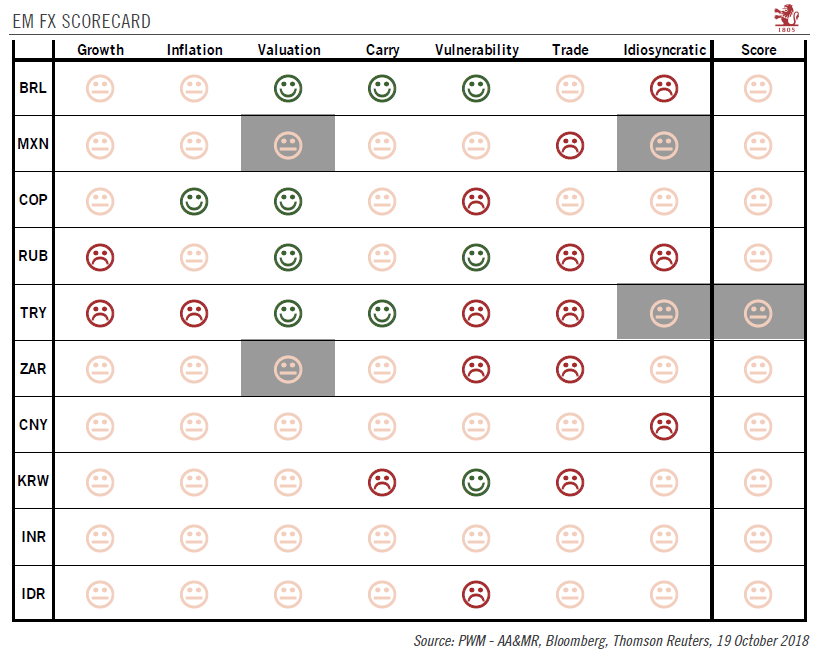

Up to now, emerging market (EM) currencies have been resilient in the face of market turmoil.Our EM FX scorecard, which ranks 10 EM currencies according to key criteria (such as growth and vulnerability to external shocks) saw few changes over the past month. The Fed’s current hawkish attitude remains a headwind for EM currencies, at it increases funding costs. That being said, the weakest EM currencies have seen some stabilisation, particularly for the Turkish lira and the Argentinian peso. We also expect China to keep the USD/CNY rate stable, given political pressure and risk of increased capital outflows.We have upgraded the Mexican peso’s idiosyncratic factor from negative to neutral, as the new United-States-Mexico-Canada (USMCA) agreement relieves concerns about the country’s

Topics:

Luc Luyet considers the following as important: currencies, currencies forecasts, EM currencies, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

Up to now, emerging market (EM) currencies have been resilient in the face of market turmoil.

Our EM FX scorecard, which ranks 10 EM currencies according to key criteria (such as growth and vulnerability to external shocks) saw few changes over the past month. The Fed’s current hawkish attitude remains a headwind for EM currencies, at it increases funding costs. That being said, the weakest EM currencies have seen some stabilisation, particularly for the Turkish lira and the Argentinian peso. We also expect China to keep the USD/CNY rate stable, given political pressure and risk of increased capital outflows.

We have upgraded the Mexican peso’s idiosyncratic factor from negative to neutral, as the new United-States-Mexico-Canada (USMCA) agreement relieves concerns about the country’s relations with its main trading partners. The new deals requires ratification by the United States Congress, which will take place next year. As Congress is likely to approve the new agreement, we believe it justifies the upgrade.

We also upgraded Turkey from negative to neutral, mostly due to the easing of tensions in its diplomatic relations with the US. Finally, we have decided not to make any changes to the Brazilian real’s score. While we have made no changes to Brazil’s idiosyncratic factor, the outcome of the first round of its presidential elections lead us to believe that fiscal reform is still on the agenda, which would be supportive of the real. However, because the exact scope of these potential reforms is currently unknown, we have decided not to change Brazil’s score for this factor at this point in time.

In sum, positive developments in EM are likely to ease some investor concerns. However, risks to EM currencies (notably, a potential escalation in the trade dispute between the US and China as well as the Fed adopting an even more hawkish stance) could call for more caution.