The euro area M3 and credit report strengthened in December after a few months of weakness. However, the latest Bank Lending Survey signalled more modest gains in credit flows in the months ahead.Euro area credit flows to non-financial corporations increased again in December, by EUR13 bn in adjusted terms. The large rebound in long-terms loans, in particular, bodes well for business investment spending.With loans to households still expanding at a healthy pace (+EUR9 bn in December), the annual growth rate of bank credit to the non-financial private sector rose to 2.3% y-o-y, the highest since June 2009.The ECB should welcome the improvement in credit flows at the end of last year, and will hope that monetary policy measures (including TLTROs) will continue to support the credit impulse. However, forward looking indicators such as the Bank Lending Survey for Q4 send a more cautious message, indicating more modest gains in credit flows in the next few months.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Bank Lending Survey, euro area bank lending, euro area credit flows, euro area credit growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The euro area M3 and credit report strengthened in December after a few months of weakness. However, the latest Bank Lending Survey signalled more modest gains in credit flows in the months ahead.

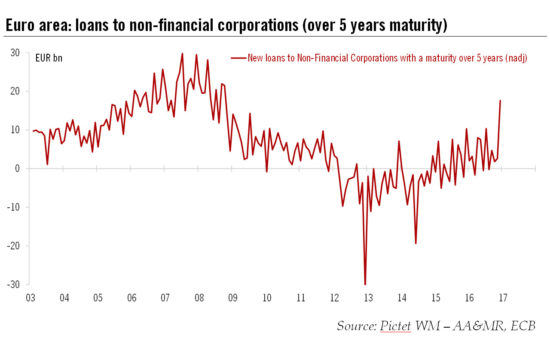

Euro area credit flows to non-financial corporations increased again in December, by EUR13 bn in adjusted terms. The large rebound in long-terms loans, in particular, bodes well for business investment spending.

With loans to households still expanding at a healthy pace (+EUR9 bn in December), the annual growth rate of bank credit to the non-financial private sector rose to 2.3% y-o-y, the highest since June 2009.

The ECB should welcome the improvement in credit flows at the end of last year, and will hope that monetary policy measures (including TLTROs) will continue to support the credit impulse. However, forward looking indicators such as the Bank Lending Survey for Q4 send a more cautious message, indicating more modest gains in credit flows in the next few months.