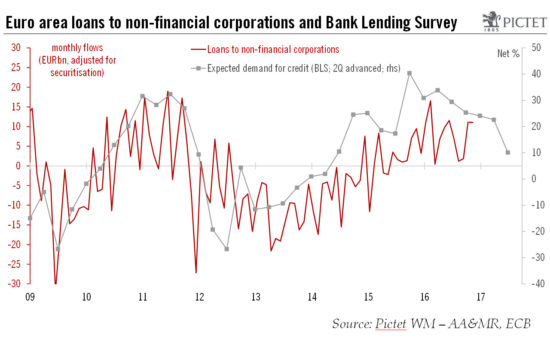

The latest Bank Lending Survey (BLS) from the ECB, showed that credit standards tightened somewhat in Q4 2016. But the details were much more upbeat than the headline reading.Credit standards on loans to euro area enterprises tightened in Q4 2016 for the first time in three years. The move was essentially driven by developments in the Netherlands. Demand for credit continued to rise across all categories of loans, once again driven by generally low interest rates and M&A activity.Looking ahead, banks expect a net easing of credit standards across all loan categories in Q1 2017.The main takeaway from the Q4 Bank Lending Survey (BLS) report is that the ECB’s expansionary monetary policy is likely to be maintained throughout this year. Given that the BLS is signalling more modest gains in credit flows in the next few months than previously, the risk is that the ECB might need to do more.

Topics:

Nadia Gharbi considers the following as important: Bank Lending Survey, euro area credit conditions, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest Bank Lending Survey (BLS) from the ECB, showed that credit standards tightened somewhat in Q4 2016. But the details were much more upbeat than the headline reading.

Credit standards on loans to euro area enterprises tightened in Q4 2016 for the first time in three years. The move was essentially driven by developments in the Netherlands. Demand for credit continued to rise across all categories of loans, once again driven by generally low interest rates and M&A activity.

Looking ahead, banks expect a net easing of credit standards across all loan categories in Q1 2017.

The main takeaway from the Q4 Bank Lending Survey (BLS) report is that the ECB’s expansionary monetary policy is likely to be maintained throughout this year. Given that the BLS is signalling more modest gains in credit flows in the next few months than previously, the risk is that the ECB might need to do more.