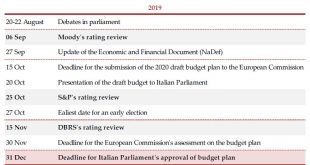

Recent developments in Italy’s political landscape have increased the probability of early elections in Q4 2019, but the situation is not so straightforward. Last week, political tensions in Italy intensified as Matteo Salvini, the League’s leader triggered a no confidence vote against Prime Minister Giuseppe Conte.PM Conte will address the Senate on 20 August. A confidence vote will likely follow the speech, though further delays remain a possibility.Once the government dissolves, the...

Read More »New monetary policies for new challenges

As central banks try (yet again) to bolster faltering growth and inflation, it is important to grasp how the ‘style’ and aims of monetary policy-making have changed over time and how they need to evolve in the future.The world is being disrupted by structural trends such as populism, demographic and climate change and technological innovation. Likewise, with previous approaches producing fewer results, we believe it is time to envisage monetary policies that address these sources of...

Read More »The case for fiscal stimulus strengthens in Germany

German real GDP shrank in the second half of the year, reinforcing our view of a significant ECB action in September.The German economy shrank by 0.1% quarter-on-quarter (q-o-q) in Q2. Today’s report contained some positives news, notably regarding the resilience of domestic demand.Nevertheless, the ongoing trade disputes between China and the US, China weakness, the threat of auto tariffs and the threat of a no-deal Brexit to supply chains, in addition to the auto sector’s own issues are...

Read More »Developed market equities update: a fairly reassuring reporting season

There is an ongoing tug-of-war between trade tensions and fundamentalsDue to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises.Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August low and 10-year US...

Read More »Weekly View – Dot-com bond?

The CIO Office's view of the week ahead.The knock-on effects of Trump’s tweets have jumped from the equity and bond markets to the economy to central banks and now currency markets. Indeed, the trade war turned tech war now increasingly resembles a currency war and a race to the bottom. The Chinese currency depreciated below CNY 7/USD after the Chinese authorities seemingly let the currency weaken on the back of Trump’s latest tariffs announcement, earning them the ‘currency manipulator’...

Read More »Update on gold – bad news is good news

Increased trade tensions have boosted the gold price to above USD 1,500.The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce.The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled with strong demand from central banks, the medium-term outlook of the yellow...

Read More »Exceptional Swiss hospitality and haute cuisine

This independently managed, family-owned hotel in the City of Basel attracts guests from all over the world for its luxurious accommodation, its superb restaurant with three Michelin stars, and its talented staff team offering superior serviceThe Grand Hotel Les Trois Rois, which sits on the Rhine in the historic centre of Basel, is one of the oldest city hotels in Europe. The first record of The Three Kings dates back to 1681 when it was described as an inn for gentlemen. Rebuilt in 1844 in...

Read More »The US labels China a currency manipulator

The near-term impact will likely be limited but this is a clear negative for trade negotiations.Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator.According to the US Treasury Department, the decision was triggered by the perceived lack of action by the PBoC to resist the renminbi depreciation. Given that the US...

Read More »Currency update – the Chinese renminbi

Despite the CNY's recent fall, we believe the People's Bank of China will refrain from competitive devaluationFollowing US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD.The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the deteriorating outlook for trade negotiations with the US and the resulting...

Read More »BoJ stays put amid economic headwinds

Japan's central bank has little room for further easing despite a downbeat outlook.At its monetary policy meeting on 30 July, the Bank of Japan (BoJ) decided to keep its monetary policy unchanged, as expected. The decision came as the Japanese economy faces strong external headwinds and a downbeat outlook for domestic demand.However, we do not expect the BoJ to make any changes to its current monetary easing framework until H1 2020 as it has probably reached the limit of its easing capacity....

Read More » Perspectives Pictet

Perspectives Pictet