Blame the German automotive industry for the fall in manufacturing orders.Recent German soft and hard data in the manufacturing sector has been surprisingly weak. Data released today showed that the final manufacturing PMI fell to 53.7 in September, from 55.9 in August. Factory orders rose by 2.0% month-on-month (m-o-m) in August, having contracted for six out of the seven previous months. The increase in August factory orders data puts the Q3 carry over at -1.4% q-o-q, slightly improving from the decline in manufacturing orders observed in Q2.Weak external demand, problems in emerging markets and global trade uncertainties are among the factors explaining the poor performance of the German industrial sector since the beginning of the year. But there is also another factor that has been

Topics:

Nadia Gharbi considers the following as important: European manufacturing, Germany, Macroview

This could be interesting, too:

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Marc Chandler writes Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Marc Chandler writes Searching for Direction

Marc Chandler writes Serenity Now

Blame the German automotive industry for the fall in manufacturing orders.

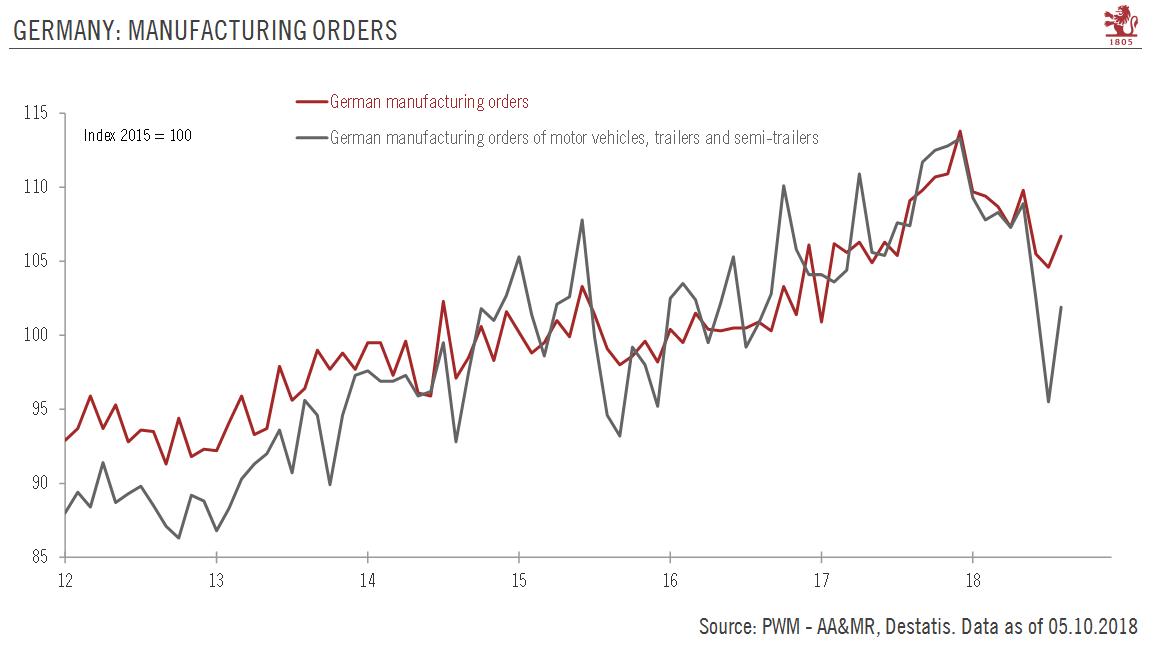

Recent German soft and hard data in the manufacturing sector has been surprisingly weak. Data released today showed that the final manufacturing PMI fell to 53.7 in September, from 55.9 in August. Factory orders rose by 2.0% month-on-month (m-o-m) in August, having contracted for six out of the seven previous months. The increase in August factory orders data puts the Q3 carry over at -1.4% q-o-q, slightly improving from the decline in manufacturing orders observed in Q2.

Weak external demand, problems in emerging markets and global trade uncertainties are among the factors explaining the poor performance of the German industrial sector since the beginning of the year. But there is also another factor that has been distorting data, notably in Q3: the introduction of the Worldwide Harmonised Light Vehicle Test Procedure (WLTP). The WLTP applies to all new car registrations since 1 September. While most European car makers have adapted more or less smoothly to these new standards, some German car manufacturers, too busy grappling with the fallout from the exhaust emission scandal, have struggled to convert some of their models. This has led some manufacturers to cut production to avoid adding to inventory.

The factory orders data released today showed that German car orders rebounded significantly in August, possibly because of front-loading of orders from EU countries ahead of the introduction of WLTP. This surge in orders is likely to have been partially reversed in September.

Given the importance of the car industry to Germany, the ‘noise’ created by WLTP will likely hurt Q3 GDP growth. Nevertheless, the negative impact is likely to be transitory and other sectors such as services and construction are helping to compensate for the manufacturing sector’s weakness. We expect the German economy to expand by 1.9% in 2018.