As the US vies to maintain world leadership beyond commerce, its policies will continue to create waves for markets.Today we are witnessing a redefinition of international relations and a new, although likely unstable, global equilibrium. The trade dispute unfolding today between the US and China should be seen in light of shifting structural trends that have developed over the last few decades. We expect rationality will eventually prevail, but the outlook is muddled by the Trump administration’s unpredictable political agenda. Our core scenario remains that the conflict between the US and China will remain contained and limited to trade, with the door still open for negotiation. We expect the US will follow its current course, eventually extending tariffs to all Chinese imports, but

Topics:

Christophe Donay considers the following as important: Macroview, Trump trade tariffs, us china trade, US China trade tension

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

As the US vies to maintain world leadership beyond commerce, its policies will continue to create waves for markets.

Today we are witnessing a redefinition of international relations and a new, although likely unstable, global equilibrium. The trade dispute unfolding today between the US and China should be seen in light of shifting structural trends that have developed over the last few decades. We expect rationality will eventually prevail, but the outlook is muddled by the Trump administration’s unpredictable political agenda. Our core scenario remains that the conflict between the US and China will remain contained and limited to trade, with the door still open for negotiation. We expect the US will follow its current course, eventually extending tariffs to all Chinese imports, but will stop there; we do not expect a global slide into a vicious circle of tariffs and counter tariffs.

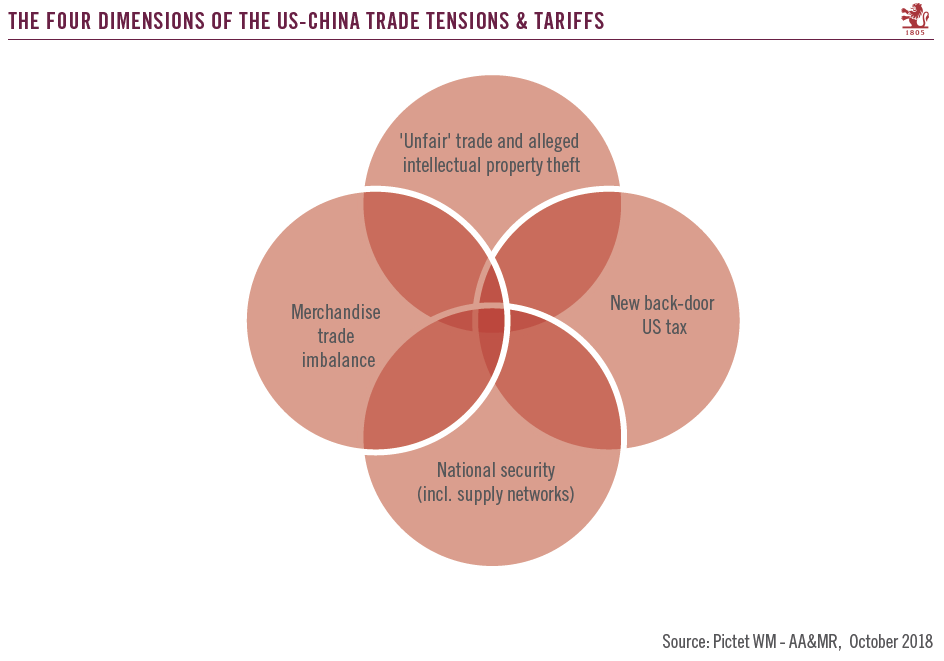

US-China trade considerations consist of both ‘big picture’ and ‘small picture’ dynamics, where distinguishing between the two is key. What is critical regarding the ‘big picture’ is understanding the trajectory of the Trump administration’s strategy and what the end goal is. The ‘small picture’ consists of the concrete repercussions of the ‘big picture’ including any potential implications on US growth in the near term. We think there will be several iterations along the way before the US chooses one direction for good. We also think that bilateral negotiation will continue even if the US goes ahead with further tariffs. The journey could be bumpy.

We expect that volatility will continue to spike in the wake of political events but without serious consequence to economic policy, free trade or free markets. Noise will impact volatility but nothing deeply disruptive will hit fundamentals. We believe tensions will remain elevated in the near term, but contained. Investors should take advantage of negative correlation in markets and diversify portfolios in order to smooth volatility spikes and drawdowns as political shocks continue to take place.

US-China trade: Where are we now?

- 10% tariff applied to USD 200bn of Chinese imports to the US in September, on top of 25% on USD 50bn of imports applied over the summer – covering roughly half of all Chinese imports

- Donald Trump and Xi Jinping could hold discussions alongside the G20 Summit in Buenos Aires at the end of November

- The tariff rate is set to rise to 25% in January 2019; Trump has threatened to cover all Chinese imports with tariffs if China retaliates further

- Inconsistent US economic policy economic policy puts stress on markets. Investors require higher risk premia as a result of the policy uncertainty