Summary:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe remain underweight or neutral across a number of risk asset classes and overweight liquidity in light of enduring uncertainties, but stand ready to deploy cash as tactical opportunities present themselves.We are neutral DM equities, but pockets of opportunity still exist (in the UK and Japan, for example). EM equities are becoming interesting, but with the risk of further earnings downgrades, the discount they offer may not yet have reached extremes.We remain comfortable with our short duration positioning and underweight allocation to government bonds in general, while we are neutral or underweight credit instruments.CommoditiesBrent crude oil prices regained strong momentum in

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe remain underweight or neutral across a number of risk asset classes and overweight liquidity in light of enduring uncertainties, but stand ready to deploy cash as tactical opportunities present themselves.We are neutral DM equities, but pockets of opportunity still exist (in the UK and Japan, for example). EM equities are becoming interesting, but with the risk of further earnings downgrades, the discount they offer may not yet have reached extremes.We remain comfortable with our short duration positioning and underweight allocation to government bonds in general, while we are neutral or underweight credit instruments.CommoditiesBrent crude oil prices regained strong momentum in

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management's latest positioning across asset classes and investment themes.

- We remain underweight or neutral across a number of risk asset classes and overweight liquidity in light of enduring uncertainties, but stand ready to deploy cash as tactical opportunities present themselves.

- We are neutral DM equities, but pockets of opportunity still exist (in the UK and Japan, for example). EM equities are becoming interesting, but with the risk of further earnings downgrades, the discount they offer may not yet have reached extremes.

- We remain comfortable with our short duration positioning and underweight allocation to government bonds in general, while we are neutral or underweight credit instruments.

Commodities

- Brent crude oil prices regained strong momentum in September, passing the USD 80/bbl mark for the first time in four years. We continue to expect upward pressure on oil prices in the short term.

Currencies

- Despite rising rates, the US dollar made only modest headway against other major currencies in September. But the robustness of the US economy leads us to believe that erosion of the dollar could be more gradual than expected. In particular, the short-term upside potential for the euro against the dollar looks limited.

- We expect ongoing concerns around Brexit to weigh on sterling’s prospects. While we expect an eventual deal on Brexit, we remain cautious on sterling in the short term.

Equities

- The sound recent performance of Japanese equities accelerated in September, yet valuations remain reasonable. Emerging market (EM) equities have fallen this year, although earnings prospects look good.

- EM exposure and high leverage have hurt expensive European consumer stocks. Some segments (spirits and personal care) could fare relatively better than others going forward.

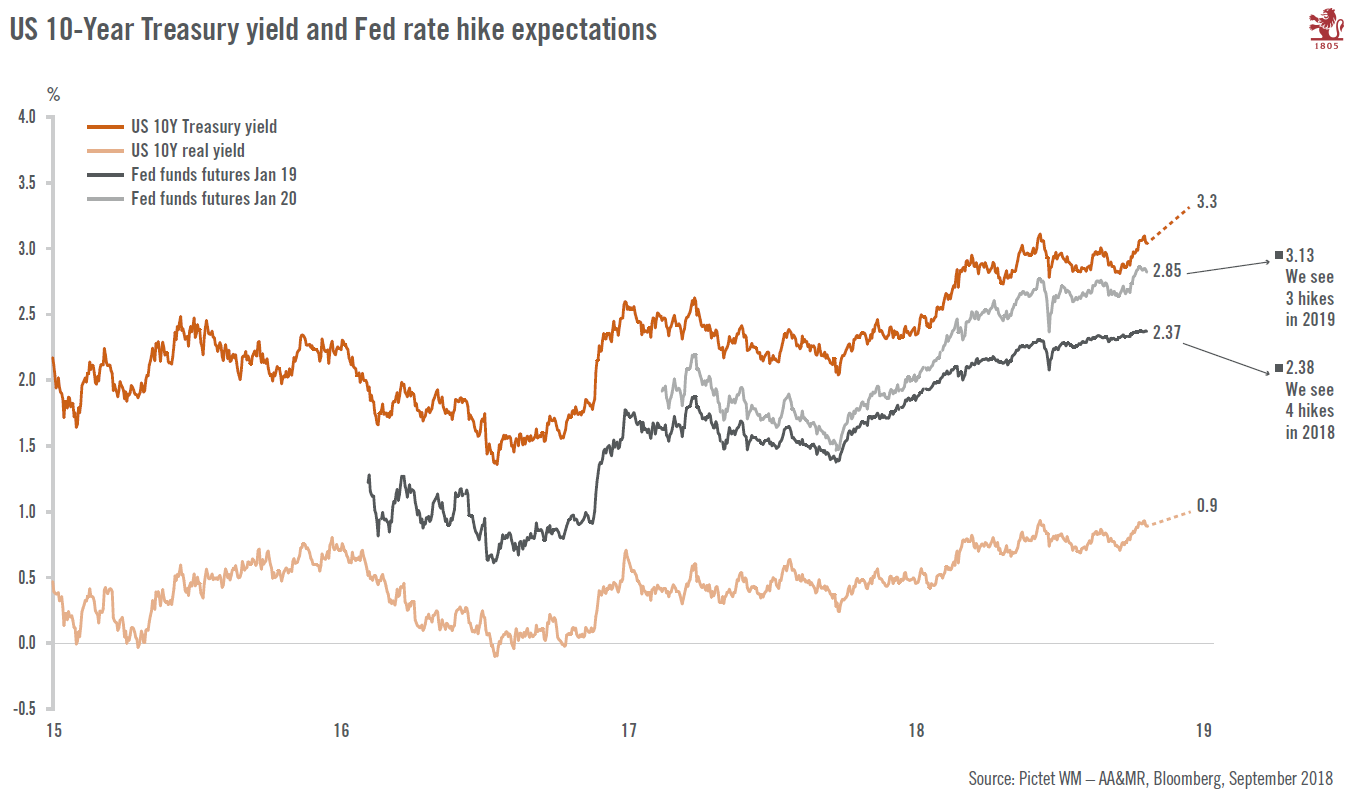

- We have raised our end-2018forecast for 10-year Treasuryyields to 3.3% from 3.0%. We are bearish on US sovereign bonds, believing now that the Fed will raise base rates three times next year rather than two.

- We are moving from bearish to neutral on US high yield asleverage ratios are not yet a concern and the yield pick-up is interesting.

Alternatives

- In hedge funds, the safe-haven upward move in US risk assets hurt short US equity and credit indexes this year. Fixed income remains the largest risk allocation across Global Macro strategies.

- While swings in EM assets and relative US dollar strength have given a glimmer of performance, summer market moves proved frustrating for Global Macro. We have a preference for managers focused on fixed income and those with expertise in EM.

- The impact of millennials on the work place is changing the configuration and use of office space, giving rise to global opportunities in in private equity real estate.