Equity markets have reached new highs, extending the longest bull market in US history. However, César Pérez Ruiz, Head of Investments and CIO at Pictet Wealth Management, is conscious of complacency in markets and keeping protection on portfolios as tail risks remain. Geopolitical developments such as the potential escalation of Iranian tensions and drawn-out trade negotiations between the US and China, could send short-term volatility through markets....

Read More »Pictet Perspectives — What we are watching for now

Equity markets have reached new highs, extending the longest bull market in US history. However, César Pérez Ruiz, Head of Investments and CIO at Pictet Wealth Management, is conscious of complacency in markets and keeping protection on portfolios as tail risks remain. Geopolitical developments such as the potential escalation of Iranian tensions and drawn-out trade negotiations between the US and China, could send short-term volatility through markets....

Read More »Oil prices decline despite the end of Iran waivers

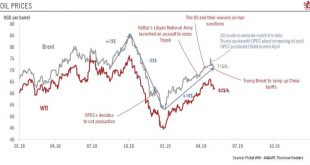

We believe prices will remain volatile in the short term, before a possible oil glut becomes an issue toward year’s end.The increase in prices that followed President Trump’s 22 April decision to end waivers on Iranian oil imports did not last, with Brent prices falling from almost USD75 on 24 April to below USD70. Nonetheless, we continue to see heightened risk of oil price spikes above USD80 for Brent in the short-term.Trump’s recent threat to increase US tariffs on Chinese imports could...

Read More »A spanner in the works

While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed.At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its trade delegation would still go to Washington DC this week for another round...

Read More »Weekly View – The final countdown

The CIO office’s view of the week ahead.Last week markets were relatively muted, with commodities down, developed markets flat and emerging markets up slightly. That brief period of calm has already ended, with Trump’s Sunday tweets sending Chinese markets sharply down on Monday. With the Chinese scheduled to attend the next round of trade negotiations in the US on Wednesday, the US president is putting extra pressure on China to concede to US demands and seal a deal through threats to...

Read More »董晨 Dong Chen : 7 things you need to know | TCCAsia

Although honored as the actor with the most delicate face in China, Dong Chen is also an Otaku who loves playing online games. He wants to travel to James Cameron's Titanic set. ABOUT 7 THINGS YOU NEED TO KNOW ... Here’s something about celebrities that you never knew. Maybe through these few little things, you can get to know your idol better. CONNECT WITH TCCASIA Web : http://weibo.com/LikeTCC instagram : https://www.instagram.com/tccasia_official/ YOUKU:http://i.youku.com/tccasia...

Read More »董晨 Dong Chen : 7 things you need to know | TCCAsia

Although honored as the actor with the most delicate face in China, Dong Chen is also an Otaku who loves playing online games. He wants to travel to James Cameron's Titanic set. ABOUT 7 THINGS YOU NEED TO KNOW ... Here’s something about celebrities that you never knew. Maybe through these few little things, you can get to know your idol better. CONNECT WITH TCCASIA Web : http://weibo.com/LikeTCC instagram : https://www.instagram.com/tccasia_official/ YOUKU:http://i.youku.com/tccasia

Read More »House View, May 2019

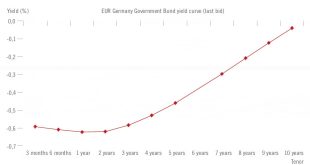

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationThere were no changes to our asset allocation in April. While we are encouraged by better-than-expected Q1 earnings and some improvement in earnings expectations, we remain neutral on global equities as we await new catalysts to justify current valuations. At the same time, we have a positive view of Chinese and Indian equities.We remain underweight government bonds given low yields,...

Read More »Fed meeting preview: Play it again Sam

While we expect the Fed to stay on hold, it could supply new insight into the threshold for a rate cut (which we consider improbable).The Fed meeting concluding on 1 May should provide only limited new information.The domestic growth backdrop is good and equity markets are buoyant, but low core inflation and the proximity of the theoretical ‘neutral rate’ will likely stifle the Fed’s temptations to raise rates. Instead, the Fed should signal it is happy to stay on hold for now.While the...

Read More »Is Europe turning Japanese?

European investment opportunities remain, despite financial repression in the region.The European Central Bank (ECB) surprised market watchers with its dovish turn in January, wiping out any prospect of an interest-rate rise this year and revising its growth projections for the euro area downward for 2019. With Europeans set to live with interest rates at zero (or negative) for longer, many are wondering if Europe now faces “Japanisation”, meaning that it is stuck in a low-growth and...

Read More » Perspectives Pictet

Perspectives Pictet