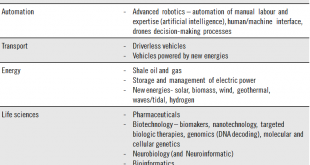

Head of Asset Allocation & Macro Research and Chief Strategist with Pictet Wealth Management, Christophe Donay shares his thoughts on the perennial relationship between innovation and economic growth.When analysing the current economic regime and assessing the potential for a shift in that regime, it is vital to take innovation into account. Demographic trends and productivity gains are commonly identified as the two main drivers of real economic growth. And innovation is a critical...

Read More »Fed rate decoupling

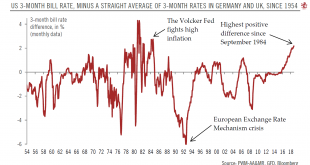

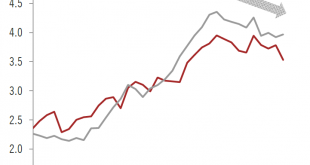

Monetary policy drift to continue.Fed likely to keep tightening while buoyed by a solid domestic backdrop Looking at the Federal Reserve (Fed) from the other side of the Atlantic, the question is really to what extent the Fed can continue to ‘decouple’ its monetary policy from other main global central banks, including those in Europe.The three-month Treasury bill rate in the US is at c.2.2%, while a straight average of the corresponding rate in Germany (c.-0.6%) and the UK (c.0.7%) is...

Read More »Squaring off over the Italian budget

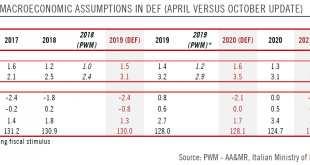

The Italian government’s budget plans set it on a collision course with the European Commission. The road to some kind of agreement is likely to be long and bumpy.The Italian government has confirmed its deficit target at 2.4% of GDP for 2019. This represents significant slippage from a previous budget deficit target of 0.8% in 2019. The deficit target has been set at 2.1% for 2020 and 1.8% for 202. But it is not the headline deficit numbers that are a problem, but rather the details behind...

Read More »No massive monetary stimulus on the way from the PBoC

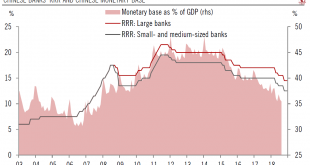

The latest cut in banks’ required reserve ratios seems likely to have been motivated by additional signs of slowdown in the Chinese economy, but may not herald a massive monetary stimulus.Over the weekend, the People’s Bank of China (PBoC) announced a cut of 100 basis points (bps) in banks’ required reserve ratio (RRR). This is the third RRR cut since April. The PBoC estimates that it will free up about Rmb 750 billion of net new liquidity in the banking system. According to the central...

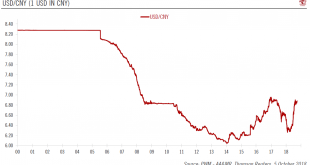

Read More »Renminbi nears a psychological threshold

The People’s Bank of China is unlikely to welcome further currency weakness.Having dropped more than 5% year to date, our scenario of weaker growth in China in 2019 (we expect GDP growth to decline to 6.1% from 6.6% in 2018) is likely to further weigh on the renminbi through the interest rate differential. The Chinese current account is unlikely to provide much relief, as it has moved into deficit in 2018. However, given that the renminbi is around 10% off its recent peak, a further sharp...

Read More »Weekly View – Dancing Queen

The CIO office’s view of the week ahead.Far-right presidential candidate Jair Bolsonaro claimed victory in the first round of Brazil’s elections on Sunday, albeit he did not obtain the over 50% of the vote required to secure a majority and avoid a run-off. Markets have grown more positive toward Bolsonaro since the start of his campaign and we think Paulo Guedes, is a reassuring choice as his economic advisor. University of Chicago-educated and former banker Guedes has liberal economic...

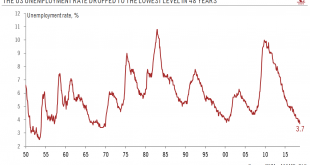

Read More »Hurricane aside, US job market is still very solid

US unemployment rate drops to lowest level in 48 years.Setting aside the impact of the hurricane that hit the Carolinas (and also the headline payroll reading as a result), the US jobs market remains in very good shape. Today’s data showed the unemployment rate dropped to its lowest level in 48 years in September (3.7%).Importantly, the nonfarm payrolls reportshowed strong employment gains in September, consistent with the view that GDP growth is remaining firm in the second half of the...

Read More »German September PMIs surprisingly weak

Blame the German automotive industry for the fall in manufacturing orders.Recent German soft and hard data in the manufacturing sector has been surprisingly weak. Data released today showed that the final manufacturing PMI fell to 53.7 in September, from 55.9 in August. Factory orders rose by 2.0% month-on-month (m-o-m) in August, having contracted for six out of the seven previous months. The increase in August factory orders data puts the Q3 carry over at -1.4% q-o-q, slightly improving...

Read More »Time to be more constructive on high yield

High yield bonds are benefiting from improved credit fundamentals and macroeconomic trends.We have just moved from an underweight to a neutral position on US and euro high yield bonds. Several factors underpin this relatively more constructive view.First, in spite of historically low spreads, the carry offered by high yield remains attractive and acts as a cushion at a time of rising government yields. Second, fundamentals remain sound, as the increase in corporate profits has outstripped...

Read More »Extraordinary times for the US economy

Fed officials compete to trumpet about the health of the US economy.We have long-highlighted how solid the US economy is, in-line with our ongoing scenario of 3% GDP growth for the year. That strong corporate investment is driving this offers still better news, given its potential to ultimately feed stronger productivity growth.Another positive lately is that US firms’ solid optimism about investment is coupled with strong hiring intentions. This is all the more striking given that hiring...

Read More » Perspectives Pictet

Perspectives Pictet