Macroview Although there were positive components in the Q1 GDP report, we are reducing our full-year growth forecast for Switzerland to 0.9% this year Read full report hereGrowth estimates from SECO (the Swiss economic affairs secretariat) released on June 1 suggest that real GDP in Switzerland expanded by 0.1% q-o-q (0.3% q-o-q annualised, 0.7% y-o-y) in Q1, lower than consensus expectations of 0.3% and Q4 2015 growth of 0.4%.But the GDP components were more encouraging than what the headline growth would suggest. GDP growth was primarily supported by private consumption , which increased by a strong 0.7% q-o-q in Q1, while much of the weakness was due to a drop in government spending and inventories. Overall, GDP growth is likely to gather pace in the next quarters, according to latest economic indicators (PMI data and the Swiss KOF barometer). Nevertheless, although we are leaving our forecasts for the quarterly pace of growth for the rest of the year unchanged, today’s Q1 figure mechanically pushes down our GDP forecast for 2016 as a whole from 1.1% to 0.9%.Although exports increased quite sharply in Q1, the Swiss franc is still strongly overvalued and continues to weigh on export dynamics. But healthy growth in the euro area, Switzerland’s main trading partner, has partly helped to compensate for the strength of the Swiss franc.

Topics:

Nadia Gharbi considers the following as important: Macroview, Swiss Franc, Swiss GDP growth, Swiss growth, Swiss National Bank

This could be interesting, too:

Marc Chandler writes China’s Politburo Validates and Extends Pivot while the US Dollar Sees Yesterday’s Gains Pared

Marc Chandler writes Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

Marc Chandler writes China Goes Big, and Market (Initially) Gives it the Benefit of the Doubt

Marc Chandler writes SNB Surprises the Market (Again)

Although there were positive components in the Q1 GDP report, we are reducing our full-year growth forecast for Switzerland to 0.9% this year

Growth estimates from SECO (the Swiss economic affairs secretariat) released on June 1 suggest that real GDP in Switzerland expanded by 0.1% q-o-q (0.3% q-o-q annualised, 0.7% y-o-y) in Q1, lower than consensus expectations of 0.3% and Q4 2015 growth of 0.4%.

But the GDP components were more encouraging than what the headline growth would suggest. GDP growth was primarily supported by private consumption , which increased by a strong 0.7% q-o-q in Q1, while much of the weakness was due to a drop in government spending and inventories. Overall, GDP growth is likely to gather pace in the next quarters, according to latest economic indicators (PMI data and the Swiss KOF barometer). Nevertheless, although we are leaving our forecasts for the quarterly pace of growth for the rest of the year unchanged, today’s Q1 figure mechanically pushes down our GDP forecast for 2016 as a whole from 1.1% to 0.9%.

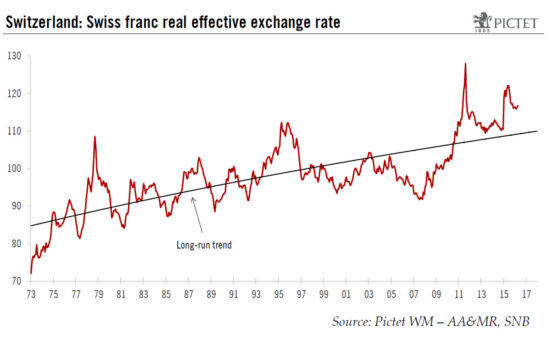

Although exports increased quite sharply in Q1, the Swiss franc is still strongly overvalued and continues to weigh on export dynamics. But healthy growth in the euro area, Switzerland’s main trading partner, has partly helped to compensate for the strength of the Swiss franc. Therefore, we believe the Swiss National Bank is likely to keep its monetary policy stance unchanged at its next policy meeting on June 16.

Overall, in the absence of systemic crisis in the euro area, Switzerland’s subdued growth outlook and very low interest rates, as well as the Swiss franc’s fundamental overvaluation (see chart) favour a gradual depreciation of the Swiss franc against the euro.