Preliminary purchasing manager indices from Markit suggest the outlook for the euro area continues to brighten. Growth forecasts for this year are tilted to the upside.The euro area composite PMI eased slightly to 54.3 in January, from 54.4 in December. Importantly, the breakdown by subindices showed that employment rose at its fastest rate since 2008, which bodes well for domestic demand. Overall, PMI indices look consistent with real euro area GDP growth of 0.5% q-o-q in Q1, slightly above our forecast. We have left our euro area GDP growth forecasts unchanged at 1.3% for 2017 (after 1.6% in 2016, according to our estimates), with risks tilted to the upside.Business confidence remained very strong in Germany, particularly in the manufacturing sector, and improved markedly in France and peripheral countries.Importantly, our PMI price pressure gauge rose for the 11th straight month in January, to its highest level since Q2 2011, but corporate margins got squeezed. All in all, we continue to expect the ECB to resist any shift in its monetary stance during the first half of this year.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: euro business activity, Euro PMI, European banks, European price pressure, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Preliminary purchasing manager indices from Markit suggest the outlook for the euro area continues to brighten. Growth forecasts for this year are tilted to the upside.

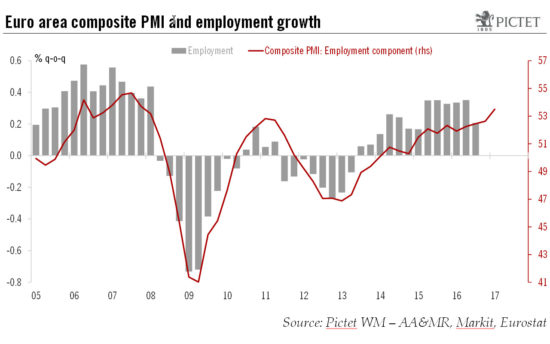

The euro area composite PMI eased slightly to 54.3 in January, from 54.4 in December. Importantly, the breakdown by subindices showed that employment rose at its fastest rate since 2008, which bodes well for domestic demand. Overall, PMI indices look consistent with real euro area GDP growth of 0.5% q-o-q in Q1, slightly above our forecast. We have left our euro area GDP growth forecasts unchanged at 1.3% for 2017 (after 1.6% in 2016, according to our estimates), with risks tilted to the upside.

Business confidence remained very strong in Germany, particularly in the manufacturing sector, and improved markedly in France and peripheral countries.

Importantly, our PMI price pressure gauge rose for the 11th straight month in January, to its highest level since Q2 2011, but corporate margins got squeezed. All in all, we continue to expect the ECB to resist any shift in its monetary stance during the first half of this year.