Economic fundamentals should come back into focus, but politics still a factor.After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy. In both countries, the political equilibrium remains fragile, with a risk of snap elections in 2019.With the end...

Read More »How mobile technology is changing the way we shop

As is evident when travelling on public transport, people spend a lot of their idle time on mobile phones. But according to Stephan Schambach, the serial entrepreneur behind several major innovations in e-commerce, retailers have been slow to recognise that the future of their industry lies in mobile technology. Customers will increasingly demand the online experience available in other consumer industries such as travel and tourism, and the retail brands that are first to provide it will...

Read More »Баянист Толстухин Александр

Weekly View – CIO view: May’s ‘TINA’ vote

The CIO office’s view of the week ahead.Economic data came in weaker than expected last week, especially in China and Europe, and we can anticipate messy forthcoming US data, given the ongoing US government shutdown. In China, manufacturing survey readings dropped into contraction territory, which together with hard data points toward continued growth deceleration in China’s imports and exports. At the same time, Germany, Europe’s manufacturing powerhouse, saw a continued fall in industrial...

Read More »Concerns about Italy have not gone away

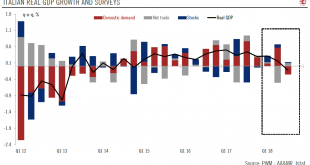

Rome and Brussels reached a compromise on the Italian government’s budget plans last month. But there are plenty of reasons for thinking this will be a challenging year for Italy.After battling for more than two months over a 2019 budget plan defiantly non-compliant with the EU fiscal rules, Rome and Brussels struck a last-minute agreement in December that avoided opening an Excessive Deficit Procedure (EDP). To avoid the EDP, Italy had to backtrack on parts its initial plans for fiscal...

Read More »UK Politicians remain stuck in the mire

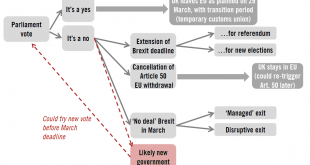

Next week’s vote on the divorce deal is likely to be defeated, and there is precious little time for an alternative before the Brexit deadline in March.The British parliamentary vote on Theresa May’s EU divorce deal will be on 15 January. The deal is likely to be rejected, as there has been little progress since December, when a first vote was called off for lack of support.The problem is that there remains no majority for any alternative. If there is no plan voted by parliament before the...

Read More »Mass customisation of breakfast cereals

When Hubertus Bessau was 16, he knew exactly what he wanted to do – or rather, he knew exactly what he did not want to do. He did not want to work for a large company where it would be hard for him to have any impact on what happened. His ambition was to find a career that he would enjoy and where he could make a difference.He was already earning his own pocket money by designing websites for friends of his parents rather than taking casual jobs like working in a bar as friends did. When he...

Read More »Germany is stagnating

Sagging industrial production and confidence figures point to weak Q4 GDP.German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009.While some idiosyncratic factors were likely at play, such as below-average water levels on the Rhine, which may have had an impact on energy production and chemical...

Read More »Outsized rise in rates charged on US credit cards

The increase in interest rates paid for credit card debt far exceeds the rise in the Fed funds rate, pointing to sizeable divergence in the impact Fed tightening is having on the US economy.The Fed’s interest-rate tightening since Q4 2015 has had divergent repercussions on interest rates paid by ‘end users’ across the US economy.Interest rates on credit card debt have risen particularly sharply since the start of Fed tightening.How monetary policy is transmitted to the ‘real economy’,...

Read More »Euro credit: 2019 outlook

After a negative 2018, developments in Italy and indirect ECB support will help define the road ahead for European corporate bonds.Last year was a difficult one for euro credit, with both the ICE Bank of America Merrill Lynch (ICE BofAML) investment grade (IG) and high yield (HY) indices posting negative total returns. This was entirely due to wider credit spreads, as medium-term German government bonds yields fell slightly. Looking back, policy makers had a major impact on the performance...

Read More » Perspectives Pictet

Perspectives Pictet