Weakness in the sector signals continuing downward trend.The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines. Part of the drop may reflect issues in the car industry, but trade tensions, uncertainty over Brexit and geopolitical worries all weighed on manufacturers’ sentiment as well.Of particular note was the loss of momentum in the German services sector. This was due to a marked decline in new business and a significant drop in business expectations, which reached their lowest point since 2014. Overall, the composite

Topics:

Nadia Gharbi considers the following as important: euro area growth, European manufacturing, European services, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Weakness in the sector signals continuing downward trend.

The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines. Part of the drop may reflect issues in the car industry, but trade tensions, uncertainty over Brexit and geopolitical worries all weighed on manufacturers’ sentiment as well.

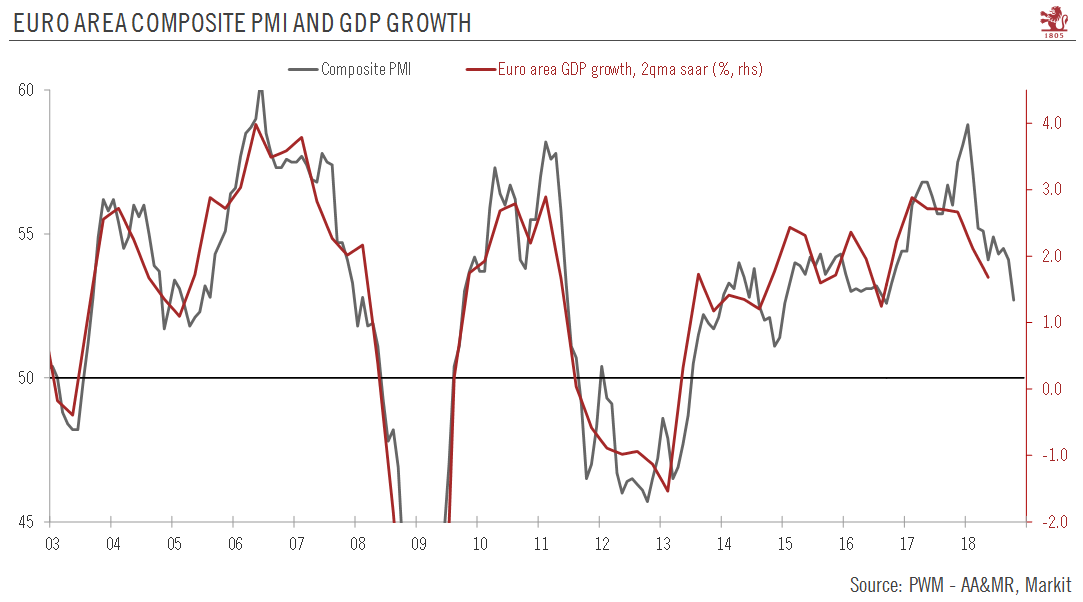

Of particular note was the loss of momentum in the German services sector. This was due to a marked decline in new business and a significant drop in business expectations, which reached their lowest point since 2014. Overall, the composite PMI points to GDP growth of 0.3% q-o-q in Q4, a pronounced loss of momentum. This may partly be due to ongoing trade tensions, uncertainty over Brexit and geopolitical worries weighing on manufacturer sentiment. However, the decline in forward-looking indicators for both sectors makes a strong Q4 rebound for Germany seem unlikely. Our euro area 2.0% GDP growth forecast for 2018 remains on track.

Twelve-month business expectations in both manufacturing and services declined to a six-year and two-year low, respectively, further suggesting that momentum could be lost in coming months. As a result, the balance of risk is tilted to the downside.

The French services sector reached its highest level since April 2018, while the manufacturing sector continued to struggle. Overall, French data currently points to a strong GDP rebound in Q3, and decent GDP growth in Q4. Concerns over the state of Brexit negotiations and trade tensions probably explain weakness in the manufacturing sector. The comparatively strong performance of the domestically-orientated services and construction sectors remain key drivers of French GDP growth.

Survey price gauges remain elevated and close to seven-year highs, but the declines in PMI, notably the German services sector, may call the ECB’s strong conviction in domestic resilience into question. Consequently, Mr. Draghi’s words at tomorrow’s ECB press conference will be weighed carefully.