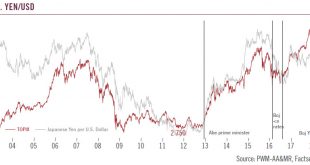

There are plenty of arguments for and against a Japanese equity market whose fortunes are tightly linked to the strength of the yen and the success of Abenomics.Since mid-December 2012, when Shinzo Abe came to power, to end-June 2018, the TOPIX increased by 12% in local currency terms on an annualised total return basis, a significant achievement that owes much to ‘Abenomics’. At the same time, the Bank of Japan (BoJ) has had a direct impact on equities through its commitment to buy 6...

Read More »House View, July 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer.Recent sell-offs have vindicated our cautiousness regarding emerging-market assets in general. But valuations are becoming more interesting, and...

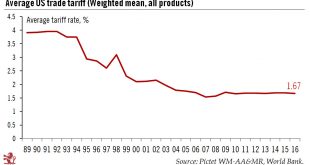

Read More »The average US tariff was low… until recently

Actions by the Trump administration may well represent a ‘regime shift’ in terms of US tariff rates.Perhaps the main regime shift that has occurred during the Trump presidency is in US trade policy. More than tax policy, this is an area where Trump could mark the clearest break – although economic historians often point out that the US economy’s rise to global dominance in the 19th century owed a lot to protectionism.Still, the trend since World War 2, and even more since the end of the Cold...

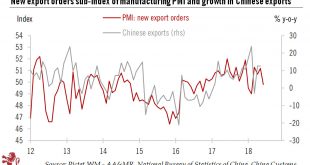

Read More »Weakening growth momentum in China will lead to policy adjustments

In response to the weakening of growth momentum and the threat of a trade war with the US, the Chinese authorities are likely to continue to make monetary and fiscal adjustments.Recent data releases generally point to a softening in China’s growth momentum. The deceleration is most notable in fixed-asset investment and retail sales, and the rising trade tensions between US and China may have weighed on the export sector.The official manufacturing PMI for June came in at 51.5, down from 51.9...

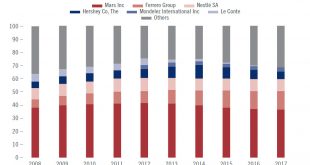

Read More »Consumer staples in Asia, are local brands or multinationals winning ?

Domestic Asian companies usually have a head start in their respective markets, but multinationals have a chance to gain share if they capture changes in user behaviour.They typically have a head-start on multinationals (MNCs) in terms of product localisation and strong relationships with distributors when it comes to rolling out products across traditional trade channels. A deep understanding of local preferences has been a key driver for the success of domestic companies as many foreign...

Read More »Weekly View – assessing the strength of the US economy and corporates

The CIO office’s view of the week ahead.After the release of tepid consumer spending and business equipment figures for May, this week will be important in helping us gauge the prospects of the US economy, with the latest Fed minutes released on Thursday and US payroll figures a day later. The minutes should reflect our belief that the economy is in good shape, with growth in Q2 set to come in at a seasonally-adjusted quarter-on-quarter rate of 4.5%. We also expect US corporates to announce...

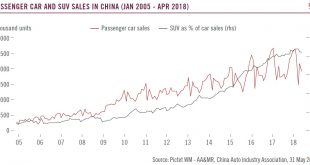

Read More »The rise of the Chinese consumer

China’s economy is becoming more consumption oriented, driven by state policy, demographic changes and solid income growth.As the Chinese economy slows down, its structure is undergoing major changes. The traditional investment-driven growth model is gradually giving way to a consumption-driven one. Household consumption is not only taking a greater share of the economy, it has increasingly become a dominant driver of China’s growth.This transition, from a long-term perspective, is driven by...

Read More »Europe chart of the week – Bank credit flows

ECB’s M3 and credit report for May showed a large rebound in long-term bank loans to corporates.The ECB’s M3 and credit report for May published this week was pretty strong overall and confirmed that lending dynamics in the euro area are in good shape. Bank credit flows to non-financial corporations (NFC, adjusted for seasonal effects and securitisations) amounted to €22bn in May, much more than the April figure of €11bn. Corporate-sector lending increased 3.6% year-over-year in May, its...

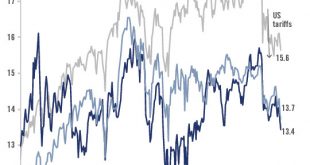

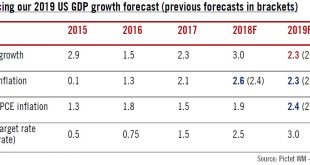

Read More »US growth looks firm in 2018; 2019 is more uncertain

While we are maintaining our 3% growth forecast for 2019, we have slightly reduced our baseline forecast for 2019.The Trump administration has been stepping up its trade rhetoric further, with concrete increases in trade tariffs already kicking in, and others in the near-term pipeline: tariffs on steel and aluminium came into effect in early June, and there will be 25% tariffs on USD 34 billion of Chinese imports (out of a total of USD505 billion in 2017) from 6 July. President Trump has...

Read More »In Conversation With Mattias Ljungman

[embedded content] Future-facing companies and disruptive business models are what Mattias Ljungman, co-founder and partner at Atomico, is all about. Mattias believes in the power of technology to shape the future of investments and he’s particularly excited about the growth potential of the gaming industry – the subject of his presentation at the Latam Family Office Master Class in the Bahamas.

Read More » Perspectives Pictet

Perspectives Pictet