Euro area inflation was well above consensus in January. However, we believe that the ECB will look through this spike in (imported) inflation as underlying price pressures remain subdued.Although euro area headline inflation jumped to 1.8% in January, the closest it has been to ECB’s 2% target since Q1 2013, core inflation remained low at 0.9%. We continue to expect the ECB to wait until September before it announces a tapering of its asset purchases in 2018.A “sustained adjustment in inflation” (the ECB’s words) will be required before the bank’s monetary stance can be adjusted, based on four criteria: 1) inflation needs to return to the 2% over the medium-term; 2) the adjustment needs to be durable, not transient; 3) self-sustained without monetary support; and 4) defined for the whole region. Our forecasts suggest that three out of four inflation criteria would be met by Q3 2017, allowing the ECB to announce a tapering on a forward-looking basis.The risk is that ECB’s communication shifts to a more hawkish stance earlier, with the next challenge coming in March, when ECB staff projections are revised upwards. As always, we remain confident that Mario Draghi will stand by his words.

Topics:

Frederik Ducrozet considers the following as important: ECB staff forecasts, ECB tapering, euro area core inflation, Euro area inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Euro area inflation was well above consensus in January. However, we believe that the ECB will look through this spike in (imported) inflation as underlying price pressures remain subdued.

Although euro area headline inflation jumped to 1.8% in January, the closest it has been to ECB’s 2% target since Q1 2013, core inflation remained low at 0.9%. We continue to expect the ECB to wait until September before it announces a tapering of its asset purchases in 2018.

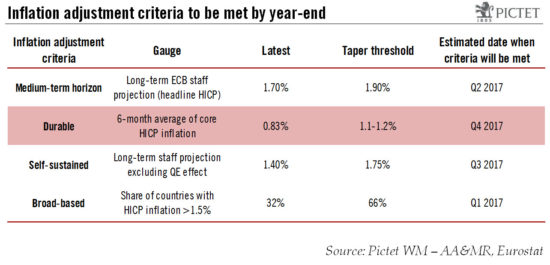

A “sustained adjustment in inflation” (the ECB’s words) will be required before the bank’s monetary stance can be adjusted, based on four criteria: 1) inflation needs to return to the 2% over the medium-term; 2) the adjustment needs to be durable, not transient; 3) self-sustained without monetary support; and 4) defined for the whole region. Our forecasts suggest that three out of four inflation criteria would be met by Q3 2017, allowing the ECB to announce a tapering on a forward-looking basis.

The risk is that ECB’s communication shifts to a more hawkish stance earlier, with the next challenge coming in March, when ECB staff projections are revised upwards. As always, we remain confident that Mario Draghi will stand by his words.