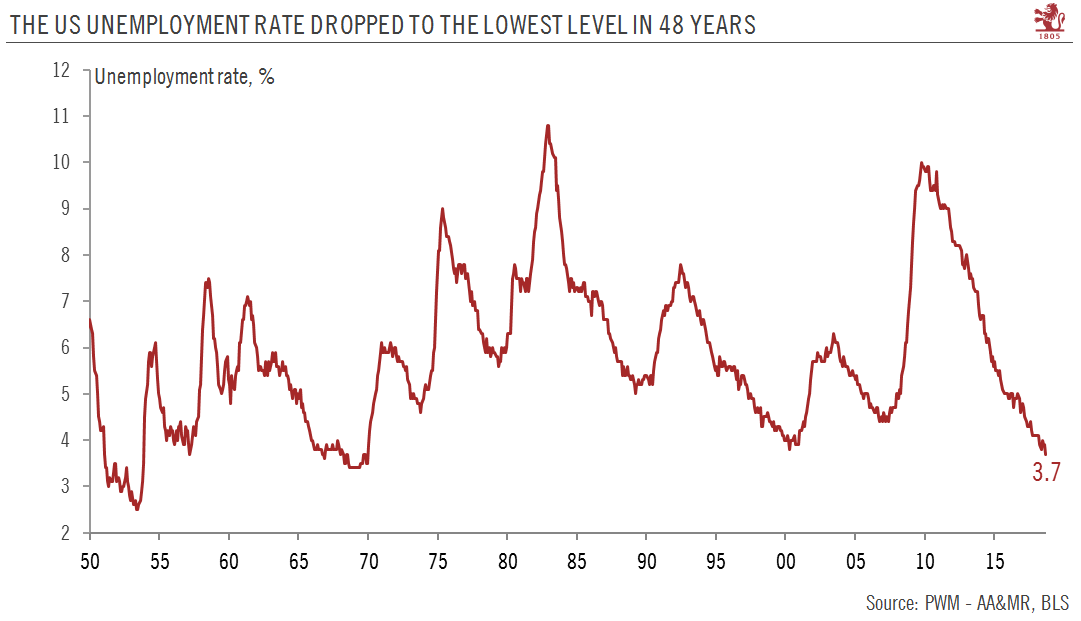

US unemployment rate drops to lowest level in 48 years.Setting aside the impact of the hurricane that hit the Carolinas (and also the headline payroll reading as a result), the US jobs market remains in very good shape. Today’s data showed the unemployment rate dropped to its lowest level in 48 years in September (3.7%).Importantly, the nonfarm payrolls reportshowed strong employment gains in September, consistent with the view that GDP growth is remaining firm in the second half of the year. Our analysis continues to indicate that the risk of a US cyclical slowdown is low at the moment.Wage growth was firm in September (2.8% year on year) but remained below the watermark level of 3% , and well below the high levels reached ahead of the global financial crisis. While this moderate wage

Topics:

Thomas Costerg considers the following as important: Macroview, Uncategorized, US Fed hikes, US unemployment rate

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

US unemployment rate drops to lowest level in 48 years.

Setting aside the impact of the hurricane that hit the Carolinas (and also the headline payroll reading as a result), the US jobs market remains in very good shape. Today’s data showed the unemployment rate dropped to its lowest level in 48 years in September (3.7%).

Importantly, the nonfarm payrolls reportshowed strong employment gains in September, consistent with the view that GDP growth is remaining firm in the second half of the year. Our analysis continues to indicate that the risk of a US cyclical slowdown is low at the moment.

Wage growth was firm in September (2.8% year on year) but remained below the watermark level of 3% , and well below the high levels reached ahead of the global financial crisis. While this moderate wage growth deserves attention, it does not in our opinion pose a meaningful risk to US economic expansion.

Fed policymakers are likely to highlight the very low unemployment rate as a reason to maintain the central bank’s rate hikes routine and to dismiss the ongoing ‘trade war’ risk as just noise. Many officials are likely to continue singing the praises of the US growth story. However, the Fed is also equally unlikely to accelerate its tightening cycle as long as US wage growth does not exceed a rate of 3.5% y-o-y and/or core inflation goes beyond 2.5%-3.0%. We continue to expect four 25bps rate increases over the next 12 months.