Monetary policy drift to continue.Fed likely to keep tightening while buoyed by a solid domestic backdrop Looking at the Federal Reserve (Fed) from the other side of the Atlantic, the question is really to what extent the Fed can continue to ‘decouple’ its monetary policy from other main global central banks, including those in Europe.The three-month Treasury bill rate in the US is at c.2.2%, while a straight average of the corresponding rate in Germany (c.-0.6%) and the UK (c.0.7%) is roughly 0%. This is the highest ‘transatlantic difference’ since September 1984, when Fed president Volcker was battling high US inflation with particularly aggressive tightening. The highest transatlantic spread was 4.3% in November 1981, also corresponding with Volcker’s early years at the Fed.The Fed has

Topics:

Thomas Costerg considers the following as important: Fed rate hikes, Macroview, US monetary policy, US rate hike

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Monetary policy drift to continue.

Fed likely to keep tightening while buoyed by a solid domestic backdrop

Looking at the Federal Reserve (Fed) from the other side of the Atlantic, the question is really to what extent the Fed can continue to ‘decouple’ its monetary policy from other main global central banks, including those in Europe.

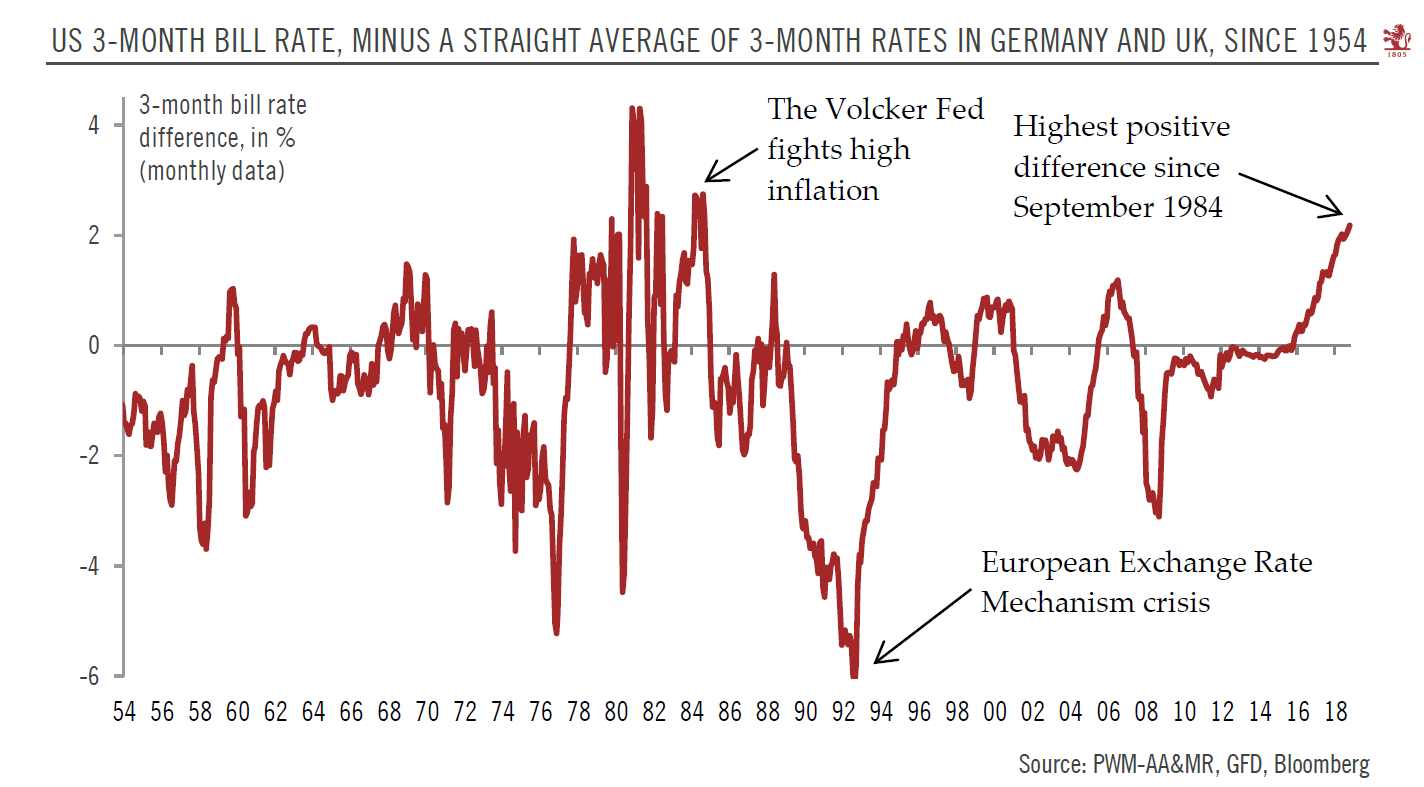

The three-month Treasury bill rate in the US is at c.2.2%, while a straight average of the corresponding rate in Germany (c.-0.6%) and the UK (c.0.7%) is roughly 0%. This is the highest ‘transatlantic difference’ since September 1984, when Fed president Volcker was battling high US inflation with particularly aggressive tightening. The highest transatlantic spread was 4.3% in November 1981, also corresponding with Volcker’s early years at the Fed.

The Fed has put the state of the US economy front and centre in its gradual tightening policy, which has manifested as an autopilot one rate hike per quarter ‘unless something serious happens’. This pragmatic vision has been further buttressed by recent comments dismissing the importance of the neutral rate as a guide for future monetary policy, while putting the emphasis on actual data instead – i.e. as long as growth and the job market remain firm, the Fed will move rates up further.

The Fed further justifies its tightening by the US being further advanced in the business cycle than others. After all, the US unemployment rate is 3.7% while the euro area’s unemployment rate remains an elevated 8.1% (albeit on a declining trend). While UK unemployment is a healthy 4.0%, the Bank of England faces high Brexit-related uncertainties.

Regarding the impact of rising US rates on the global economy, including emerging markets, the Fed has been relatively sanguine. Recently Saint Louis Fed president James Bullard echoed this view, asserting in Singapore that emerging markets were “as prepared as they can be for changes in US monetary policy”, and that the Fed had been as “transparent” as possible about its plans. Bullard repeated that risks of volatile growth in emerging markets spreading to the US economy were “contained”. In other words, emerging markets’ situation remains peripheral and as of now, it appears that only a slowdown in the US economy or a sudden shock to financial markets could lead to an interruption of the Fed’s ‘autopilot tightening’.

We expect four additional rate hikes in the coming months (at the December, March, June and September meetings), after which the Fed is likely to pause tightening, in our view. If our forecast is correct, the transatlantic spread high of 4.3% of the early 1980s will not be matched.