Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago. The deterioration...

Read More »FX Daily, May 24: Greenback Pushes Lower

Swiss Franc The Euro is down by 0.34% to 1.1601 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the...

Read More »FX Daily, May 23: Greenback Pushes Lower

Swiss Franc The Euro is down by 0.34% to 1.1601 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the...

Read More »Swiss pharma suspected of delaying generic competition

Switzerland is home to a thriving pharmaceutical industry. (Keystone) - Click to enlarge The United States Food and Drug Administration (FDA) published Thursday a list of pharmaceutical companies that include Basel-based Novartis and Roche, all of which are suspected of hindering the development of generic versions of their own medicines. Over 150 complaints were filed. The FDA slammed the development of...

Read More »Anchoring Globally Synchronized Growth, Or We Gave Up Long Ago?

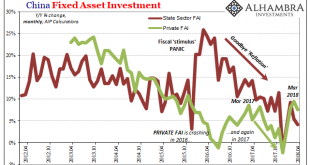

January was the last month in which China’s National Bureau of Statistics (NBS) specifically mentioned Fixed Asset Investment (FAI) of state holding enterprises (or SOE’s). For the month of December 2017, the NBS reported accumulated growth (meaning for all of 2017) in this channel of 10.1%. Through FAI of SOE’s, Chinese authorities in early 2016 had panicked themselves into unleashing considerable “stimulus.” There...

Read More »Tales from “The Master of Disaster”

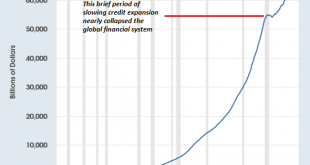

Tightening Credit Markets Daylight extends a little further into the evening with each passing day. Moods ease. Contentment rises. These are some of the many delights the northern hemisphere has to offer this time of year. As summer approaches, and dispositions loosen, something less amiable is happening. Credit markets are tightening. The yield on the 10-Year Treasury note has exceeded 3.12 percent. If yields...

Read More »FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

Swiss Franc The Euro is down by 0.53% to 1.1628 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Italy political drama is has spurred a significant rally in the Swiss franc. Over the past five days, it has been the strongest of the majors, rising 1.1% against the dollar and 1.8% against the euro. Today, it is the only major currency beside the yen that is gaining ground. Italian assets were...

Read More »Alpine tunnel closure causes major holiday traffic disruption

Tailbacks to enter the Gotthard tunnel going south on Saturday reached a record since 1999, and drivers are being advised to use alternative routes. (Keystone) - Click to enlarge Traffic queues of up to 28 kilometres were reported at the northern entrance to the Gotthard tunnel on Saturday, owing to a long weekend and the closure of another major Alpine road tunnel because of a fire. The San Bernadino...

Read More »Great Graphic: Euro-Swiss Shows Elevated Systemic Risk

Summary: The euro fell every day last week against the Swiss franc. Italian political anxiety is the key development. Speculators in the futures market got caught leaning the wrong way. The Swiss National Bank’s decision in January 2015 to remove the cap on the Swiss franc (floor on the euro) that it has set at CHF1.20 is seared into the memory of a generation of foreign exchange participants. It is not...

Read More »The Next Recession Will Be Devastatingly Non-Linear

The acceleration of non-linear consequences will surprise the brainwashed, loving-their-servitude mainstream media. Linear correlations are intuitive: if GDP declines 2% in the next recession, and employment declines 2%, we get it: the scale and size of the decline aligns. In a linear correlation, we’d expect sales to drop by about 2%, businesses closing their doors to increase by about 2%, profits to notch down by...

Read More » SNB & CHF

SNB & CHF