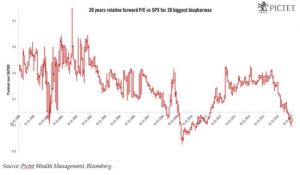

The sector may remain prone to volatility until the Trump administration provides more policy clarity. But a weak 2016 at least helped reset expectations and US biopharm is riding a crest of innovation.Biopharma suffered a poor 2016 after years of strong performance. Political rhetoric was the main source of volatility, but the sector also suffered from poor execution. We think 2016 helped reset expectations and created an attractive opportunity to build long-term positions. Uncertainty will linger in the first half of 2017, but overall we expect a better relative and absolute performance this year.Key drivers of the improved outlook include the following: we are only midway through a major scientific innovation wave and late-stage clinical trials are set to mature, particularly in the second half of 2017 and even more so in 2018; EPS and revenue growth expectations are beatable; valuations are attractive and will be boosted by buybacks and M&A.Importantly, we also expect the political controversy on drugs pricing in the US to tone down, probably in the second half of the year. We think the Republican administration will ultimately adopt a more pro-business agenda. The sector will remain volatile until investors have better clarity over which views will prevail—probably within the first 100 days of the Trump administration.

Read More »