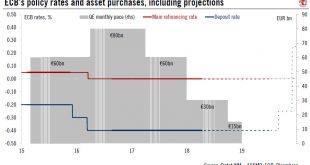

Read More »ECB: contingency plans

A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle.Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance.Still, downside risks have risen to the point where another open-ended QE extension can no longer be ruled out, albeit at a slower pace, in order to...

Read More »US chart of the week – Still some capacity

Growth in US capex may be skewed toward the booming energy sector, while manufacturing still has spare capacity.A key question for this year’s US macroeconomic outlook is whether firms become less stingy about investment (capex). The December 2017 tax cuts have fuelled hopes for a long-awaited acceleration in US capex, as they de facto lower the cost of capital. The tax boost to collective business sentiment, the so-called ‘animal spirits’, is supposed to be an additional impetus to capex...

Read More »PMIs point to downside risk to near term euro area growth

Following another disappointing set of business sentiment indicators, speculation over a longer extension of QE is rising.Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the...

Read More »China-US trade war on hold

A significant softening of the US stance increases the likelihood of reaching a final agreement.Two weeks after the US-China talks in Beijing, the two countries held another round of trade negotiations in Washington DC on 17-18 May. After the meetings, delegations on both sides released a joint statement that was brief but constructive in tone. In essence, China has agreed to significantly increase its imports of American goods and services to reduce the US trade deficit with China, to...

Read More »Oil price forecast revised up

Tensions surrounding oil supplies from Iran and Venezuela are destabilising the supply/demand balance.The decision by Donald Trump to withdraw from the nuclear agreement with Iran in early May constitutes a major geopolitical shift. Iran is the world’s seventh-largest world oil producer, exporting 1.1 million barrels per day (mbd). At this stage, it is unclear how Iranian exports will be affected, but taken together with the crisis in Venezuelan oil production, it could cause significant...

Read More » Perspectives Pictet

Perspectives Pictet