Fed officials compete to trumpet about the health of the US economy.We have long-highlighted how solid the US economy is, in-line with our ongoing scenario of 3% GDP growth for the year. That strong corporate investment is driving this offers still better news, given its potential to ultimately feed stronger productivity growth.Another positive lately is that US firms’ solid optimism about investment is coupled with strong hiring intentions. This is all the more striking given that hiring intentions, and therefore employment growth, tend to erode when the economy enters a ‘late cycle phase’. The current strength in employment intentions – and particularly the ISM survey’s employment sub-index touching a record high – suggests that the US business cycle may have further running room. In

Topics:

Thomas Costerg considers the following as important: FED, Fed rate hikes, Macroview, US employment

This could be interesting, too:

investrends.ch writes Neuer Fed-Chef Warsh könnte US-Geldpolitik umkrempeln

investrends.ch writes Powell-Ermittlungen erhöhen den Druck auf die Fed – Auswirkungen auf Gold und den Dollar

investrends.ch writes Trump deutet Powell-Nachfolge bis Jahresende an

investrends.ch writes Jerome Powell schürt Hoffnungen auf tiefere Zinsen

Fed officials compete to trumpet about the health of the US economy.

We have long-highlighted how solid the US economy is, in-line with our ongoing scenario of 3% GDP growth for the year. That strong corporate investment is driving this offers still better news, given its potential to ultimately feed stronger productivity growth.

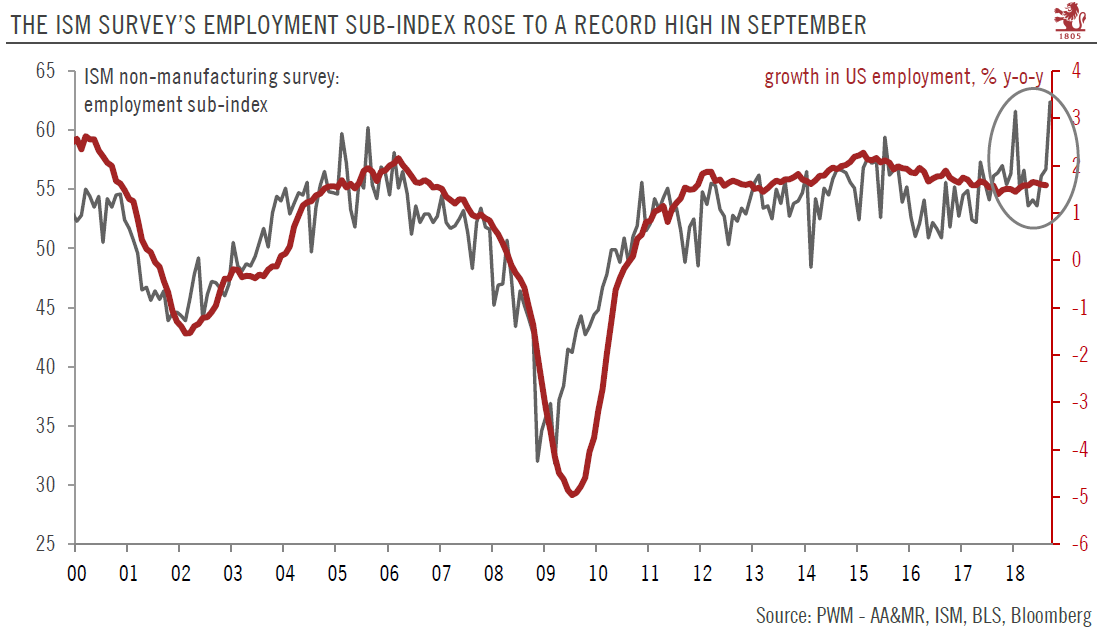

Another positive lately is that US firms’ solid optimism about investment is coupled with strong hiring intentions. This is all the more striking given that hiring intentions, and therefore employment growth, tend to erode when the economy enters a ‘late cycle phase’. The current strength in employment intentions – and particularly the ISM survey’s employment sub-index touching a record high – suggests that the US business cycle may have further running room. In other words, the risk of recession remains low.

As we noted recently, the Fed’s recent hawkish tilt stems mainly from their increased confidence in the US outlook, which was particularly crystallised in its upward revisions to GDP growth forecasts: 3.1% for 20point of the latest Fed meeting, given that the dot plot (chart of future rate hikes planned) remained unchanged.

While Fed speeches in recent days have not yielded anything new in terms of stance since the last Fed meeting, what has been interesting is the sharp crescendo of positive rhetoric used to qualify the state of the US economy. New York Fed president John Williams said the US economy is doing “very well overall”, and that it may be “about as good as it gets”. Chairman Powell went a step even further as saying these are “extraordinary times” as he highlighted the sweet spot of a tight labour market but still “low inflation”.

We think this rhetoric provides even more credibility to the Fed’s plan to deliver three rate hikes next year, as it has communicated for months – although somewhat un-listened up to now.

We previously highlighted, following the Fed meeting, that the Fed’s dot plot of three rate hikes in 2019 should be taken at face value, given the increased confidence in the US outlook. Recent speeches only reinforce our scenario that the Fed will hike rates at the December meeting, and then follow on with three additional quarter-point rate hikes next year. This served as the salient point of the latest Fed meeting, given that the dot plot (chart of future rate hikes planned) remained unchanged.

While Fed speeches in recent days have not yielded anything new in terms of stance since the last Fed meeting, what has been interesting is the sharp crescendo of positive rhetoric used to qualify the state of the US economy. New York Fed president John Williams said the US economy is doing “very well overall”, and that it may be “about as good as it gets”. Chairman Powell went a step even further as saying these are “extraordinary times” as he highlighted the sweet spot of a tight labour market but still “low inflation”.

We think this rhetoric provides even more credibility to the Fed’s plan to deliver three rate hikes next year, as it has communicated for months – although somewhat un-listened up to now.

We previously highlighted, following the Fed meeting, that the Fed’s dot plot of three rate hikes in 2019 should be taken at face value, given the increased confidence in the US outlook. Recent speeches only reinforce our scenario that the Fed will hike rates at the December meeting, and then follow on with three additional quarter-point rate hikes next year. For more, see ‘Flash Note – Taking the dots at face value’ released earlier this week.