Future-facing companies and disruptive business models are what Mattias Ljungman, co-founder and partner at Atomico, is all about. Mattias believes in the power of technology to shape the future of investments and he’s particularly excited about the growth potential of the gaming industry – the subject of his presentation at the Latam Family Office Master Class in the Bahamas.

Read More »US chart of the week – Car imports

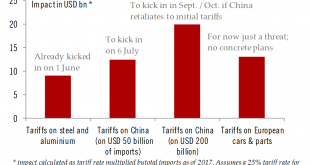

Latest Trump threats menace car imports.The US trade rhetoric has reached a fever pitch in recent weeks: after threatening China with additional tariffs if they retaliate against the first batch of US actions (set to enter into force on 6 July), President Trump has turned his attention to foreign car producers, which he has threatened with a 20% import tariff.A few weeks ago, Trump ordered a review of all car imports on the rather legally loose ground of “national security” – the same reason...

Read More »Buying more time

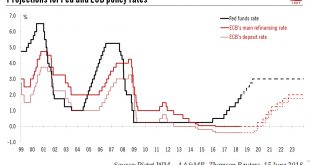

Clear signs from the ECB that it won’t raise rates until H2 2019 mean we are revising our expectations for monetary tightening in Switzerland.The Swiss National Bank’s (SNB) monetary meeting was held last week. The press release was little changed from the previous one. The SNB reiterated its willingness to intervene in the foreign exchange market if needed. The central bank’s assessment of the Swiss franc also remained unchanged, stating that it continued to see the currency as “highly...

Read More »A modified approach for a low-return environment

Download issue:English /Français /Deutsch /Español /ItalianoOur annual Horizon publication contains Pictet Wealth Management’s analysis of expected returns over a 10-year horizon. Simply put, major asset classes are expected to deliver lower returns. But alternatives offer greater potential — in exchange for a degree of illiquidity.This abridged edition of Horizon sets out our rationale behind our expected returns forecasts relative to risk for the next ten years across some 35 asset...

Read More »Weekly View – Greece out of the woods, Italy raising doubts

The CIO office’s view of the week ahead.The week gone by saw some good news in Europe in the form of a debt relief agreement for Greece that ends eight years of bailouts and gives that country some measure of spending flexibility. The agreement sparked an encouraging rally in Greek equities and bonds. The latest flash purchasing managers’ index (PMI) figures also suggested that business sentiment is steadying in the euro area, whose economy looks to have performed decently in Q2 2018. But...

Read More »Communal spaces for greater sustainability

Photographic artist Simon Roberts says that cities have gradually opened up more of their private land for public use, driven by the noblesse oblige of sovereigns, then philanthropic industrialists, and now city-dwellers demanding more sustainable cities.Until the 17th century, urban parks in Europe were private land – exclusively owned and used by royalty, the nobility and wealthy families. But when Charles II became King of England in 1660, he opened the grounds of St James’s Park next to...

Read More »Rise in Bund yield will be limited

A mixture of soft data, a change of government in Italy and a dovish ECB exit from quantitative easing mean we are revising downward our year-end forecast for the 10-year Bund yield.With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous...

Read More »US trade tariffs: a new consumer tax in disguise?

A new set of tariffs on Chinese imports threatened by the Trump administration look like a stealth tax on consumers.After the steel and aluminium tariffs introduced in early June, another stage was reached last week when the Trump Administration announced that further tariffs specifically aimed at imports from China will kick in on 6 July (first on USD34 billion of imports, to be followed shortly thereafter by tariffs on a further USD16 billion). The tariff rate will be 25%. Officially,...

Read More »Short-term hurdles to euro strength, but 2019 should be different

An ECB commitment not to hike rates at least until summer 2019 has added to recent euro weakness against the dollar, but factors behind the long-term decline of the latter could soon come back to the fore.The ECB’s commitment on rates announced at its June monetary policy meeting showed it remains very prudent. Given recent unsupportive data, the euro likely faces high hurdles to significant appreciation in the short term. Macro data in the euro area may not be supportive in the very short...

Read More »Pressure is rising in US-China trade

We are not yet in a trade war, but US brinkmanship means the risk is rising.The US will hit USD34 billion (out of a total of USD500 billion) of imports from China with a 25% trade tariff, effective 6 July. The official reason is to sanction China’s intellectual property theft and to fire a warning shot against the ‘Made in China 2025’ industrial policy. This move has prompted retaliatory measures by the Chinese authorities on imports from the US of the same scale and intensity. For now, the...

Read More » Perspectives Pictet

Perspectives Pictet