We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list. To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”. After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Topics:

George Dorgan considers the following as important: Featured, newsletter, Swiss Macro, Switzerland Exports, Switzerland Exports by Sector, Switzerland Imports, Switzerland Imports by Sector, Switzerland Trade Balance

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true.

Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans.

But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

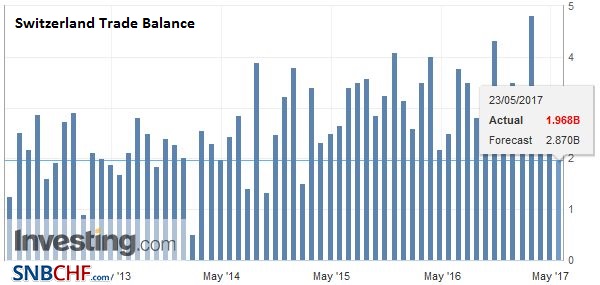

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

Texts and Charts from the Swiss customs data release (translated from French).

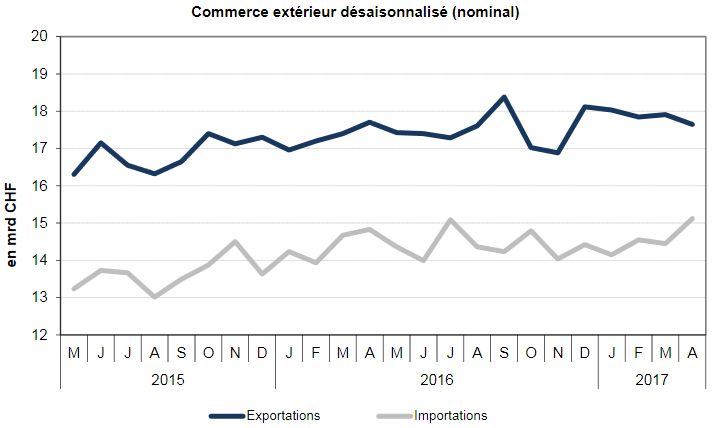

Exports and Imports YoY DevelopmentIn April 2017, adjusted exports of working days shrank as imports strengthened by 2.3%. Changes in sales were marked by the reluctance of the chemical and pharmaceutical sector. The trade balance has closed with the smallest surplus in the last two years. ▲ Dynamism of exports to China Exports adjusted for working days were at the same level as in April 2016 (actual: -3.8%). In seasonally adjusted terms (compared with the previous month), they fell by 1.5%. They have thus shown a slight downward trend since the beginning of the year. Conversely, imports increased by 2.3% over one year. After seasonal adjustment, they even strengthened by 4.7% over a month. As a result, they have continued to build up their highest level since 2014. |

Swiss exports and imports, seasonally adjusted (in bn CHF), April 2017(see more posts on Switzerland Exports, Switzerland Imports, ) Source: Swiss Customs - Click to enlarge |

Overall Evolution

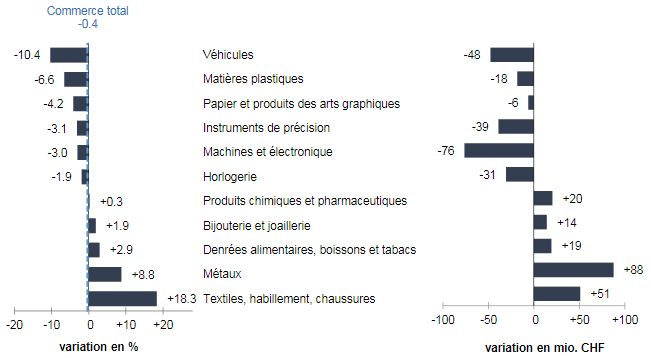

Exports adjusted for working days were at the same level as in April 2016 (actual: -3.8%). In seasonally adjusted terms (compared with the previous month), they fell by 1.5%. They thus show a slight Since the beginning of the year. Conversely, imports increased by 2.3% over one year. After seasonal adjustment, they even strengthened by 4.7% Over a month. They have continued their momentum in order to boast their highest level since 2014. Seasonally adjusted foreign trade (nominal) Different trends in exports Different sectors have evolved in a heterogeneous way between -10 and +18%. Outflows have stagnated, like chemicals and pharmaceuticals where the decline in pharmaceuticals (-221 million francs) has annihilated the leap of active ingredients (+228 million). |

Switzerland Trade Balance, April 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge |

ExportsVehicle exports plunged by 10%, led by aeronautics (-56 million francs). The export n ° 2 and 3, the machinery and electronics sector as well as the watch industry, have regressed. Conversely, metals (+ 9%) confirmed their vitality in the previous months. Exports to Europe lost ground (-1%) while those to Asia (+ 2%) and North America (+ 3%) gained. On the Old Continent, shipments to the EU have stagnated. The rise in Austria (+ 43%, pharma) and Germany (+ 6%, +208 million) contrasted with the decline in the United Kingdom (-11%) and Italy (-12%). On the Asian side, the Middle East continued to weaken as the other regions grew. Chinese demand surged by 30% (pharma and watchmaking) |

Swiss Exports per Sector April 2017 vs. 2016(see more posts on Switzerland Exports, Switzerland Exports by Sector, ) |

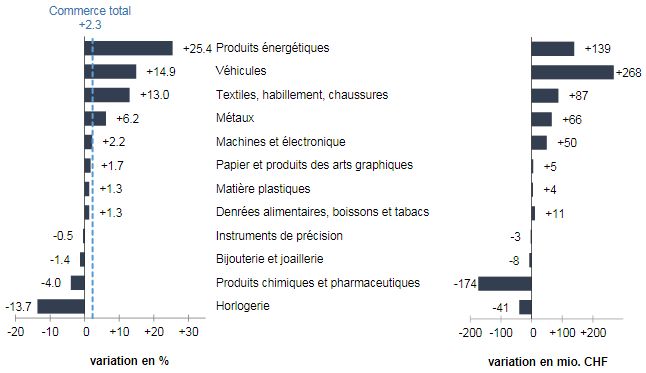

ImportsThe flagship sector, chemicals and pharmaceuticals, suffered a 4% drop in imports. The other commodity groups, on the other hand, showed growth. The palm returned to energy products with a rise of 25%; This was, however, induced by the rise in prices (real: -3%). The take-off of vehicle imports (+268 million francs) was based on aeronautics. The textile, clothing and footwear sector has also sparked the gunpowder. Metals (+ 6%) and machinery and electronics (+ 2%) increased for the fifth consecutive month. The decline in chemicals and pharmaceuticals is explained by the contraction of active ingredients (-324 million). Excluding North America (-8%), all continents increased in imports. The surge in Canada, whose shipments quadrupled (aircraft), could not compensate for the decline in pharmaceutical products originating in the USA. The rise in Asia (+ 6%) was largely sustained; Hong Kong and Singapore in particular have shone. On the European continent (+ 1%), French shipments were strong (+ 21%, pharmaceuticals and vehicles), whereas those in the United Kingdom were flanked by a third. |

Swiss Imports per Sector April 2017 vs. 2016(see more posts on Switzerland Imports, Switzerland Imports by Sector, ) |

Tags: Featured,newsletter,Switzerland Exports,Switzerland Exports by Sector,Switzerland Imports,Switzerland Imports by Sector,Switzerland Trade Balance