Although wage growth in Japan is picking up and our inflation forecast may face some modest upside risk, we do not expect a change in the BoJ’s policies in 2018.Anaemic in the past couple of years, wage growth in Japan finally seems to be picking up. In January and February 2018, the average nominal cash earnings of Japanese workers grew by 1.2% and 1.3% year-over-year (y-o-y) respectively, compared to average growth of 0.4% y-o-y in the previous 12 months.In our view, the rise in wage growth, especially in base salaries, likely reflects the increasingly tight labour market conditions in Japan, where the economy is running at full employment and well above its potential.At the moment, our forecast of core inflation in Japan stands at 1.0% for 2018. Given the momentum behind Japan’s wage

Topics:

Dong Chen considers the following as important: Japan wage growth, Japanese wage growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Although wage growth in Japan is picking up and our inflation forecast may face some modest upside risk, we do not expect a change in the BoJ’s policies in 2018.

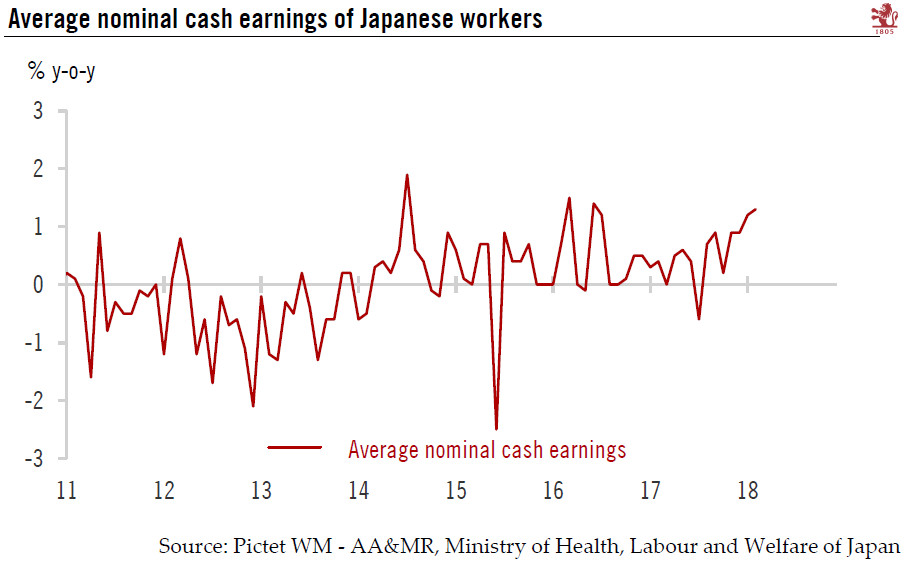

Anaemic in the past couple of years, wage growth in Japan finally seems to be picking up. In January and February 2018, the average nominal cash earnings of Japanese workers grew by 1.2% and 1.3% year-over-year (y-o-y) respectively, compared to average growth of 0.4% y-o-y in the previous 12 months.

In our view, the rise in wage growth, especially in base salaries, likely reflects the increasingly tight labour market conditions in Japan, where the economy is running at full employment and well above its potential.

At the moment, our forecast of core inflation in Japan stands at 1.0% for 2018. Given the momentum behind Japan’s wage inflation and rising crude oil prices in recent months, this forecast may be subject to some upside risk, although the size of any potential revisions should be modest.

We do not believe any small change in the inflation outlook will lead the BoJ to change its policy stance in 2018. After all, the current rate of inflation is still only half what the Bank of Japan (BoJ) has vowed to achieve since 2013. With the JGB yield curve firmly under the BoJ’s control and no pronounced side effects from monetary easing, the central bank does not seem to face any significant pressure to end its stimulus policy in the near term. However, if wage pressure continues to mount and translates into more sustained inflation momentum, the case for a BoJ exit from monetary easing will grow stronger. This means the likelihood of a move toward policy normalisation in 2019 could be rising, perhaps starting with an adjustment to the yield curve targets.