Policy makers’ forecast for rate hikes this year likely to be raised, but central bank will be much more cautious on view further out.The Federal Reserve’s 12-13 June meeting takes place amid a strong economic backdrop at home, and the Fed is unlikely to hesitate about hiking rates by another quarter-point to a range of 1.75-2.00% this week. The US labour market is particularly solid: the unemployment rate dropped to 3.8% in May, the lowest rate since April 2000. The three-month average gain...

Read More »Weekly view—Central banks and Korea make for a busy week

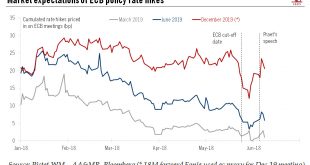

The CIO office’s view of the week ahead.The ECB’s chief economist, Peter Praet, hinted that there could be an announcement on the winding-down of the bank’s bond-buying programme this week rather than in July, as many had thought, with Praet expressing confidence that inflation would rise toward the ECB’s 2% target. Coming at a particularly sensitive time, with the euro area economy continuing to work through a prolonged soft patch and the new populist government in Italy still an unknown...

Read More »Sustainable offices for the cities of the future

An office building in Amsterdam has been designed as a zero-carbonbuilding that occasionally generates more power than it consumes and uses a host of smart technologies to create adaptable and intelligent workspaces.Just under a third of the world’s energy is consumed by buildings that are responsible for about a fifth of global greenhouse gas emissions, according to the International Panel on Climate Change. More worrying, their use of energy could double or even treble by 2050, as billions...

Read More »Europe chart of the week—German new orders

This is not what we ordered!German new orders were weak across the board in April, contracting for a fourth consecutive month and by a larger-than-expected 2.5% m-o-m following a downwardly-revised 1.1% drop in March. As a result, total manufacturing orders are off to an extremely weak start in Q2 (-3.3% q-o-q after -2.2% q-o-q in Q1). What is more, the decline in demand for German goods in April was fairly broad-based across countries and sectors.Beneath the surface of horrible headline...

Read More »ECB gets ready to make the leap

An announcement on quantitative easing is looking likely as early as next week. But the jury is out on what the central bank will actually say.Peter Praet’s hawkish comments on inflation this week did not surprise us in terms of substance but did in terms of timing. The view of the (usually dovish) ECB chief economist carries significant weight, and therefore an announcement on QE is now likely at the 14 June meeting.We expect the staff projections to be revised lower in terms of GDP growth,...

Read More »The US economy is doing fine. What are the main risks?

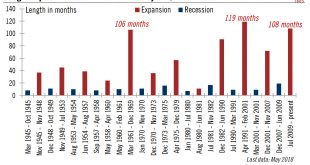

While there are plenty of signs we are in the late stage of the business cycle, and while the Fed is tightening policy, we do not expect a recession in the US.The US economy is doing fine and we continue to expect solid growth in the coming quarters. The strength of corporate profits versus still-subdued unit labour costs is a sign of the robustness of the underlying US business cycle.One risk sometimes evoked is a sudden acceleration in inflation. But we forecast that core PCE inflation...

Read More »US chart of the week—solid jobs market

Growth in US jobs marches on: openings now exceed the numbers of unemployed.The US job market is going from strength to strength. The unemployment rate dropped to 3.8% in May, the lowest since April 2000. And another milestone has been reached as the number of job openings rose to 6.70 million in April, exceeding the number of unemployed people (6.1 million in May, 6.3 million in April)Job openings remain a good leading indicator for future US employment growth, and the ongoing momentum in...

Read More »In Conversation With Alfonso Prat-Gay

[embedded content] Latin America is at a crossroads in 2018 with several regional powerhouses heading to the polls. And while plenty is yet to be defined – both economically and politically – there are also causes for optimism as populism arguably shifts out of the region and into North America. Alfonso Prat-Gay, Argentina’s former finance minister and ex-president of the nation’s central bank, spoke inside the tented event space at the Latam Family Office Master Class in the Bahamas. And...

Read More »Pictet — In Conversation With Alfonso Prat-Gay

Latin America is at a crossroads in 2018 with several regional powerhouses heading to the polls. And while plenty is yet to be defined – both economically and politically – there are also causes for optimism as populism arguably shifts out of the region and into North America. Alfonso Prat-Gay, Argentina’s former finance minister and ex-president of the nation’s central bank, spoke inside the tented event space at the Latam Family Office Master Class in the Bahamas. And he’s adamant there...

Read More »Global business survey heralds inflection in economic activity

A slowdown in global business sentiment is not too worrying at this stage, but further deterioration will trigger downward revisions to GDP projections.Markit’s world manufacturing purchasing managers index (PMI) dropped from 53.5 in April to 53.1 in May. All in all, the world PMI declined in four of the first five months of 2018. No region has been spared the decline in business sentiment. Nonetheless, the index is still well above the 50 threshold that separates expansion from...

Read More » Perspectives Pictet

Perspectives Pictet