The latest cut in banks’ required reserve ratios seems likely to have been motivated by additional signs of slowdown in the Chinese economy, but may not herald a massive monetary stimulus.Over the weekend, the People’s Bank of China (PBoC) announced a cut of 100 basis points (bps) in banks’ required reserve ratio (RRR). This is the third RRR cut since April. The PBoC estimates that it will free up about Rmb 750 billion of net new liquidity in the banking system. According to the central bank, the aim of this move is to improve liquidity conditions and lower financing costs, especially for small- and medium-sized enterprises.This latest cut to the RRR is largely in line with our expectations and a tilt toward policy easing since Q2 in response to the escalating trade tensions with the US

Topics:

Dong Chen considers the following as important: Chinese economy, Chinese monetary policy, Macroview, People's Bank Of China

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest cut in banks’ required reserve ratios seems likely to have been motivated by additional signs of slowdown in the Chinese economy, but may not herald a massive monetary stimulus.

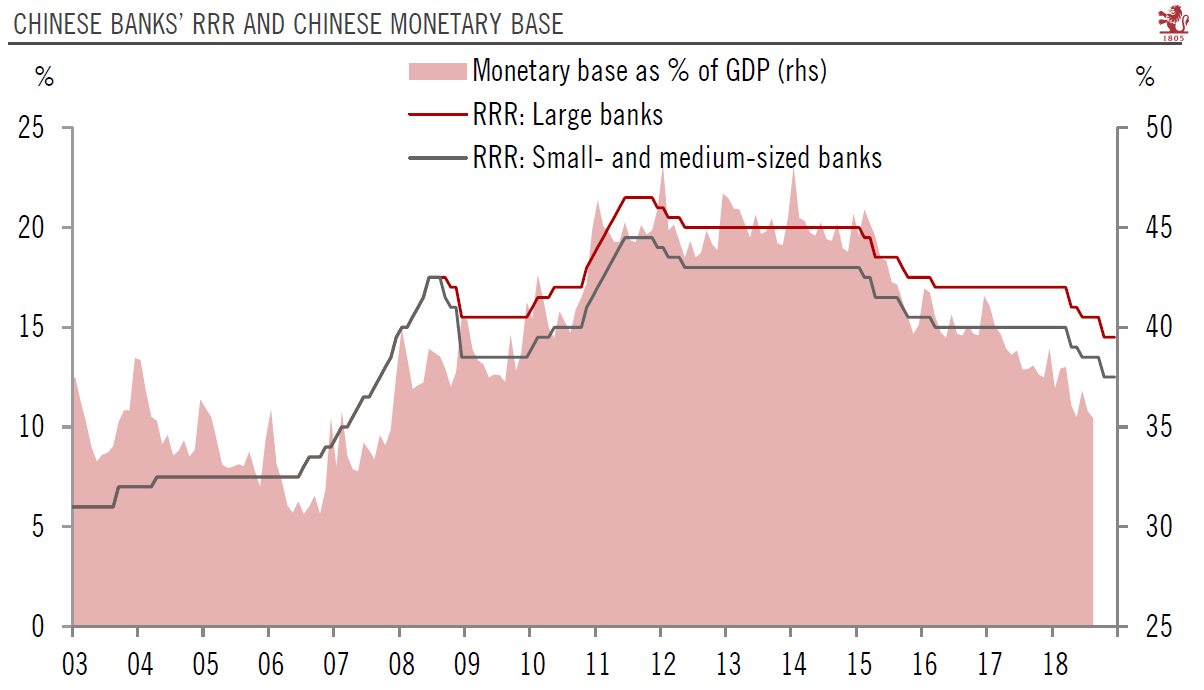

Over the weekend, the People’s Bank of China (PBoC) announced a cut of 100 basis points (bps) in banks’ required reserve ratio (RRR). This is the third RRR cut since April. The PBoC estimates that it will free up about Rmb 750 billion of net new liquidity in the banking system. According to the central bank, the aim of this move is to improve liquidity conditions and lower financing costs, especially for small- and medium-sized enterprises.

This latest cut to the RRR is largely in line with our expectations and a tilt toward policy easing since Q2 in response to the escalating trade tensions with the US and softening growth momentum. In our view, the timing of the latest RRR reduction is likely motivated by additional signs of slowdown, such as the September purchasing manager index, as well as further escalation in US-China tensions.

The RRR cut should be broadly positive for liquidity conditions, credit supply and investment growth, but we do not see it as part of a massive monetary stimulus. It will increase commercial banks’ capacity to extend loans, but whether or not the banks will actually engage in more lending depends on other factors such as the risk appetite of the banks themselves and the firms they lend to. In the current macro environment, especially in the context of the ongoing deleveraging campaign, we do not expect a massive increase in bank lending following the RRR cut.

Looking forward, we expect more official policy adjustments to support the Chinese economy through more RRR cuts and open market operations (such as medium-term lending facilities (MLF)), increasing commercial banks’ loan quotas, more government bond issuance, faster roll-out of infrastructure investment and, potentially, additional tax cuts beyond those already introduced.

Finally, given the government’s efforts to curb China’s rising debt and financial risks, we believe fiscal policy could continue to play a more important role than monetary efforts for the time being. Supply-side reform measures such as tax cuts could benefit the economy much more than creating additional credit.