Today's preliminary GDP reports came in broadly in line with expectations and are therefore unlikely to alter the ECB’s assessment of economic activity. We continue to forecast a gradual pick-up in the pace of economic expansion, largely led by domestic strength. According to Eurostat’s preliminary estimate, euro area real GDP grew by 0.3% q-o-q (1.2% q-o-q annualised; 1.6% y-o-y) in Q3, below consensus expectations (0.4%), thus marking a gentle slowdown from the 0.4% q-o-q recorded in Q2...

Read More »United States: core retail sales have risen only modestly so far in the fourth quarter

Today’s retail sales report was rather disappointing. Nevertheless, we continue to expect overall consumption to grow robustly in Q4 and in 2016. Nominal total retail sales increased by 0.1% m-o-m in October, below consensus expectations (+0.3%). Total sales were dented by a 0.9% m-o-m fall in nominal sales at gasoline stations and a 0.5% decline in nominal auto sales. This latter decrease came as a surprise as already published data on unit car sales (real) had shown a 0.5% rise m-o-m...

Read More »ECB policy meeting preview: set to ease in December despite a weaker euro

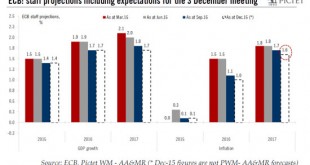

Despite a 1% weaker EUR/USD than three months ago, the ECB is likely to announce new easing measures at its 3 December meeting, for several reasons. Firstly, Mario Draghi effectively made a pre-commitment to further easing at the October meeting and he is unlikely to risk disappointing the markets. Secondly, and more fundamentally, we expect the new set of staff forecasts to lead to a downward revision to the 2017 HICP inflation median projection, to 1.6% (see chart and assumptions below),...

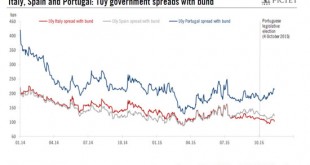

Read More »Portugal: political uncertainty, but low systemic risk

Just 11 days after Portuguese Prime Minister Pedro Passos Coelho took office, the new left-wing majority yesterday voted down the government’s programme leading to the collapse of the minority centre-right coalition (PàF). In the general election on 4 October, the PàF coalition, led by Pedro Passos Coelho, claimed the largest share of the popular vote (38.4%), but failed to retain its parliamentary majority as it obtained just 107 seats of the 230 seats in parliament. The Socialist Party...

Read More »The markets’ pole star is fading

Published: 11th November 2015 Download issue: Since 2009, major central banks such as the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BoJ) and others have largely determined the trends in the major asset classes of both emerging and developed countries: equities, sovereign and corporate bonds, and currencies. Investors found their guiding light in the central banks. Markets are once again likely to find themselves under their influence in 2016, but without as...

Read More »Bond yields are heading up

Yields on DM sovereign bonds are catching up with the wider equity market rally, as fears about deflation have dissipated and a first Fed rate rise is now likely in December. The rebound in equity markets has played out as expected since the beginning of October, after excessively negative perceptions about the global economy, notably China, abated. Data continue to confirm broadly robust global economic fundamentals, even if growth lacks momentum. The S&P 500 has now moved back into...

Read More »Spain’s politics: challenging time ahead

Yesterday, November 9th, the Catalan parliament voted to formally begin the process of breaking away from Spain. A resolution in the Catalan parliament laying out an 18-month road map for the region's independence was passed by 72 to 63, backed by MPs from the pro-independence “Junts pel Si” coalition and the smaller far-left Popular Unity Candidacy (CUP). The resolution calls for further laws to facilitate the creation of an independent social security system, a Catalan tax authority...

Read More »Equities: central banks underpinning markets

Macroview News of the euro area QE programme being expanded helped all stock markets to stage a rebound. After a testing September, financial markets benefited from the boost from news of a forthcoming expansion in the ECB’s QE programme. On the US side of the Atlantic, the Fed postponed its first interest rate hike. European stock markets were also buoyed by the weak euro. The Stoxx Europe 600 rebounded by 8.1% in October, propelled upwards by German shares (up 12.3%). In contrast, the...

Read More »Bank of England: a dovish Inflation Report points to very gradual policy normalisation

There is still scope for sterling appreciation on the back of monetary policy divergences. However, the upside potential has been reduced given the BoE’s dovish stance. Market participants were eagerly awaiting the Bank of England’s assessment ahead of “Super Thursday”, looking for hints at the next policy move(s). Our impression is that the BoE failed to provide much clarity, postponing an actual decision to later this year or early next year. The BoE’s Monetary Policy Committee (MPC)...

Read More »United States: upbeat employment report – a December hike seems likely

We believe however that the pace of rate tightening after the initial hike will be rather pedestrian. October’s employment report was more robust on all fronts. Job creation came in above expectations, the unemployment rate touched 5.0%, wages increased by a solid 0.4% m-o-m and the proxy for household wage incomes rose markedly m-o-m. We now believe the most likely scenario is that the Fed will hike rates in December. Non-farm payroll employment rose by a solid 271,000 m-o-m in October...

Read More » Perspectives Pictet

Perspectives Pictet