There were no policy changes at today's meeting of the ECB’s governing council (GC). Central bank seems intent on looking through short-term spikes in imported inflation.At today’s press conference following the GC meeting, ECB President Mario Draghi’s message was one of continuity, very much as expected. The stronger momentum in economic activity and headline inflation, he suggested, was no reason to declare victory as long as downside risks remain. Importantly, the ECB’s statement suggests that the GC will look through any spike in imported inflation provided that it has no implication for the medium-term outlook. The December 2016 decision to extend quantitative easing (QE) until December 2017 (at a EUR60 bn monthly pace from April to December, compared with the current EUR80 bn) provided the ECB with all the “operational clarity” needed to do so, Draghi said.We see no reason to change our ECB scenario following today’s press conference. We expect the ECB to resist any shift in its monetary stance during the first half of this year, with any announcement that it will extend its QE programme into 2018 at a reduced pace only coming in September. Our working assumption is that asset purchases will be scaled down at a very gradual pace and will end in December 2018. We do not expect the first hike in base rates before the first half of 2019.

Topics:

Frederik Ducrozet considers the following as important: core euro area inflation, ECB, ECB tapering, imported inflation, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

There were no policy changes at today's meeting of the ECB’s governing council (GC). Central bank seems intent on looking through short-term spikes in imported inflation.

At today’s press conference following the GC meeting, ECB President Mario Draghi’s message was one of continuity, very much as expected. The stronger momentum in economic activity and headline inflation, he suggested, was no reason to declare victory as long as downside risks remain. Importantly, the ECB’s statement suggests that the GC will look through any spike in imported inflation provided that it has no implication for the medium-term outlook. The December 2016 decision to extend quantitative easing (QE) until December 2017 (at a EUR60 bn monthly pace from April to December, compared with the current EUR80 bn) provided the ECB with all the “operational clarity” needed to do so, Draghi said.

We see no reason to change our ECB scenario following today’s press conference. We expect the ECB to resist any shift in its monetary stance during the first half of this year, with any announcement that it will extend its QE programme into 2018 at a reduced pace only coming in September. Our working assumption is that asset purchases will be scaled down at a very gradual pace and will end in December 2018. We do not expect the first hike in base rates before the first half of 2019.

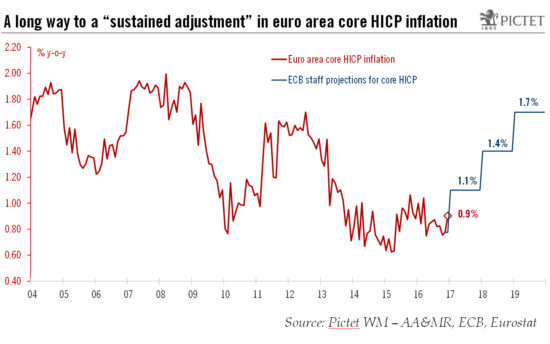

Draghi was very adamant about the need for the ECB to be patient and wait for stronger activity data and imported price pressure to turn into domestically-generated inflation, if any. This is likely a matter of quarters, not months, and we still expect core inflation to undershoot the ECB staff projections for now.

In the end, we continue to expect future decisions by the GC to be dictated by developments in underlying inflation. On that front, the ECB sees little reason to upgrade its assessment, and rightly so in our view. Using a Fed analogy, the ECB is likely to wait until it sees ‘the whites of the eyes’ of core inflation.

Draghi gave very little away in terms of the extent to which the Eurosystem would use the new QE modalities, or ‘option’ to buy in a broader range of public debt securities. Our simulations suggest that the Bundesbank will have to make extensive use of this option to buy debt securities with a yield below the deposit rate.